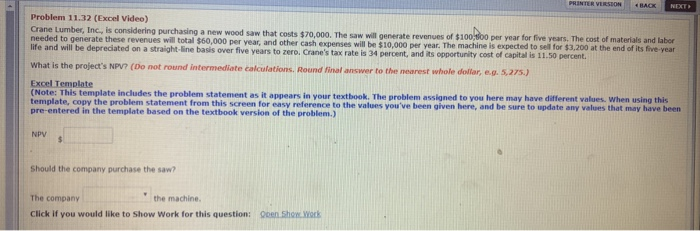

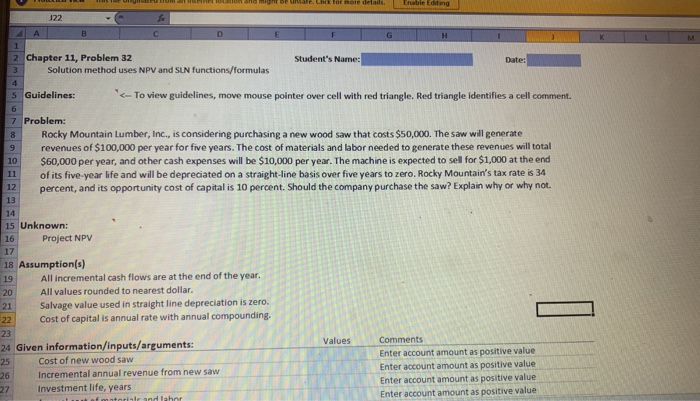

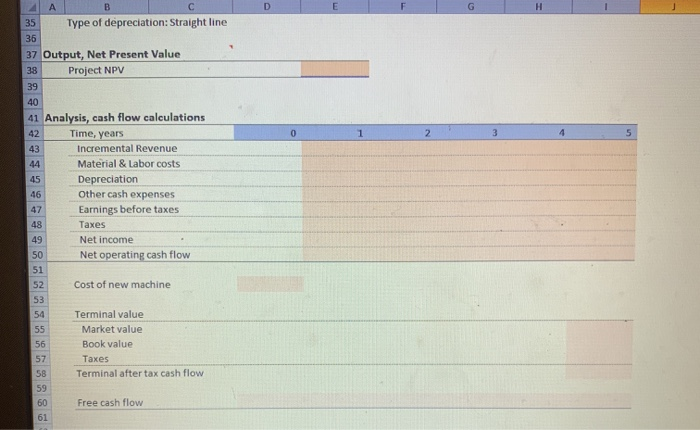

PRINTER VERSION BACK NEXT Problem 11.32 (Excel Video) Crane Lumber, Inc, is considering purchasing a new wood saw that costs $70,000, The saw will generate revenues of $100o0 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $3,200 at the end of its five-year life and will be depreciated on a straight-line basis over five years to zero. Crane's tax rate is 34 percent, and its opportunity cost of capital is 11.50 percent What is the project's NPV? (Do not round intermediate calculations. Round final answer to the nearest whole dollar, e.g. 5,275.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) NPV Should the company purchase the saw? The company the machine. Click if you would like to Show Work for this question: Qpen Show Work ation and might be unMare. Chck for more details. Enable Editing J22 G H L M 2 Chapter 11, Problem 32 Student's Name: Date: Solution method uses NPV and SLN functions/formulas 3 Guidelines: To view guidelines, move mouse pointer over cell with red triangle. Red triangle identifies a cell comment. 7 Problem: Rocky Mountain Lumber, Inc., is considering purchasing a new wood saw that costs $50,000. The saw will generate revenues of $100,000 per year for five years. The cost of materials and labor needed to generate these revenues will total $60,000 per year, and other cash expenses will be $10,000 per year. The machine is expected to sell for $1,000 at the end 10 of its five-year life and will be depreciated on a straight-line basis over five years to zero. Rocky Mountain's tax rate is 34 percent, and its opportunity cost of capital is 10 percent. Should the company purchase the saw? Explain why or why not. 11 12 13 14 15 Unknown: Project NPV 16 17 18 Assumption(s) 19 All incremental cash flows are at the end of the year. All values rounded to nearest dollar. 20 Salvage value used in straight line depreciation is zero. Cost of capital is annual rate with annual compounding. 21 22 23 Values Comments 24 Given information/inputs/arguments: Enter account amount as positive value Cost of new wood saw 25 Enter account amount as positive value Incremental annual revenue from new saw 26 Enter account amount as positive value 27 Investment life, years Enter account amount as positive value iale and lahor B E G C A Type of depreciation: Straight line 35 36 37 Output, Net Present Value Project NPV 38 39 40 41 Analysis, cash flow calculations 3 2 5 42 Time, years 0 1 Incremental Revenue 43 Material & Labor costs 44 45 Depreciation Other cash expenses 46 Earnings before taxes 47 48 es 49 Net income Net operating cash flow 50 51 52 Cost of new machine 53 Terminal value 54 Market value 55 Book value 56 57 es Terminal after tax cash flow 58 59 60 Free cash flow 61