Question

Prior to 2018, the company had 100 shares issued and outstanding. The par value is $1 per share. Provide the journal entry for the issuance

Prior to 2018, the company had 100 shares issued and outstanding. The par value is $1 per share. Provide the journal entry for the issuance of 200 shares of stock in 2018 for $12 a share.

The company issued 100 shares in 2019 (at the beginning of the year). Provide the journal entry for the issuance of equity. For this question, assume that no other transactions affected Paid-in capital in excess of par that year.

Suppose that the stock repurchase in 2019 was the companys first and only repurchase. Provide the journal entry for stock repurchase.

Now suppose that in 2020 the companys stock price plummets, and the company reissues the repurchased shares for $6 per share. Provide the journal entry for this transaction (2 points). What effect would this reissue have on the companys net income: increase, decrease, or no effect (2 points)?

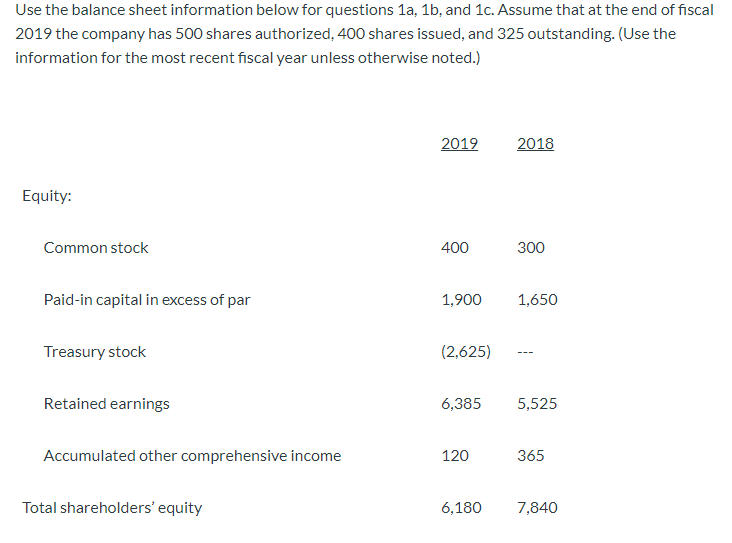

Use the balance sheet information below for questions 1a, 1b, and 1c. Assume that at the end of fiscal 2019 the company has 500 shares authorized, 400 shares issued, and 325 outstanding. (Use the information for the most recent fiscal year unless otherwise noted.) 2019 2018 Equity: Common stock 400 300 Paid-in capital in excess of par 1,900 1,650 Treasury stock (2,625) Retained earnings 6,385 5,525 Accumulated other comprehensive income 120 365 Total shareholders' equity 6,180 7,840Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started