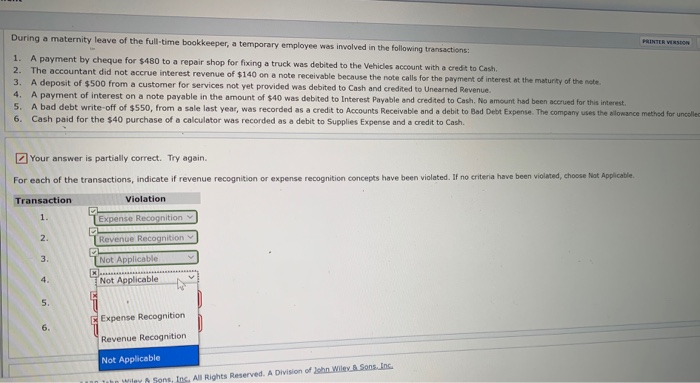

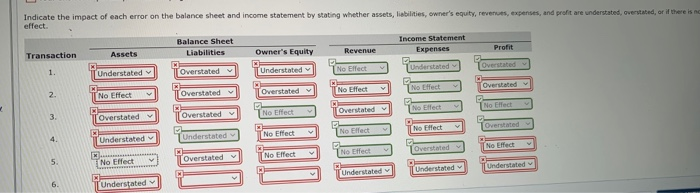

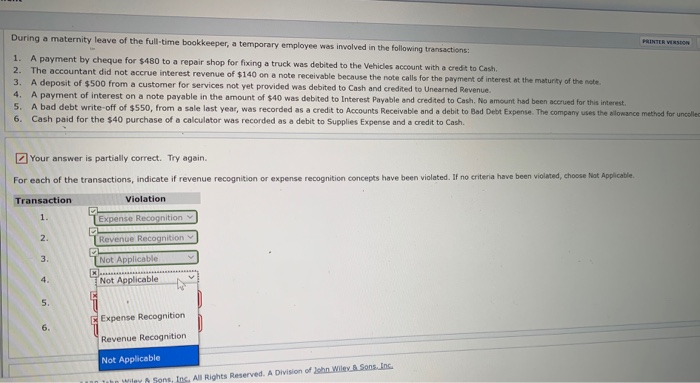

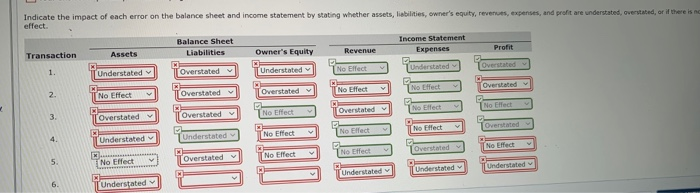

PRINTER VERSION During a maternity leave of the full-time bookkeeper, a temporary employee was involved in the following transactions: 1. A payment by cheque for $480 to a repair shop for fixing a truck was debited to the Vehicles account with a credit to Cash. 2. The accountant did not accrue interest revenue of $140 on a note receivable because the note calls for the payment of interest at the maturity of the note 3. A deposit of $500 from a customer for services not yet provided was debited to Cash and credited to Uneared Revenue 4. A payment of interest on a note payable in the amount of $40 was debited to Interest Payable and credited to Cash. No amount had been accrued for this interest 5. A bad debt write-off of $550, from a sale last year, was recorded as a credit to Accounts Receivable and a debit to Bad Debt Expense. The company uses the slowance method for uncollec 6. Cash paid for the $40 purchase of a calculator was recorded as a debit to Supplies Expense and a credit to Cash. Your answer is partially correct. Try again. For each of the transactions, indicate if revenue recognition or expense recognition concepts have been violated. If no criteria have been violated, choose Not Applicable. Transaction Violation 1. Expense Recognition 2 PPS Revenue Recognition 3. Not Applicable Not Applicable 5. xx E Expense Recognition 6 Revenue Recognition Not Applicable Wey Sons, Inc. All Rights Reserved. A Division of John Wiley & Sons, Inc. Indicate the impact of each error on the balance sheet and income statement by stating whether assets, liabilities, owner's equity, revenues, expenses, and profit are understated, overstated, or if there is no effect Balance Sheet Income Statement Transaction Assets Liabilities Owner's Equity Revenue Expenses Profit 1. Understated Overstated Understated No Effect Understated Overstated Overstated No Effect 2 No Effect Overstated No Effect Overstated (No Effect No Effect No Elect Overstated Overstated Overstated Overstated No Effect No Effect No Effect 4 Understated Understated No Effect Overstated No Effect No Effect 5 M. No Effect Overstated Understated Understated Understated 6. Understated