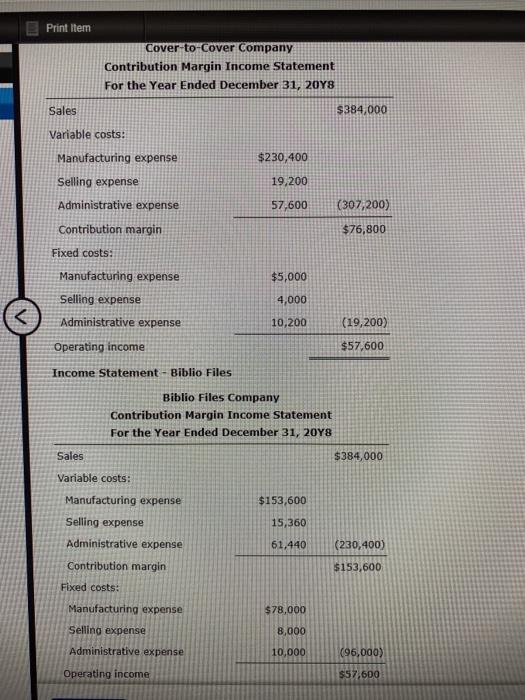

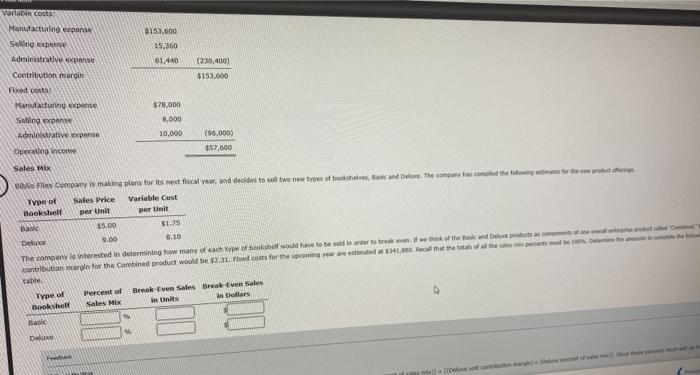

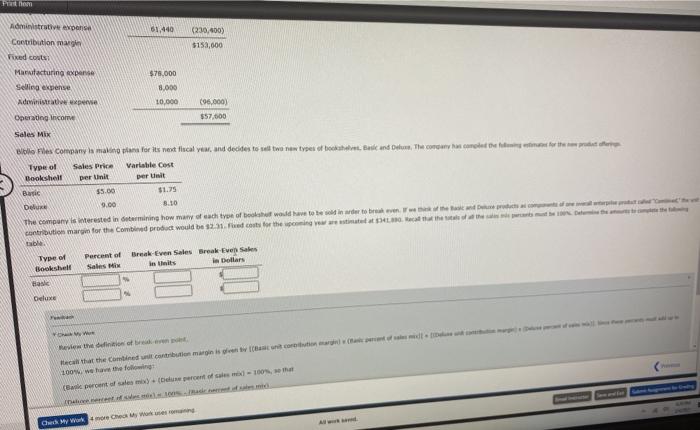

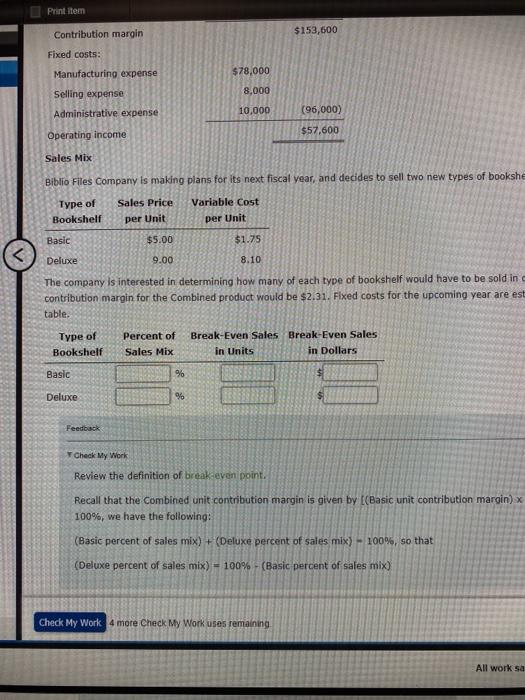

Print Item Cover-to-Cover Company Contribution Margin Income Statement For the Year Ended December 31, 2018 Sales $384.000 Variable costs: Manufacturing expense $230,400 Selling expense 19,200 Administrative expense 57,600 (307,200) Contribution margin $76,800 Fixed costs: $5,000 Manufacturing expense Selling expense Administrative expense 4,000 10,200 (19,200) Operating income $57,600 Income Statement - Biblio Files Biblio Files Company Contribution Margin Income Statement For the Year Ended December 31, 2048 Sales $384,000 Variable costs: $153,600 Manufacturing expense Selling expense Administrative expense 15,360 61.440 (230,400) $153,600 Contribution margin Fixed costs: $78,000 Manufacturing expense Selling expense 8,000 Administrative expense 10,000 (96,000) Operating income $57,600 Variable costs Manufacturing expanse Selling expert Administrative expense Contribution margin 3153,600 15.360 61.440 (230.400) $153,600 Food Cot $78,000 8,000 Manufacturing expense seling expand Administrative expense Operating income 10,000 (96.000) $57,600 Sales Mix Billes commis making plans for its not fiscal year and decides to sell two new types of bookshelves Basic and Dee The company has completohet Type of Sales Price Variable cost Bookshelf per Unit per Unit 15.00 $1.5 Deluxe 9.00 5.10 The company le interested in determining how many of each type of would have to be sold in order to break it werk of the cand me contribution margin for the Combined product would be hot for the upcoming year we estimated $1,100Becal that the whole be Type of Bookshel Percent of Sales Mix Break Even Sales Break-Evens Sales in Units in Dollars De Plnom Administrativa 61,440 Contribution and (230.400) $153,000 Fixed Marutacturing expen $75.000 Selling expense 8.000 Administrative perwe 10.000 (96.000) Operang Income $57,600 Sales Mix Blolle les company main for its mest flical year, and decides to sell types of the Bad and The concedere Type of Sales Price Variable Cost Bookshell per Unit per Unit Basic $5.00 $1.75 Deluxe 9.00 3.10 The company is interested in determining how many of each type of books would have to be wind to break even when contribution margin for the combined product would be 231 Fried costs for the upcoming we Type of Bootstall Han Percent of Brecken Sales Break Eve Sales ia Dollars Deluxe the door Recall that the contine di contribution margin is een van com 100% were the follow ( percent of sal my percent of 100, Chudy Work Print item Contribution margin $153,600 Fixed costs: Manufacturing expense $78,000 8.000 Selling expense Administrative expense 10,000 (96,000) $57,600 Operating income Sales Mix Biblio Files Company is making plans for its next fiscal year, and decides to sell two new types of bookshe Variable Cost Type of Bookshelf Sales Price per Unit per Unit Basic $5.00 $1.75