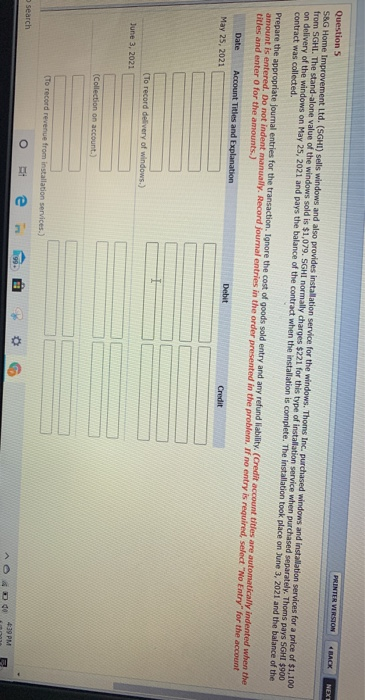

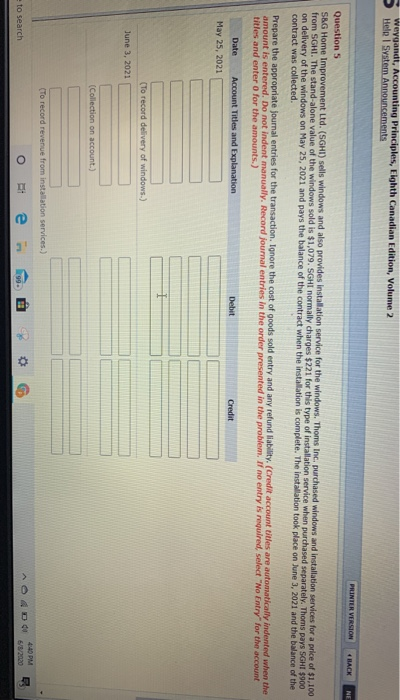

PRINTER VERSION BACK NEXT Questions SAG Home Improvement Ltd. (SGHI) sells windows and also provides installation service for the windows. Thoms Inc. purchased windows and installation services for a price of $1,100 from SGHL. The stand-alone value of the windows sold is $1,079. SGHI normally charges $221 for this type of installation service when purchased separately. Thoms pays SGHI $900 on delivery of the windows on May 25, 2021 and pays the balance of the contract when the installation is complete. The installation took place on June 3, 2021 and the balance of the contract was collected. Prepare the appropriate journal entries for the transaction. Ignore the cost of goods sold entry and any refund liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit May 25, 2021 (To record delivery of windows) June 3, 2021 (Collection on account (To record revenue from installation services.) e search D a AO 400 439 PM Weygandt, Accounting Principles, Eighth Canadian Edition, Volume 2 Help System Announcements PRINTER VERSION HACK NE Question 5 S&G Home Improvement Ltd. (SGHI) sells windows and also provides installation service for the windows. Thoms Inc, purchased windows and installation services for a price of $1,100 from SGHI. The stand-alone value of the windows sold is $1,079. SGH normally charges $221 for this type of installation service when purchased separately. Thoms pays SGHI $900 on delivery of the windows on May 25, 2021 and pays the balance of the contract when the installation is complete. The installation took place on June 3, 2021 and the balance of the contract was collected. Prepare the appropriate Journal entries for the transaction. Ignore the cost of goods sold entry and any refund liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Il no entry is required, select "No Entry for the account titles and enter o for the amounts.) Date Account Titles and Explanation Debit Credit May 25, 2021 (To record delivery of windows.) June 3, 2021 (Collection on account.) (To record revenue from installation services.) 4:40 PM to search 99- C G