Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Print Item Value, Net Present Value, Internal Rate of Payback, Accou For discount factors use Exhibit 12B.1 and Exhibit 128.2. of all other scenarios. Assume

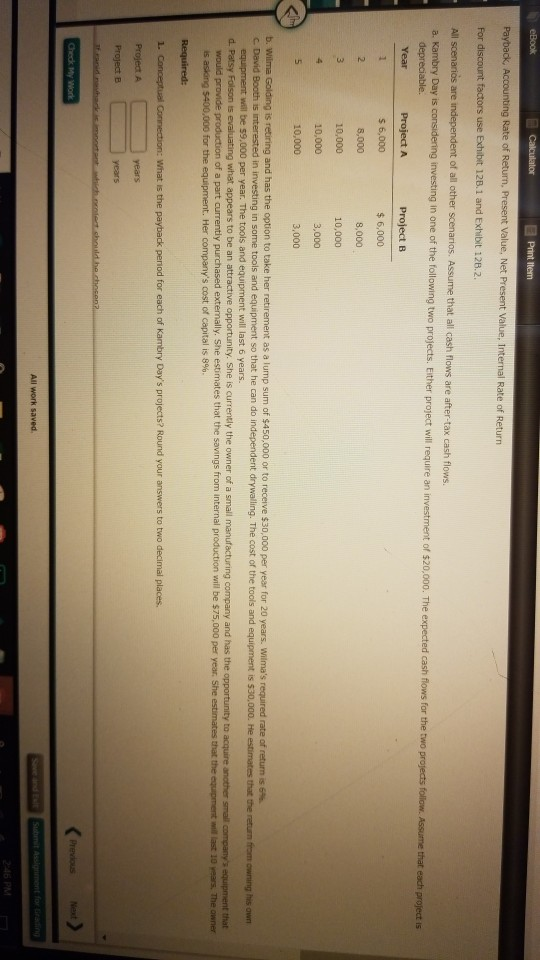

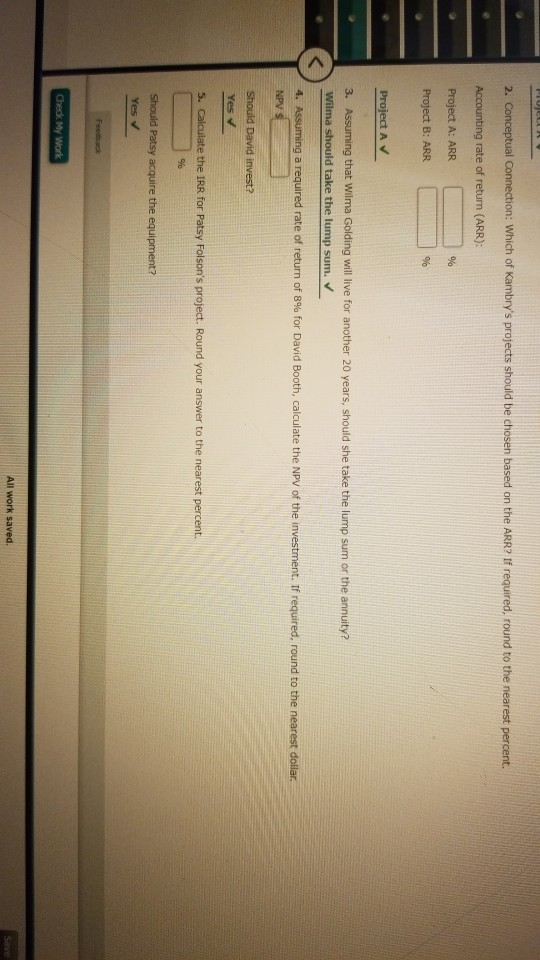

Print Item Value, Net Present Value, Internal Rate of Payback, Accou For discount factors use Exhibit 12B.1 and Exhibit 128.2. of all other scenarios. Assume that all cash flows are after-tax cash flows. Kambry Day is considering investing in one of the lowing two projects. Either project will require an investment of $20,000. The expected cash flows for the two projects follow. Assume that a. project will require an Year $ 6,000 8,000 10,000 3,000 s 6,000 10,000 10,000 10,000 as a lump sum of $450,000 or to receive $30,000 per year for 20 years. wilma's required rate of return is 6%. c David Booth is interested in investing in some tools and equipment so that he can do independent drywalling. The cost of the tools and equipment is $30,000. He estimates that the return from owning hs will be s9,000 per year. The tools and equipment will last 6 years d. Patsy per year. She estimates that the equipment will last 10 years. The owner is asking $400,00 forthe equipment. Her company's cost of capital is 8%. Previous Next 2. Conceptual Connection: Which of Kambry's projects should be chosen based on the ARR? If required, round to the nearest percent. Accounting rate of return (ARR) Project A: ARR Project B: ARR 3. Assuming that Wilma Golding will live for another 20 years, should she take the lump sum or the annuity? Wilma should take the lump sum. v 4, Assum ing a required rate of return of 8% for David Booth, calculate the NPV of the investment. If required, round to the nearest dollar. S. Calculate the IRR for Patsy Folson's project. Round your answer to the nearest percent. Yes All work saved

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started