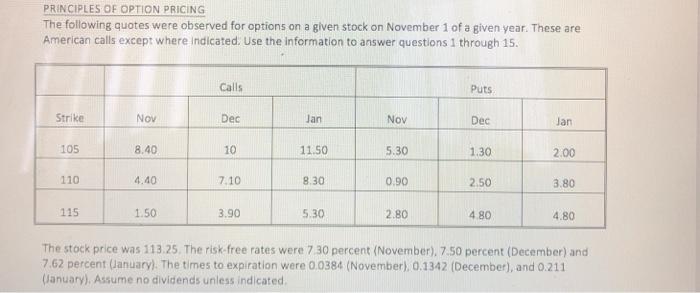

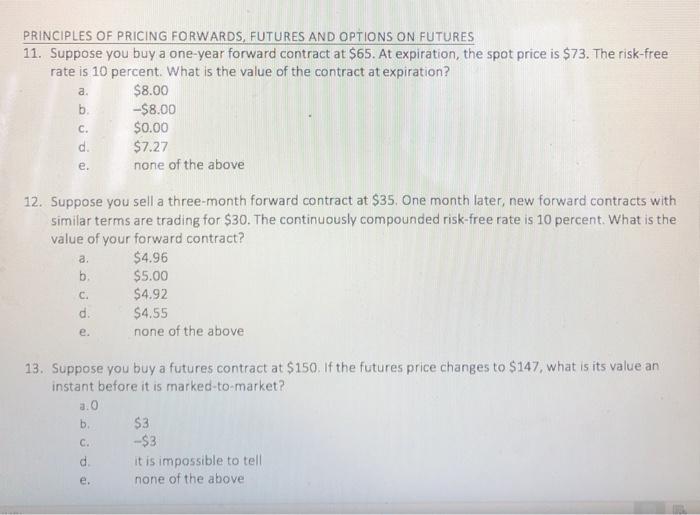

PRINCIPLES OF OPTION PRICING The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions through 15. Calls Puts Strike Nov Dec Jan Nov Dec Jan 105 8.40 10 11.50 5.30 1.30 2.00 110 4.40 7.10 8.30 0.90 2.50 3.80 115 1.50 3.90 5.30 2.80 4.80 4.80 The stock price was 113.25. The risk-free rates were 7 30 percent (November). 7.50 percent (December) and 7.62 percent January). The times to expiration were 0.0384 (November), 0.1342 (December), and 0.211 (anuary). Assume no dividends unless indicated PRINCIPLES OF PRICING FORWARDS, FUTURES AND OPTIONS ON FUTURES 11. Suppose you buy a one-year forward contract at $65. At expiration, the spot price is $73. The risk-free rate is 10 percent. What is the value of the contract at expiration? a. $8.00 b -$8.00 C. $0.00 d. $7.27 none of the above e. a. 12. Suppose you sell a three-month forward contract at $35. One month later, new forward contracts with Similar terms are trading for $30. The continuously compounded risk-free rate is 10 percent. What is the value of your forward contract? $4.96 b $5.00 $4.92 d. $4.55 none of the above C. e. 13. Suppose you buy a futures contract at $150. If the futures price changes to $147, what is its value an instant before it is marked-to-market? a. $3 -$3 d it is impossible to tell none of the above b. C. e. PRINCIPLES OF OPTION PRICING The following quotes were observed for options on a given stock on November 1 of a given year. These are American calls except where indicated. Use the information to answer questions through 15. Calls Puts Strike Nov Dec Jan Nov Dec Jan 105 8.40 10 11.50 5.30 1.30 2.00 110 4.40 7.10 8.30 0.90 2.50 3.80 115 1.50 3.90 5.30 2.80 4.80 4.80 The stock price was 113.25. The risk-free rates were 7 30 percent (November). 7.50 percent (December) and 7.62 percent January). The times to expiration were 0.0384 (November), 0.1342 (December), and 0.211 (anuary). Assume no dividends unless indicated PRINCIPLES OF PRICING FORWARDS, FUTURES AND OPTIONS ON FUTURES 11. Suppose you buy a one-year forward contract at $65. At expiration, the spot price is $73. The risk-free rate is 10 percent. What is the value of the contract at expiration? a. $8.00 b -$8.00 C. $0.00 d. $7.27 none of the above e. a. 12. Suppose you sell a three-month forward contract at $35. One month later, new forward contracts with Similar terms are trading for $30. The continuously compounded risk-free rate is 10 percent. What is the value of your forward contract? $4.96 b $5.00 $4.92 d. $4.55 none of the above C. e. 13. Suppose you buy a futures contract at $150. If the futures price changes to $147, what is its value an instant before it is marked-to-market? a. $3 -$3 d it is impossible to tell none of the above b. C. e