Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Priscella pursued a hobby of making bedspreads in her spare time. Her AGI before considering the hobby is $40,000. During 2021 she sold the

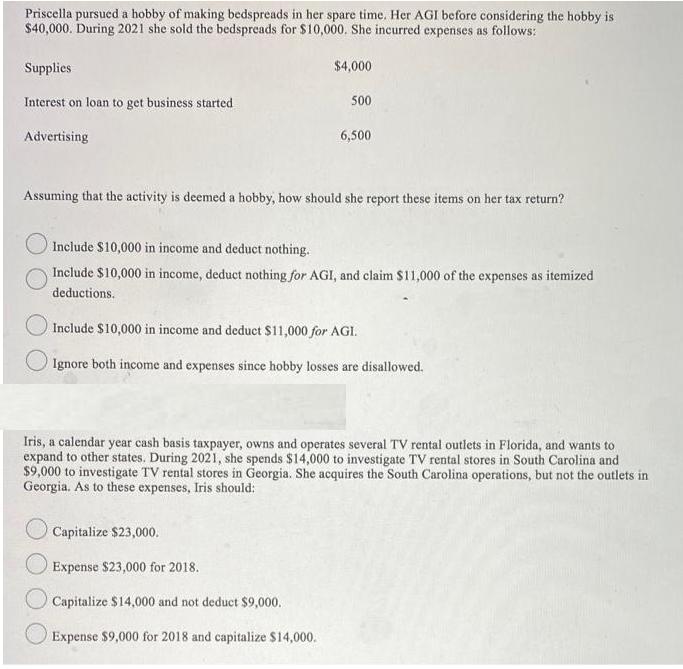

Priscella pursued a hobby of making bedspreads in her spare time. Her AGI before considering the hobby is $40,000. During 2021 she sold the bedspreads for $10,000. She incurred expenses as follows: Supplies Interest on loan to get business started Advertising $4,000 500 Assuming that the activity is deemed a hobby, how should she report these items on her tax return? 6,500 Include $10,000 in income and deduct nothing. Include $10,000 in income, deduct nothing for AGI, and claim $11,000 of the expenses as itemized deductions. Capitalize $23,000. O Expense $23,000 for 2018. Include $10,000 in income and deduct $11,000 for AGI. O Ignore both income and expenses since hobby losses are disallowed. Capitalize $14,000 and not deduct $9,000. Expense $9,000 for 2018 and capitalize $14,000. Iris, a calendar year cash basis taxpayer, owns and operates several TV rental outlets in Florida, and wants to expand to other states. During 2021, she spends $14,000 to investigate TV rental stores in South Carolina and $9,000 to investigate TV rental stores in Georgia. She acquires the South Carolina operations, but not the outlets in Georgia. As to these expenses, Iris should:

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided bel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started