Question

Prism Corporation acquires the voting stock of Streetspace Inc. on January 1, 2020, for $100,000 in cash. Streetspaces book value at the date of acquisition

Prism Corporation acquires the voting stock of Streetspace Inc. on January 1, 2020, for $100,000 in cash. Streetspaces book value at the date of acquisition was:

| Common stock, $1.00 par | $ 2,000 |

| Additional paid-in capital | 4,000 |

| Retained earnings | 6,000 |

| Accumulated other comprehensive loss | (200) |

| Treasury stock | (100) |

| Total | $11,700 |

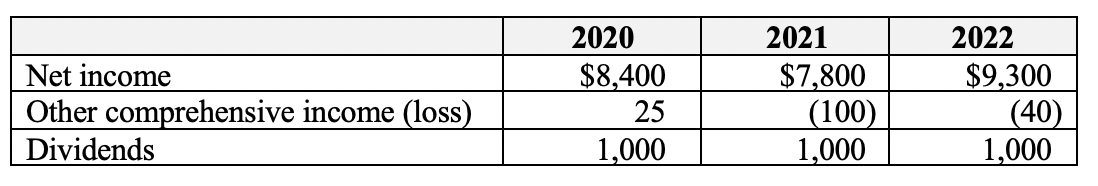

All of Streetspaces recorded assets and liabilities are carried at fair value, but it has previously unrecorded customer-related intangible assets valued at $28,000 that are capitalizable under the requirements of ASC Topic 805. These intangibles have an estimated life of 5 years, straight-line. It is determined through impairment testing that acquired goodwill is impaired by $500 in 2020, and is unimpaired in 2021 and 2022. Customer-related intangible assets are not impaired during the three years following acquisition. Streetspace reports net income, other comprehensive income, and declared and paid dividends as follows for 2020, 2021, and 2022:

Prism uses the complete equity method to account for its investment in Streetspace on its own books.

Required

a. Calculate the amount Prism reports for 2022 as equity in net income of Streetspace on its own books.

b. Present, in journal entry form, the four eliminating entries needed to consolidate the trial balances of Prism and Streetspace at December 31, 2022. Revaluation write-offs are adjustments to operating expenses.

Net income Other comprehensive income (loss) Dividends 2020 $8,400 25 1,000 2021 $7,800 (100) 1,000 2022 $9,300 (40) 1,000 Net income Other comprehensive income (loss) Dividends 2020 $8,400 25 1,000 2021 $7,800 (100) 1,000 2022 $9,300 (40) 1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started