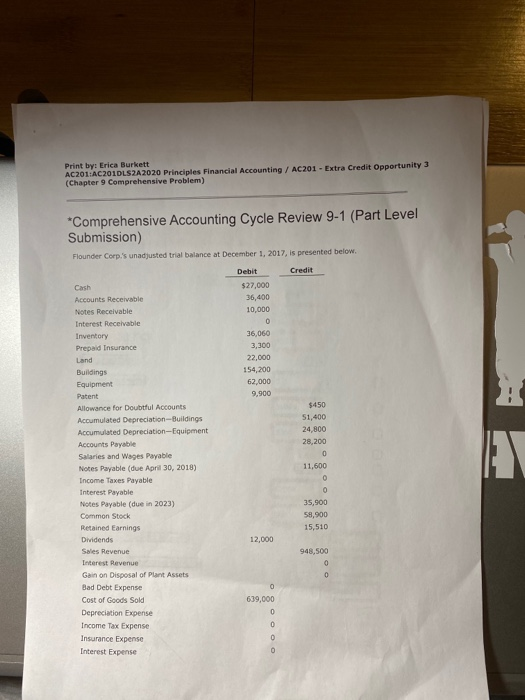

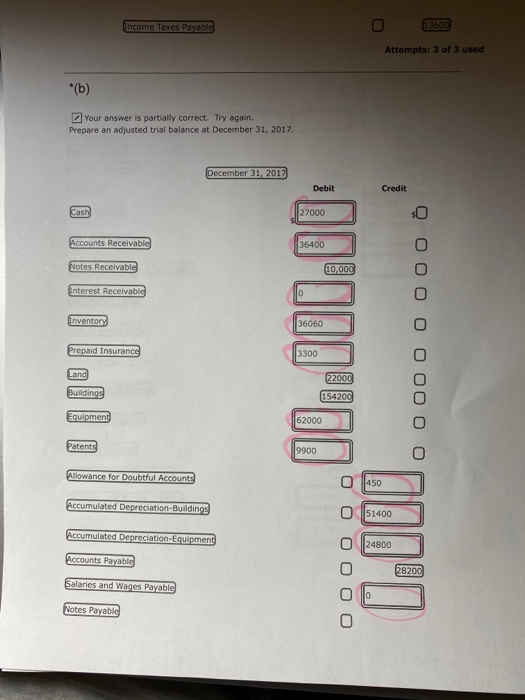

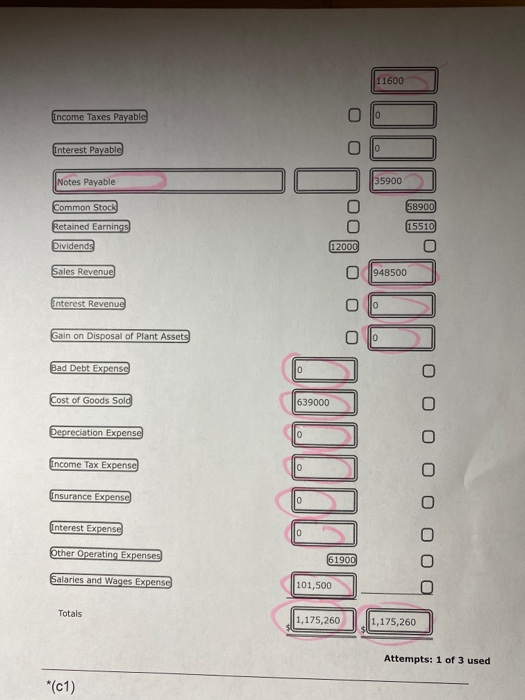

Print by: Erica Burkett AC201:AC201DLS2A 2020 Principles Financial Accounting / AC201 - Extra Credit Opportunity 3 (Chapter 9 Comprehensive Problem) *Comprehensive Accounting Cycle Review 9-1 (Part Level Submission) Flounder Corp. 'Sunadjusted trial balance at December 1, 2017, is presented below. Debit Credit $27.000 Accounts Receivable 36,400 Notes Receivable 10,000 Interest Receivable Inventory 35,060 Prepaid Insurance 3,300 Land 22,000 Budings 154,200 Equipment 62,000 Patent 9,900 Allowance for Doubtful Accounts $450 Accumulated Depreciation-Buildings 51,400 Accumulated Depreciation Equipment 24,800 Accounts Payable 28.200 Salaries and Wages Payable Notes Payable (due April 30, 2018) 11,600 Income Taxes Payable Interest Payable Notes Payable (due in 2023) 35,900 Common Stock 58,900 Retained Earnings 15,510 Dividends 12,000 Sales Revenue 948,500 Interest Revenue Ganon Disposal of Punt Assets Bad Debt Expense Cost of Goods Sold 639,000 Depreciation Expense Income Tax Expense Insurance Expense Interest Expense Income Taxes Payable (1 3600) Attempts: 3 of 3 used *(b) Your answer is partially correct. Try again. Prepare an adjusted trial balance at December 31, 2017. December 31, 2017 Credit Debit 27000 Accounts Receivable 36400 Notes Receivable (10,000 Interest Receivable Inventory Prepaid Insurance 300 Land Buildings 22000 154200 Equipment |62000 | Patents 9900 Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation Equipment o 51400 200) Accounts Payable Salaries and Wages Payable | Notes Payable 11600 Income Taxes Payable Interest Payable Notes Payable 35900 Common Stock Retained Earnings Dividends 58900 15510 Vooo loooo 12000 0 Sales Revenue 948500 Interest Revenue Gain on Disposal of Plant Assets Bad Debt Expense Cost of Goods Sold 639000 Depreciation Expense boooOOOOUUU Income Tax Expense Insurance Expense Interest Expense Other Operating Expenses 61900 Salaries and Wages Expense 101,500 Totals 1,175,260 1,175,260 Attempts: 1 of 3 used *(c1) Print by: Erica Burkett AC201:AC201DLS2A 2020 Principles Financial Accounting / AC201 - Extra Credit Opportunity 3 (Chapter 9 Comprehensive Problem) *Comprehensive Accounting Cycle Review 9-1 (Part Level Submission) Flounder Corp. 'Sunadjusted trial balance at December 1, 2017, is presented below. Debit Credit $27.000 Accounts Receivable 36,400 Notes Receivable 10,000 Interest Receivable Inventory 35,060 Prepaid Insurance 3,300 Land 22,000 Budings 154,200 Equipment 62,000 Patent 9,900 Allowance for Doubtful Accounts $450 Accumulated Depreciation-Buildings 51,400 Accumulated Depreciation Equipment 24,800 Accounts Payable 28.200 Salaries and Wages Payable Notes Payable (due April 30, 2018) 11,600 Income Taxes Payable Interest Payable Notes Payable (due in 2023) 35,900 Common Stock 58,900 Retained Earnings 15,510 Dividends 12,000 Sales Revenue 948,500 Interest Revenue Ganon Disposal of Punt Assets Bad Debt Expense Cost of Goods Sold 639,000 Depreciation Expense Income Tax Expense Insurance Expense Interest Expense Income Taxes Payable (1 3600) Attempts: 3 of 3 used *(b) Your answer is partially correct. Try again. Prepare an adjusted trial balance at December 31, 2017. December 31, 2017 Credit Debit 27000 Accounts Receivable 36400 Notes Receivable (10,000 Interest Receivable Inventory Prepaid Insurance 300 Land Buildings 22000 154200 Equipment |62000 | Patents 9900 Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation Equipment o 51400 200) Accounts Payable Salaries and Wages Payable | Notes Payable 11600 Income Taxes Payable Interest Payable Notes Payable 35900 Common Stock Retained Earnings Dividends 58900 15510 Vooo loooo 12000 0 Sales Revenue 948500 Interest Revenue Gain on Disposal of Plant Assets Bad Debt Expense Cost of Goods Sold 639000 Depreciation Expense boooOOOOUUU Income Tax Expense Insurance Expense Interest Expense Other Operating Expenses 61900 Salaries and Wages Expense 101,500 Totals 1,175,260 1,175,260 Attempts: 1 of 3 used *(c1)