Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Prior to beginning work on this discussion forum, read Chapter 12: The Cost of Capital and Chapter 8, Section 5c of the text, and

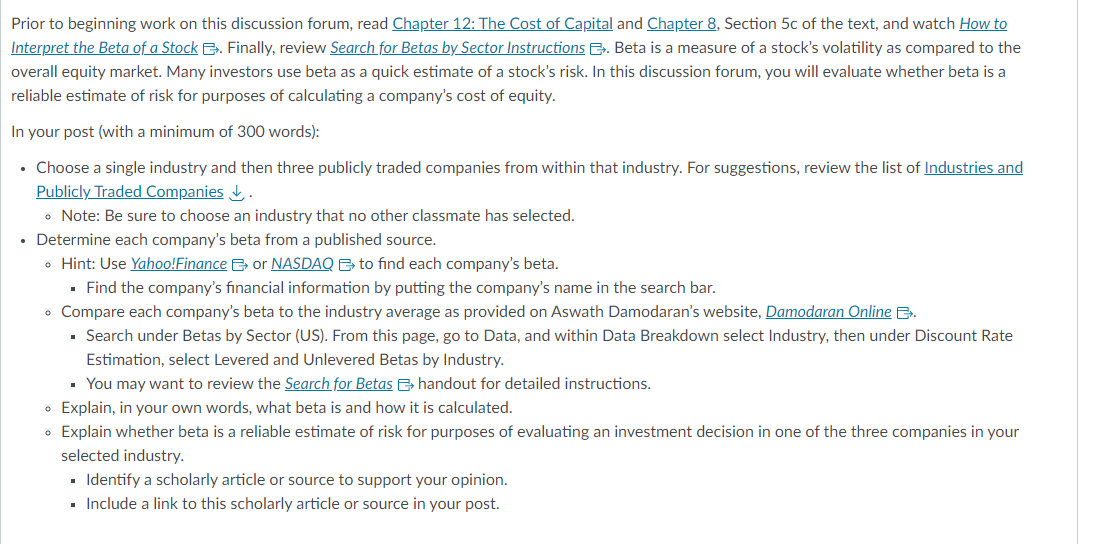

Prior to beginning work on this discussion forum, read Chapter 12: The Cost of Capital and Chapter 8, Section 5c of the text, and watch How to Interpret the Beta of a Stock B. Finally, review Search for Betas by Sector Instructions B. Beta is a measure of a stock's volatility as compared to the overall equity market. Many investors use beta as a quick estimate of a stock's risk. In this discussion forum, you will evaluate whether beta is a reliable estimate of risk for purposes of calculating a company's cost of equity. In your post (with a minimum of 300 words): Choose a single industry and then three publicly traded companies from within that industry. For suggestions, review the list of Industries and Publicly Traded Companies. Note: Be sure to choose an industry that no other classmate has selected. Determine each company's beta from a published source. Hint: Use Yahoo! Finance or NASDAQ to find each company's beta. Find the company's financial information by putting the company's name in the search bar. Compare each company's beta to the industry average as provided on Aswath Damodaran's website, Damodaran Online >. Search under Betas by Sector (US). From this page, go to Data, and within Data Breakdown select Industry, then under Discount Rate Estimation, select Levered and Unlevered Betas by Industry. You may want to review the Search for Betas handout for detailed instructions. Explain, in your own words, what beta is and how it is calculated. Explain whether beta is a reliable estimate of risk for purposes of evaluating an investment decision in one of the three companies in your selected industry. Identify a scholarly article or source to support your opinion. Include a link to this scholarly article or source in your post.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started