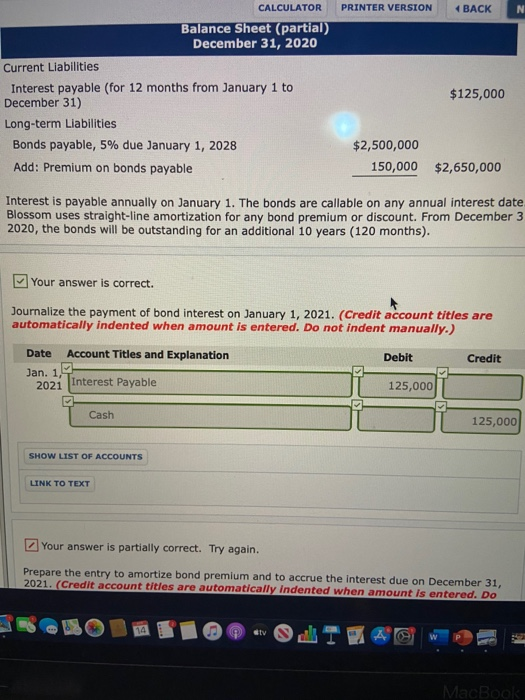

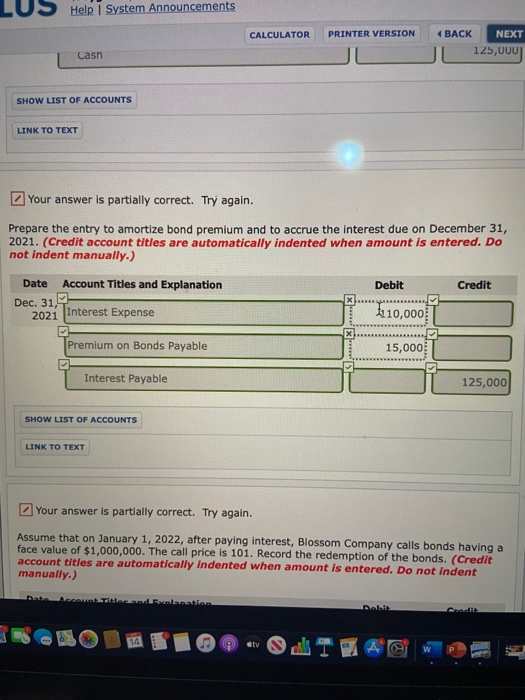

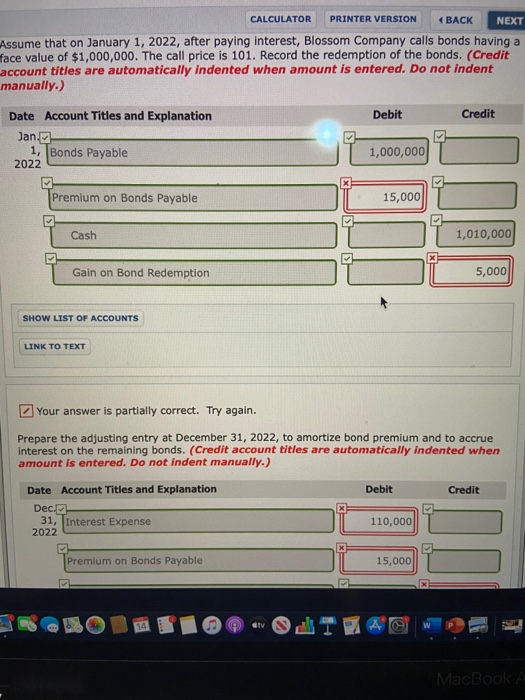

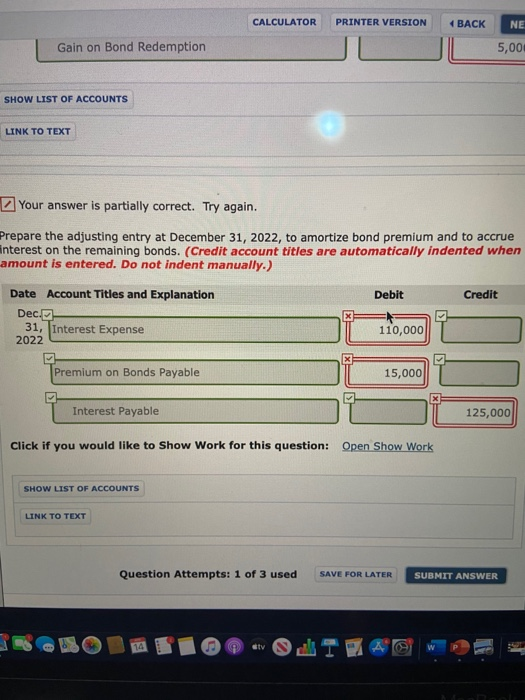

PRINTER VERSION BACK CALCULATOR Balance Sheet (partial) December 31, 2020 Current Liabilities Interest payable (for 12 months from January 1 to December 31) Long-term Liabilities Bonds payable, 5% due January 1, 2028 Add: Premium on bonds payable $125,000 $2,500,000 150,000 $2,650,000 Interest is payable annually on January 1. The bonds are callable on any annual interest date Blossom uses straight-line amortization for any bond premium or discount. From December 3 2020, the bonds will be outstanding for an additional 10 years (120 months). Your answer is correct. Journalize the payment of bond interest on January 1, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 19 202i Interest Payable 125,000 TCash 125,000 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the entry to amortize bond premium and to accrue the interest due on December 31, 2021. (Credit account titles are automatically Indented when amount is entered. Do LUS Help System Announcements CALCULATOR PRINTER VERSION BACK NEXT | 125,000 Casn SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the entry to amortize bond premium and to accrue the interest due on December 31, 2021. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31, 2021 Interest Expense 110,000 Premium on Bonds Payable Interest Payable 125,000 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Assume that on January 1, 2022, after paying interest, Blossom Company calls bonds having a face value of $1,000,000. The call price is 101. Record the redemption of the bonds. (Credit account titles are automatically Indented when amount is entered. Do not Indent manually.) Dodation Dahit CALCULATOR PRINTER VERSION BACK NEXT Assume that on January 1, 2022, after paying interest, Blossom Company calls bonds having a face value of $1,000,000. The call price is 101. Record the redemption of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Jan. 1, Bonds Payable 2022 1,000,000 Premium on Bonds Payable 15,000 Cash 1,010,000 Gain on Bond Redemption 5,000 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the adjusting entry at December 31, 2022, to amortize bond premium and to accrue Interest on the remaining bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec 31, Interest Expense Premium on Bonds Payable 15,000 CALCULATOR PRINTER VERSION BACK NE Gain on Bond Redemption 5,00 SHOW LIST OF ACCOUNTS LINK TO TEXT Your answer is partially correct. Try again. Prepare the adjusting entry at December 31, 2022, to amortize bond premium and to accrue Interest on the remaining bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Debit Credit Date Account Titles and Explanation Dec. 31, Interest Expense 110,000 2022 rest Expense Premium on Bonds Payable 15,000 Interest Payable 125,000 Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS LINK TO TEXT Question Attempts: 1 of 3 used