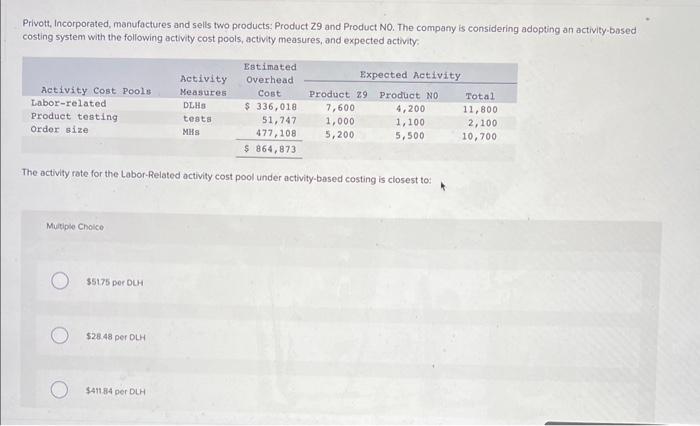

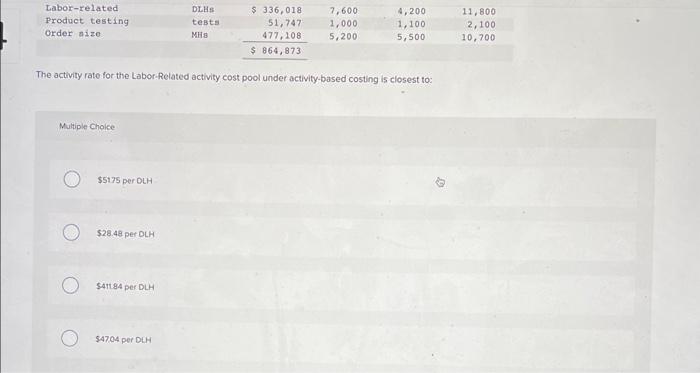

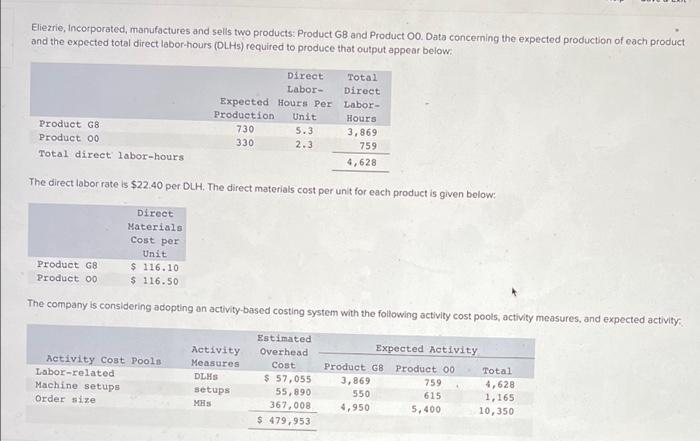

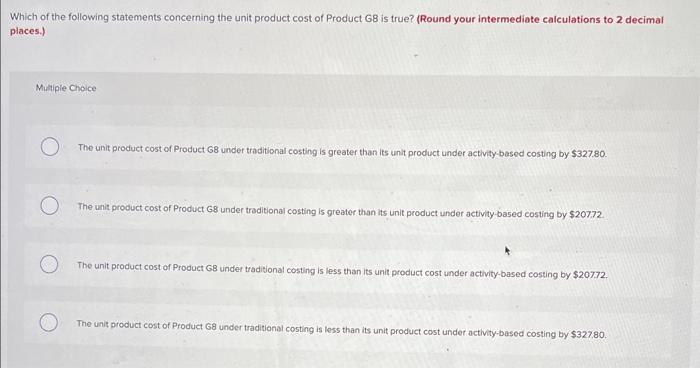

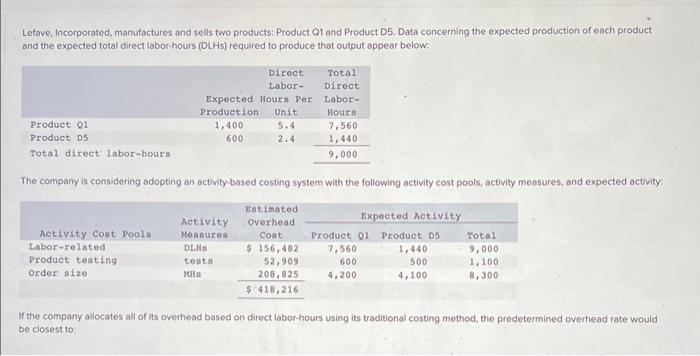

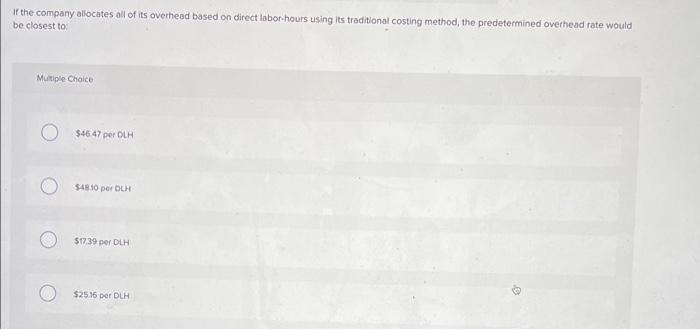

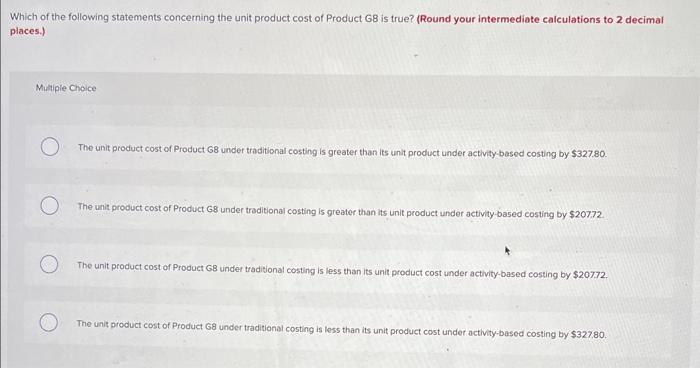

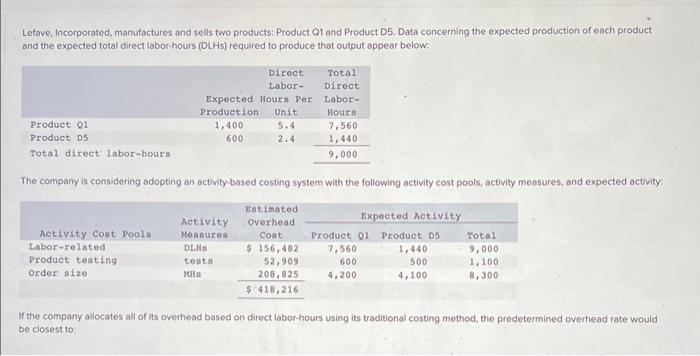

Privott, Incorporated, manufactures and sells two products: Product 29 and Product NO. The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity; The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to: Mutipie Choice 35175 Dor DLH $28.48 per DLH $41184 per DLH The activity rate for the Labor-Related activity cost pool under activity-based costing is closest to: Multiple Choice $5175 per DLH $28.48perDLH S4tt 84 per DLH $47,04 per DLH Eliezrie, Incorporated, manufactures and sells two products: Product G8 and Product O0. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below: The direct labor rate is $22.40 per. DLH, The direct materials cost per unit for each product is given below: The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity: Which of the following statements concerning the unit product cost of Product G8 is true? (Round your intermediate calculations to 2 decimal places.) Mutiple Choice The unit product cost of Product 68 under traditional costing is greater than its unit product under activity.based costing by $327,80. The unit product cost of Product 68 under traditional costing is greater than its unit product under activity based costing by $20772. The unit product cost of Product G8 under traditional costing is less than its unit product cost under activity-based costing by $20772. The unit product cost of Product G8 under traditional costing is less than its unit product cost under activity-based costing by $327.80. Lefave, incorporated, manufactures and sells two products: Product Q1 and Product D5. Data concerning the expected production of each product and the expected total direct labor-hours (D(Hs) required to produce that output appear below: The company is considering adopting an activity-bosed costing system with the following activity cost pools, octivity mensures, and expected activity: If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the predetermined overhead rate would be closest to: If the company allocates all of its overhead based on direct labor-hours tising its traditlonal costing method, the predetermined overhead rate would be closest to: Mutiple Choice $4647 per DLH $4810 per DLH $17,39 per OLH $25.16 per DLH