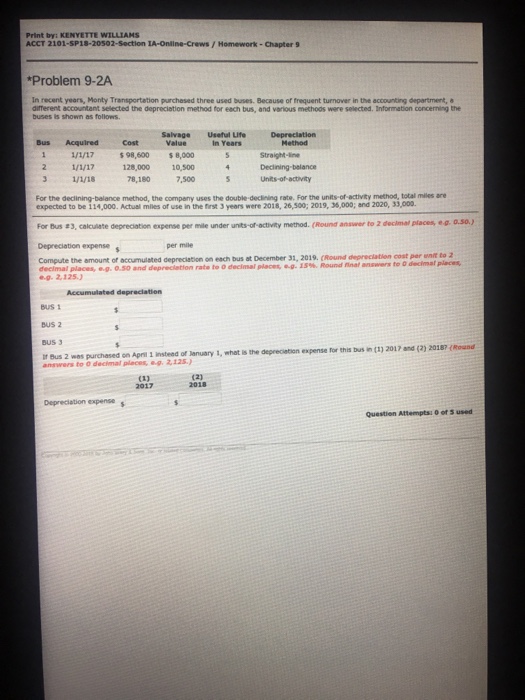

Print by: KENYETTE WILLIAMS ACCT 2101-SP18-20502-Section IA-Oniine-Crews/ Homework-Chapter 9 Problem 9-2A In recent years, Monty Transportation purchesed three used buses. Because of frequent turnover in the accounting department, a ditterent accountant selected the depreciation method for each bus, and various methoos were selected. Information concerning the buses is shown as follows Salvage Useful Life Depreclation Bus Acquired Cost Value In Years Method Straight-ine 98,600 8,000 10,500 78180 7,500 2/1/17128,000 Units-of-acovity units-of-activity method, total miles are For the declining-balance method, the company uses the double-declining rate. For the expected to be 114,000. Actual miles of use in the first 3 years were 2018, 26,500; 2019, 3%,000; and 2020, 33,00. for tus #3, calcate deprecation expense per mile under unt rodity method. (Round answer to 2 decimal places, q. 0SOJ Depreciation expense per mile Compute the amount of accumulated depreciation on each bus at December 31, 2019. (Round depreciatien cost per enit to 2 decimal places, o.g. 0.50 and depreciation rate to 0 decimal places, 60. 15%. Round nnat answers to 0 e.g. 2,125. Bus 1 BUS 2 BUS 3 ir Bus 2 was purchased on Api 1 insteed of a.g 2,125) 2017 2018 Question Attemptsi 0 of 3 used Print by: KENYETTE WILLIAMS ACCT 2101-SP18-20502-Section IA-Oniine-Crews/ Homework-Chapter 9 Problem 9-2A In recent years, Monty Transportation purchesed three used buses. Because of frequent turnover in the accounting department, a ditterent accountant selected the depreciation method for each bus, and various methoos were selected. Information concerning the buses is shown as follows Salvage Useful Life Depreclation Bus Acquired Cost Value In Years Method Straight-ine 98,600 8,000 10,500 78180 7,500 2/1/17128,000 Units-of-acovity units-of-activity method, total miles are For the declining-balance method, the company uses the double-declining rate. For the expected to be 114,000. Actual miles of use in the first 3 years were 2018, 26,500; 2019, 3%,000; and 2020, 33,00. for tus #3, calcate deprecation expense per mile under unt rodity method. (Round answer to 2 decimal places, q. 0SOJ Depreciation expense per mile Compute the amount of accumulated depreciation on each bus at December 31, 2019. (Round depreciatien cost per enit to 2 decimal places, o.g. 0.50 and depreciation rate to 0 decimal places, 60. 15%. Round nnat answers to 0 e.g. 2,125. Bus 1 BUS 2 BUS 3 ir Bus 2 was purchased on Api 1 insteed of a.g 2,125) 2017 2018 Question Attemptsi 0 of 3 used