Answered step by step

Verified Expert Solution

Question

1 Approved Answer

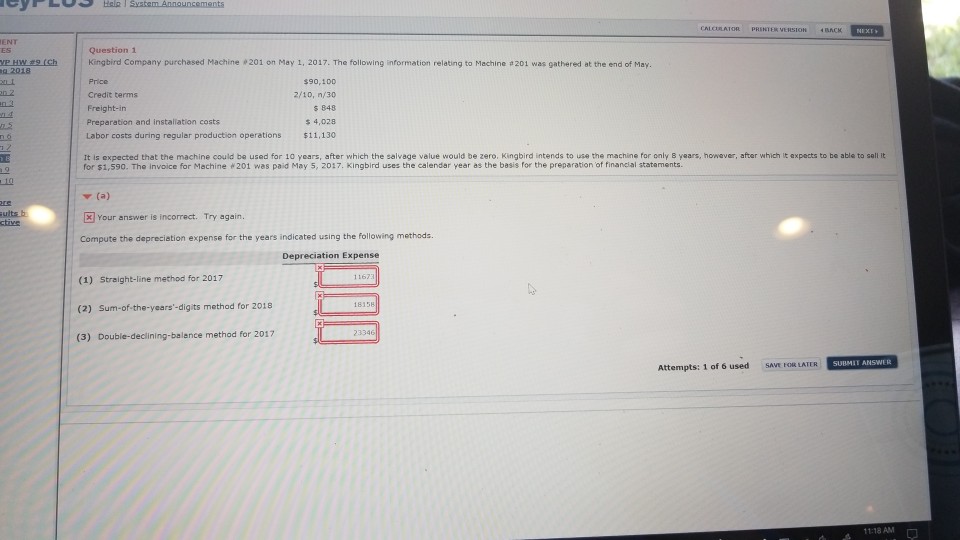

PRINTER VERSION ENT Question 1 Kingbird Company purchased Machine #201 on May 1, 2017. The following information relating to Machine a201 was gathered at the

PRINTER VERSION ENT Question 1 Kingbird Company purchased Machine #201 on May 1, 2017. The following information relating to Machine a201 was gathered at the end of May. 2018 $90,100 2/10,n/30 s 848 4,028 $11,130 n? Credit terms Preparation and instaliation costs Labor costs during regular production operations ? pected that the machine could b used for 10 years, after which the salvage value would be zero. Kingbird intends to use the machine ror only 8 years, however, after which t expects to be able to s for $1,590. The invoice for Machine 201 was paid May 5, 2017. Kingbird uses the calendar year as the basis for the preparation of tinancial stataments. 10 ? (a) x Your answer is incorrect. Try again. ctive Compute the depreciation expense for the years indicated using the following methods. (1) Straight-line method for 2017 (2) Sum-of-the-years'-digits method for 2018 (3) Double-declining-balence method for 2017 23346 Attempts: 1 of 6 used SAVE FOR LATERUBART ASWE 11:18 AM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started