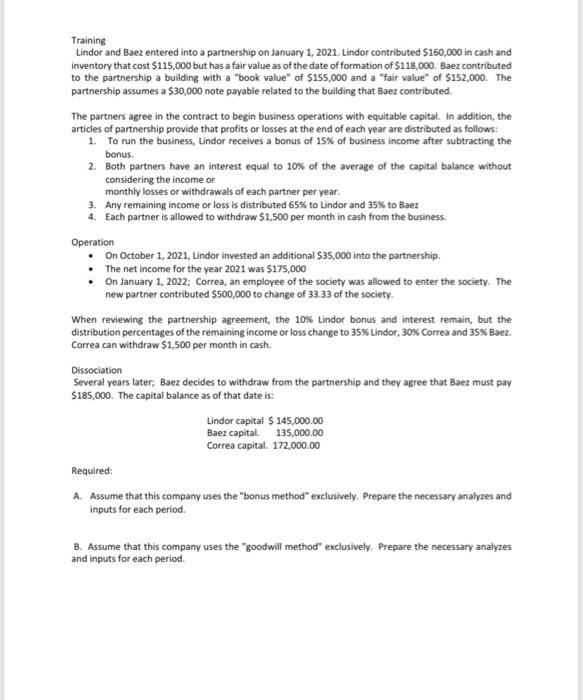

Training Lindor and Baez entered into a partnership on January 1, 2021. Lindor contributed $160,000 in cash and inventory that cost $115,000 but has a fair value as of the date of formation of S118,000. Baez contributed to the partnership a building with a "book value of $155,000 and a "fair value of $152,000. The partnership assumes a $30,000 note payable related to the building that Baez contributed The partners agree in the contract to begin business operations with equitable capital. In addition, the articles of partnership provide that profits or losses at the end of each year are distributed as follows: 1. To run the business, Lindor receives a bonus of 15% of business income after subtracting the bonus. 2. Both partners have an interest equal to 10% of the average of the capital balance without considering the income or monthly losses or withdrawals of each partner per year. 3. Any remaining income or loss is distributed 65% to Lindor and 35% to Baez 4. Each partner is allowed to withdraw $1,500 per month in cash from the business. Operation On October 1, 2021, Lindor invested an additional $35,000 into the partnership The net income for the year 2021 was $175,000 . On January 1, 2022: Correa, an employee of the society was allowed to enter the society. The new partner contributed $500,000 to change of 33.33 of the society. When reviewing the partnership agreement, the 10% Lindor bonus and interest remain, but the distribution percentages of the remaining income or loss change to 35% Lindor, 30% Correa and 35% Baez. Correa can withdraw $1,500 per month in cash. Dissociation Several years later; Baez decides to withdraw from the partnership and they agree that Baez must pay $185,000. The capital balance as of that date is: Lindor capital $ 145,000.00 Baez capital 135,000.00 Correa capital. 172,000.00 Required: A. Assume that this company uses the "bonus method" exclusively. Prepare the necessary analyzes and inputs for each period. B. Assume that this company uses the "goodwill method exclusively. Prepare the necessary analyzes and inputs for each period. Training Lindor and Baez entered into a partnership on January 1, 2021. Lindor contributed $160,000 in cash and inventory that cost $115,000 but has a fair value as of the date of formation of S118,000. Baez contributed to the partnership a building with a "book value of $155,000 and a "fair value of $152,000. The partnership assumes a $30,000 note payable related to the building that Baez contributed The partners agree in the contract to begin business operations with equitable capital. In addition, the articles of partnership provide that profits or losses at the end of each year are distributed as follows: 1. To run the business, Lindor receives a bonus of 15% of business income after subtracting the bonus. 2. Both partners have an interest equal to 10% of the average of the capital balance without considering the income or monthly losses or withdrawals of each partner per year. 3. Any remaining income or loss is distributed 65% to Lindor and 35% to Baez 4. Each partner is allowed to withdraw $1,500 per month in cash from the business. Operation On October 1, 2021, Lindor invested an additional $35,000 into the partnership The net income for the year 2021 was $175,000 . On January 1, 2022: Correa, an employee of the society was allowed to enter the society. The new partner contributed $500,000 to change of 33.33 of the society. When reviewing the partnership agreement, the 10% Lindor bonus and interest remain, but the distribution percentages of the remaining income or loss change to 35% Lindor, 30% Correa and 35% Baez. Correa can withdraw $1,500 per month in cash. Dissociation Several years later; Baez decides to withdraw from the partnership and they agree that Baez must pay $185,000. The capital balance as of that date is: Lindor capital $ 145,000.00 Baez capital 135,000.00 Correa capital. 172,000.00 Required: A. Assume that this company uses the "bonus method" exclusively. Prepare the necessary analyzes and inputs for each period. B. Assume that this company uses the "goodwill method exclusively. Prepare the necessary analyzes and inputs for each period