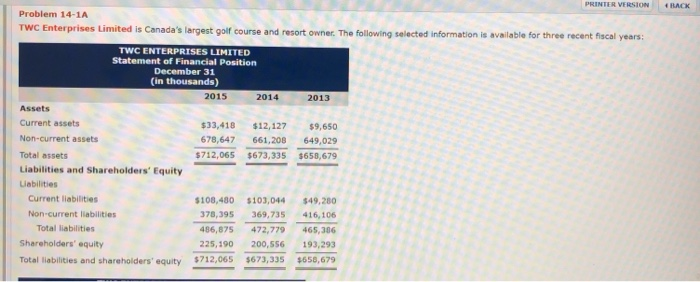

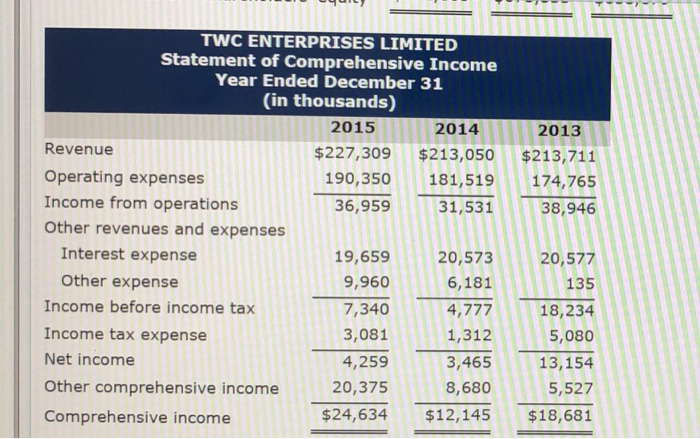

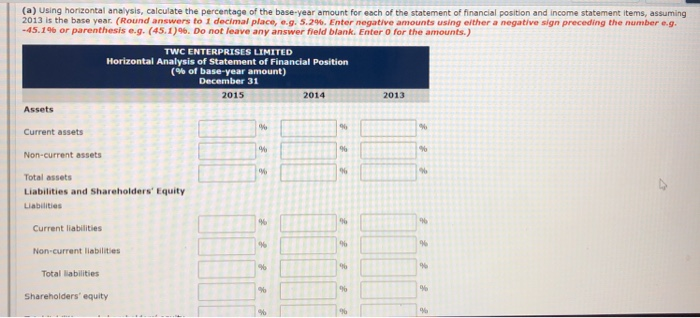

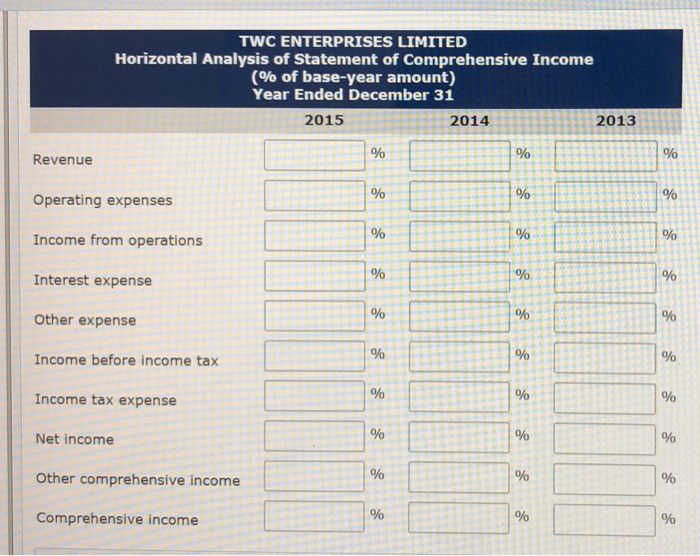

PRINTER VERSION RACK Problem 14-1A TWC Enterprises Limited is Canada's largest golf course and resort owner. The following selected information is available for three recent fiscal years: TWC ENTERPRISES LIMITED Statement of Financial Position December 31 (in thousands) 2015 2014 2013 Assets Current assets Non-current assets $33,418 $12,127 $9,650 678,647 661,208 649,029 $712,065 $673,335 $658,679 Total assets Liabilities and Shareholders' Equity Liabilities Current liabilities Non current liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity $108,480 378,395 486,875 225,190 $712,065 $103,044 369,735 472,779 200,556 $673,335 $49,280 416,106 465,306 193,293 $658,679 - 2013 $213,711 174,765 38,946 TWC ENTERPRISES LIMITED Statement of Comprehensive Income Year Ended December 31 (in thousands) 2015 2014 Revenue $227,309 $213,050 Operating expenses 190,350 181,519 Income from operations 36,959 31,531 Other revenues and expenses Interest expense 19,659 20,573 Other expense 9,960 6,181 Income before income tax 7,340 4,777 Income tax expense 3,081 1,312 Net income 4,259 3,465 Other comprehensive income 20,375 8,680 Comprehensive income $24,634 $12,145 20,577 135 18,234 5,080 13,154 5,527 $18,681 (a) Using horizontal analysis, calculate the percentage of the base-year amount for each of the statement of financial position and income statement items, assuming 2013 is the base year. (Round answers to 1 decimal place, e.g. 5.2%. Enter negative amounts using either a negative sign preceding the number e.g. -45.1% or parenthesis e.g. (45.1). Do not leave any answer field blank. Enter o for the amounts.) TWC ENTERPRISES LIMITED Horizontal Analysis of Statement of Financial Position (% of base-year amount) December 31 2015 2014 2013 Assets % 90 Current assets 9% 96 % Non-current assets 90 96 Total assets Liabilities and shareholders' Equity Liabilities 90 Current liabilities % % 96 96 Non-current liabilities 96 Total liabilities Shareholders' equity TWC ENTERPRISES LIMITED Horizontal Analysis of Statement of Comprehensive Income (% of base-year amount) Year Ended December 31 2015 2014 2013 % Revenue % % Operating expenses % % % Income from operations % % % % Interest expense % % % Other expense % % % % Income before income tax % Income tax expense % % % Net income % % Other comprehensive income % % % Comprehensive income % % %