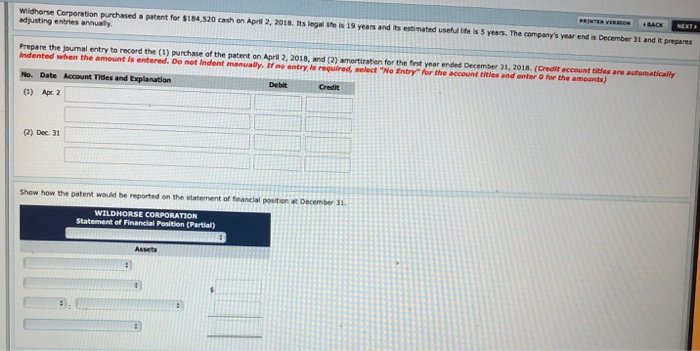

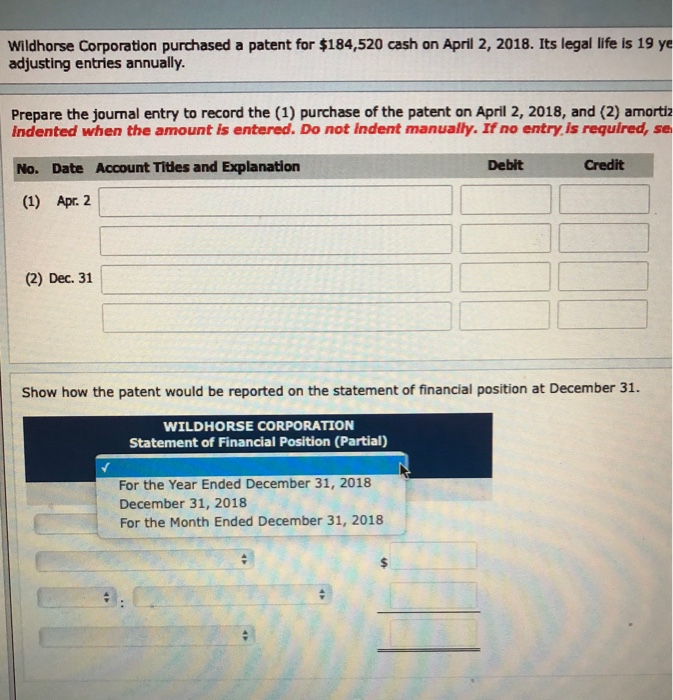

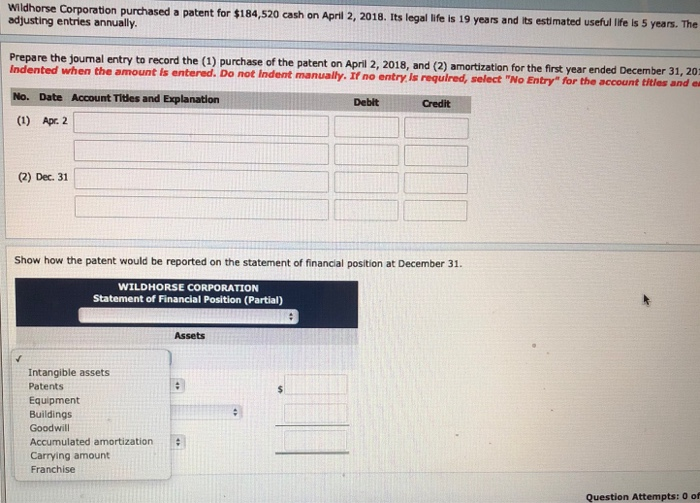

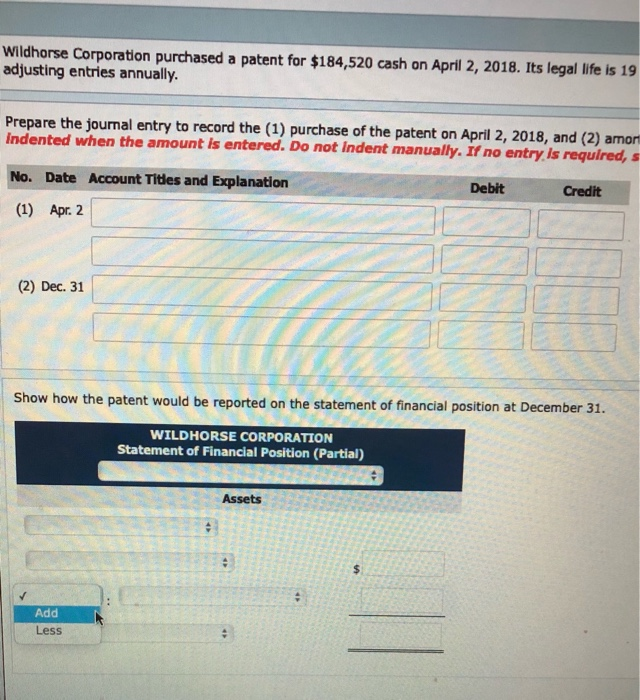

PRINTER VERBON BACK NEKT Wildhorse Corporation purchased a patent for $184,520 cash on April 2, 2018. Its legales 19 years and bestimated series 5 years. The company's year and is December 31 and it prepares usting en analy Prepare the journal entry to record the (1) purchase of the patent on April 2, 2018, and (2) amortiration for the first year ended December 31, 2018. (Credit account titles are automatically Indented when the amount is entered. De not indent manually. If no antry required, "No Entry for the account tities and enter for the amounts) Debit Credit No. Date Account Titles and Explanation (1) Apr 2 (3) Dec. 31 Show how the patent would be reported on the statement of financial position WILDHORSE CORPORATION Statement of Financial Position (Partial Wildhorse Corporation purchased a patent for $184,520 cash on April 2, 2018. Its legal life is 19 ye adjusting entries annually. Prepare the journal entry to record the (1) purchase of the patent on April 2, 2018, and (2) amortiz indented when the amount is entered. Do not indent manually. If no entry is required, se Debit Credit No. Date Account Titles and Explanation (1) Apr. 2 (2) Dec. 31 Show how the patent would be reported on the statement of financial position at December 31. WILDHORSE CORPORATION Statement of Financial Position (Partial) For the Year Ended December 31, 2018 December 31, 2018 For the Month Ended December 31, 2018 Wildhorse Corporation purchased a patent for $184,520 cash on April 2, 2018. Its legal life is 19 years and its estimated useful life is 5 years. The adjusting entries annually. Prepare the joumal entry to record the (1) purchase of the patent on April 2, 2018, and (2) amortization for the first year ended December 31, 20 Indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the account titles and a No. Date Account Titles and Explanation Debit Credit (1) Apr. 2 (2) Dec. 31 Show how the patent would be reported on the statement of financial position at December 31. WILDHORSE CORPORATION Statement of Financial Position (Partial) Intangible assets Patents Equipment Buildings Goodwill Accumulated amortization Carrying amount Franchise Question Attempts: 0 Vildhorse Corporation purchased a patent for $184,520 cash on April 2, 2018. Its legal life is 19 adjusting entries annually. Prepare the journal entry to record the (1) purchase of the patent on April 2, 2018, and (2) amor undented when the amount is entered. Do not Indent manually. If no entry is required, s Debit Credit No. Date Account Titles and Explanation (1) Apr. 2 (2) Dec. 31 Show how the patent would be reported on the statement of financial position at December 31. WILDHORSE CORPORATION Statement of Financial Position (Partial) Assets Add Less