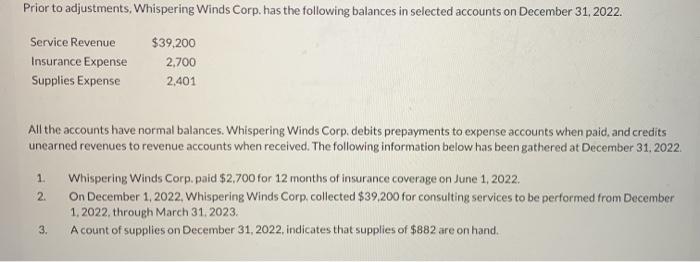

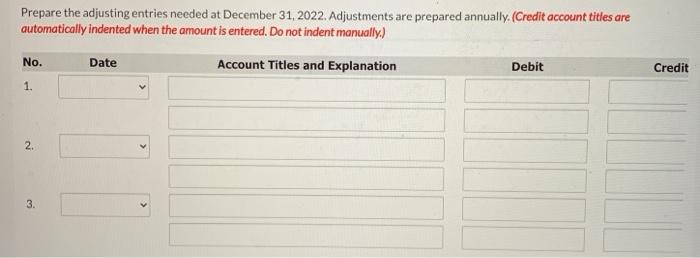

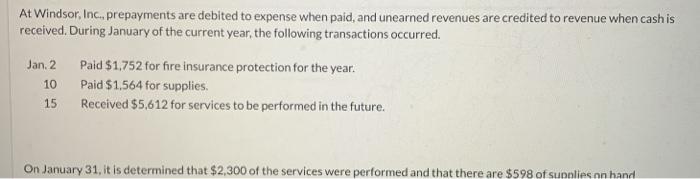

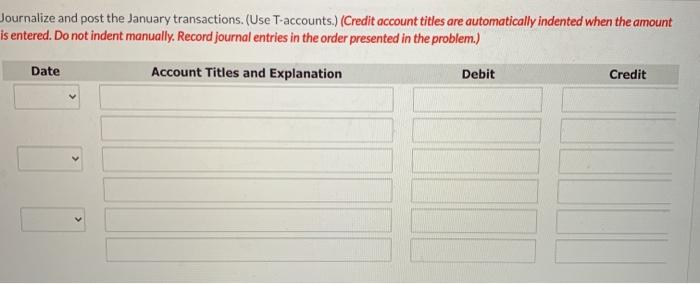

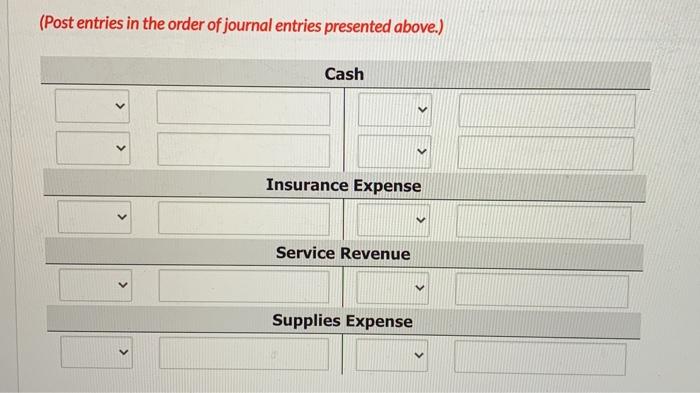

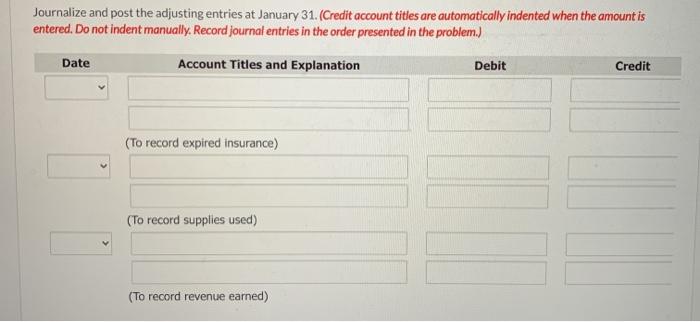

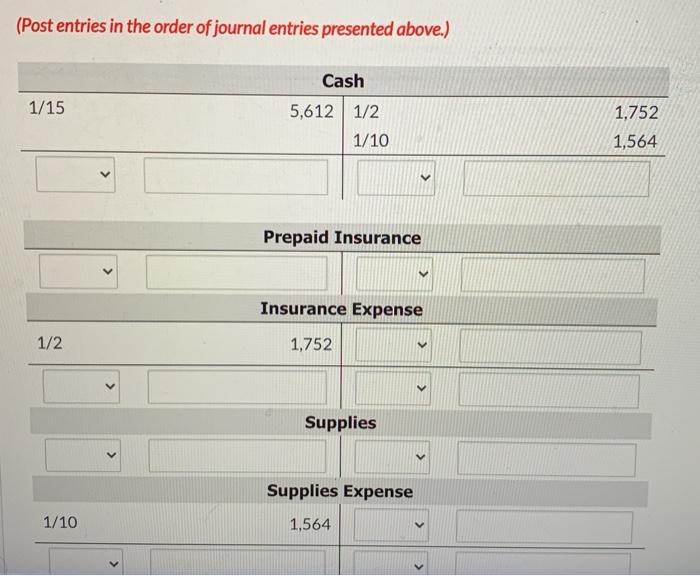

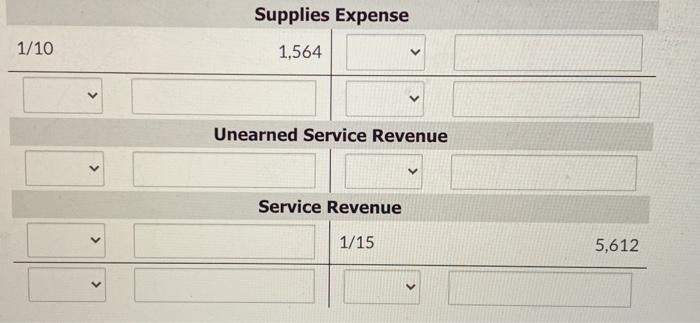

Prior to adjustments, Whispering Winds Corp. has the following balances in selected accounts on December 31, 2022. Service Revenue Insurance Expense Supplies Expense $39.200 2.700 2,401 All the accounts have normal balances. Whispering Winds Corp. debits prepayments to expense accounts when paid, and credits unearned revenues to revenue accounts when received. The following information below has been gathered at December 31, 2022 Whispering Winds Corp. paid $2,700 for 12 months of insurance coverage on June 1, 2022. On December 1, 2022. Whispering Winds Corp.collected $39.200 for consulting services to be performed from December 1,2022, through March 31, 2023. A count of supplies on December 31, 2022, indicates that supplies of $882 are are on hand. 1 2 3. Prepare the adjusting entries needed at December 31, 2022. Adjustments are prepared annually. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit 1 2. 3. At Windsor, Inc., prepayments are debited to expense when paid, and unearned revenues are credited to revenue when cash is received. During January of the current year, the following transactions occurred. Jan. 2 Paid $1.752 for fire insurance protection for the year. Paid $1,564 for supplies 15 Received $5,612 for services to be performed in the future. 10 On January 31, it is determined that $2,300 of the services were performed and that there are $598 of supplies on hand Journalize and post the January transactions. (Use T-accounts.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (Post entries in the order of journal entries presented above.) Cash Insurance Expense Service Revenue Supplies Expense Journalize and post the adjusting entries at January 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit (To record expired insurance) (To record supplies used) (To record revenue earned) (Post entries in the order of journal entries presented above.) Cash 1/15 5,612 1/2 1,752 1,564 1/10 Prepaid Insurance Insurance Expense 1/2 1,752 Supplies Supplies Expense 1/10 1,564 Supplies Expense 1/10 1,564 Unearned Service Revenue Service Revenue 1/15 5,612 V Determine the ending balance in each of the accounts. Cash A Prepaid insurance 8 Supplies 2 Unearned service revenue 2 Service revenue 2 Insurance expense $ Supplies expense A