Question

Prior to beginning this Interactive Assignment, review the sections of Chapters 5, 8, and 9 in the Abrahams textbook on Assessing the Company and Operational

Prior to beginning this Interactive Assignment, review the sections of Chapters 5, 8, and 9 in the Abrahams textbook on Assessing the Company and Operational and Budget Planning. Also read the online articles Analyze Investments Quickly With Ratios (Links to an external site.) (Elmerraji, 2017) and What Is an Annualized Budget? (Links to an external site.) (Ashe-Edmunds, n.d.).

Using the same publicly traded company you used in the Environmental Scanning Interactive Assignment, and the downloadable Operating Budget Template Download Operating Budget Template, research the company online by accessing the Mergent University of Arizona Global Campus Library online database which offers company financials, descriptions, history, property, subsidiaries, officers and directors. Also, access the Business Insights: Global University of Arizona Global CampusLibrary online database which offers information on global companies, and industries. It includes SWOT reports, market share data, financial reports, case studies, business news, and company comparison charts. (View the Getting Started With Mergent (Links to an external site.) and Business Insights: Global (Links to an external site.) documents for suggested methods of searching University of Arizona Global Campus Library databases generally as well as specific advice for searching these two databases). You can always conduct research using credible online sources of corporate financial information, just be sure that wherever you obtain financial information that you cite your source.

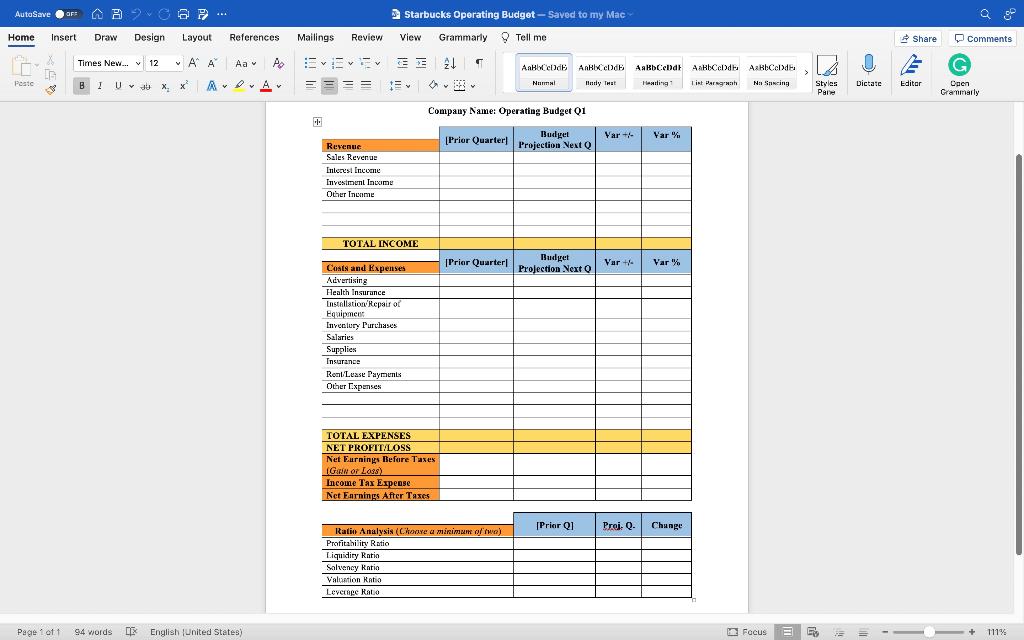

For this Interactive Assignment, you are going to look at the financial statements for the company you selected and, using the previous quarters financial data, interpret the data and propose a budget for the next Quarter based on your current and previous analysis of company performance. Complete the budget template using this Operating Budget Template Download Operating Budget Template:

- List your current sales, discounts and allowances, net sales, margins, operating costs, and earning before and after taxes.

- Choose a minimum of two financial ratios (below) and include in your analysis.

- Prepare the next quarters budget based on your interpretation of past data.

Include at least two of the following types of relevant financial ratios in your analysis. Review the online article Analyze Investments Quickly With Ratios (Links to an external site.) (Elmerraji, 2017) and Chapter 5 in the Abrahams textbook to help with this portion of the budget:

- Profitability Ratio

- Liquidity Ratio

- Solvency Ratio

- Valuation Ratio

- Leverage Ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started