Answered step by step

Verified Expert Solution

Question

1 Approved Answer

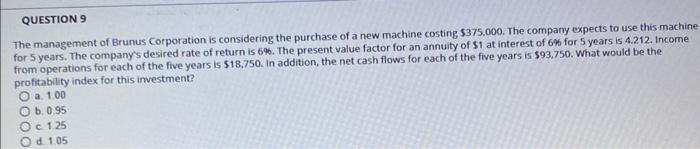

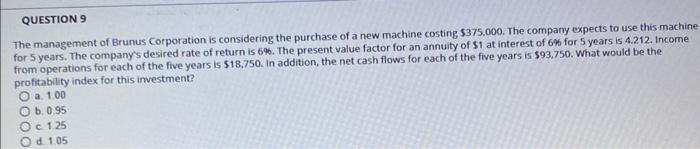

principles of finance The management of Brunus Corporation is considering the purchase of a new machine costing $375.000. The company expects to use this machine

principles of finance

The management of Brunus Corporation is considering the purchase of a new machine costing $375.000. The company expects to use this machine for 5 years. The company's desired rate of return is 6%. The present value factor for an annuity of $1 at interest of 6% for 5 years is 4.212. Income from operations for each of the five years is 518.750. In addition, the net cash flows for each of the five years is 593.750. What would be the profitability index for this investment? a. 1.00 b. 0.95 c. 125 d. 1.05

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started