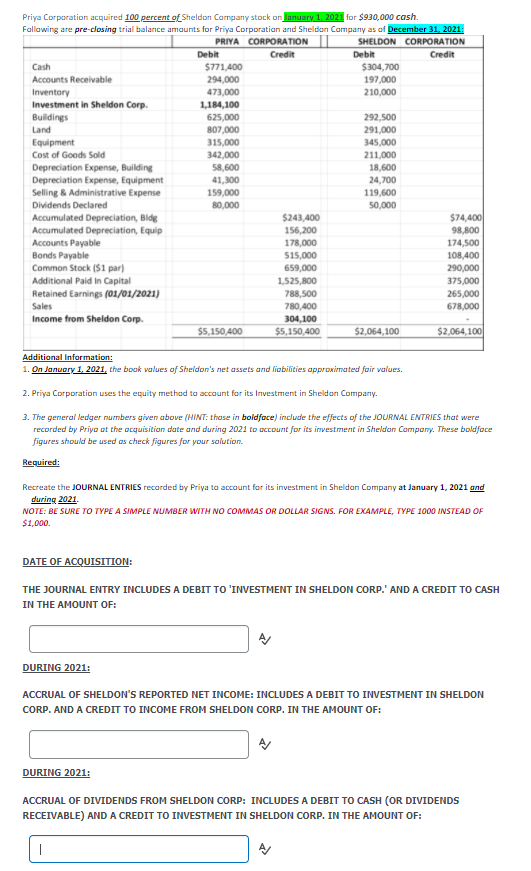

Priya Corporation acquired 100 percent of Sheldon Company stock on January 1, 2021 for $930,000 cash. Following are pre-closing trial balance amounts for Priya Corporation and Sheldon Company as of December 31, 2021: PRIYA CORPORATION SHELDON CORPORATION Debit Credit Debit Credit Cash $771,400 $304,700 Accounts Receivable 294,000 197,000 Inventory 473,000 210,000 Investment in Sheldon Corp. 1,184,100 Buildings 625,000 292,500 Land 807,000 291,000 Equipment 315,000 345,000 Cost of Goods Sold 342,000 211,000 Depreciation Expense, Building 58,600 18,600 Depreciation Expense, Equipment 41,300 24,700 Selling & Administrative Expense 159,000 119,600 Dividends Declared 80,000 50,000 Accumulated Depreciation, Bldg $243,400 $74,400 Accumulated Depreciation, Equip 156,200 98,800 Accounts Payable 178,000 174,500 Bonds Payable 515,000 108,400 Common Stock ($1 par) 659,000 290,000 Additional Paid in Capital 1.525,800 375,000 Retained Earnings (01/01/2021) 788,500 265,000 Sales 780,400 678,000 Income from Sheldon Corp. 304,100 $5,150,400 $5,150,400 $2,064,100 $2,064,100 Additional Information: 1. On January 1, 2021, the book values of Sheldon's net assets and liabilities approximated fair values. 2. Priya Corporation uses the equity method to account for its Investment in Sheldon Company 3. The general ledger numbers given above (HINT: those in boldface) include the effects of the JOURNAL ENTRIES that were recorded by Priyo at the acquisition date and during 2021 to account for its investment in Sheldon Company. These boldface figures should be used as check figures for your solution Required: Recreate the JOURNAL ENTRIES recorded by Priya to account for its investment in Sheldon Company at January 1, 2021 and during 2021 NOTE: BE SURE TO TYPE A SIMPLE NUMBER WITH NO COMMAS OR DOLLAR SIGNS. FOR EXAMPLE, TYPE 1000 INSTEAD OF $1,000 DATE OF ACQUISITION: THE JOURNAL ENTRY INCLUDES A DEBIT TO 'INVESTMENT IN SHELDON CORP.' AND A CREDIT TO CASH IN THE AMOUNT OF: A/ DURING 2021: ACCRUAL OF SHELDON'S REPORTED NET INCOME: INCLUDES A DEBIT TO INVESTMENT IN SHELDON CORP. AND A CREDIT TO INCOME FROM SHELDON CORP. IN THE AMOUNT OF: DURING 2021 ACCRUAL OF DIVIDENDS FROM SHELDON CORP: INCLUDES A DEBIT TO CASH (OR DIVIDENDS RECEIVABLE) AND A CREDIT TO INVESTMENT IN SHELDON CORP. IN THE AMOUNT OF