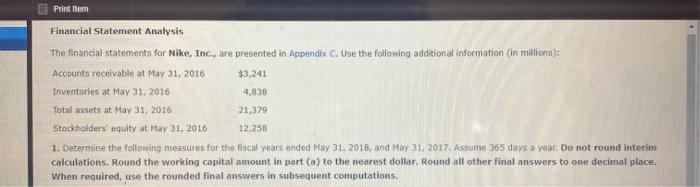

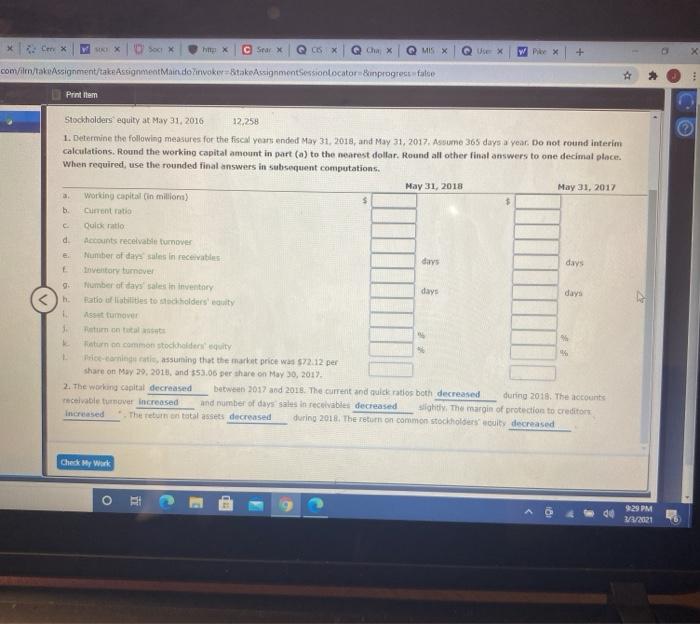

Print Item Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix c. Use the following additional information in millions): Accounts receivable at May 31, 2016 $3,241 Inventories at May 31, 2016 4,838 Total assets at May 31, 2016 21,379 Stockholders equity at May 31, 2016 12,258 1. Determine the following measures for the fiscal years ended May 31, 2018, and May 31, 2017. Assume 365 days a year. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar. Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations, @ MSX + Ce C Star X CSX Goha x com/m/takeAssignment/take Assignment Mind invokerStakeAssignmentSessionlocator Bonprogrestato Print item Stockholders equity at May 31, 2016 12,258 1. Determine the following measures for the fiscal years ended May 31, 2018, and May 31, 2017. Assume 365 days a year. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar. Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations May 31, 2018 May 31, 2017 a Working capital (in million) $ b Current ratio Quick ratio d Accounts receivable turnover Number of die sales in recevables days Inventory turnover Number of days sales in Inventory days days h Ratio of litilities to teholders woulty Asstturnover C days Return on common stocichlidensity Price-carnis rate, assuming that the market price was $72.12 per share on May 19, 2010, and 553.06 per share on May 30, 2017 2. The working capital decreased between 2017 and 2018 The current and quick ratlos both decreased during 2018. The accounts receivable turnover increased and number of days sales in recevables decreased slightly. The margin of protection to creditors Then on total assets decreased during 2018. The return on common stockholders' wouly decreased Check My Work RI 9:29 PM 3/3/2021 Print Item Financial Statement Analysis The financial statements for Nike, Inc., are presented in Appendix c. Use the following additional information in millions): Accounts receivable at May 31, 2016 $3,241 Inventories at May 31, 2016 4,838 Total assets at May 31, 2016 21,379 Stockholders equity at May 31, 2016 12,258 1. Determine the following measures for the fiscal years ended May 31, 2018, and May 31, 2017. Assume 365 days a year. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar. Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations, @ MSX + Ce C Star X CSX Goha x com/m/takeAssignment/take Assignment Mind invokerStakeAssignmentSessionlocator Bonprogrestato Print item Stockholders equity at May 31, 2016 12,258 1. Determine the following measures for the fiscal years ended May 31, 2018, and May 31, 2017. Assume 365 days a year. Do not round interim calculations. Round the working capital amount in part (a) to the nearest dollar. Round all other final answers to one decimal place. When required, use the rounded final answers in subsequent computations May 31, 2018 May 31, 2017 a Working capital (in million) $ b Current ratio Quick ratio d Accounts receivable turnover Number of die sales in recevables days Inventory turnover Number of days sales in Inventory days days h Ratio of litilities to teholders woulty Asstturnover C days Return on common stocichlidensity Price-carnis rate, assuming that the market price was $72.12 per share on May 19, 2010, and 553.06 per share on May 30, 2017 2. The working capital decreased between 2017 and 2018 The current and quick ratlos both decreased during 2018. The accounts receivable turnover increased and number of days sales in recevables decreased slightly. The margin of protection to creditors Then on total assets decreased during 2018. The return on common stockholders' wouly decreased Check My Work RI 9:29 PM 3/3/2021