Answered step by step

Verified Expert Solution

Question

1 Approved Answer

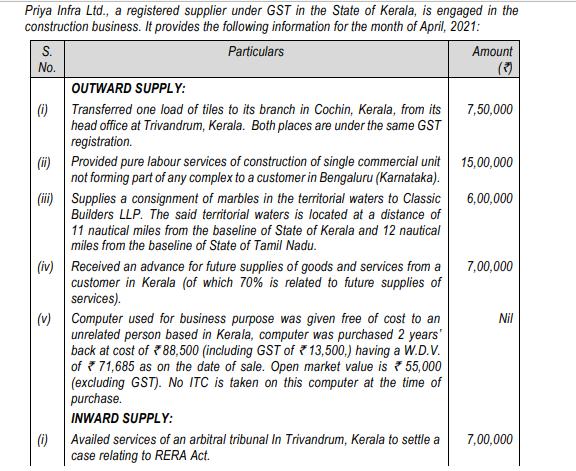

Priya Infra Ltd., a registered supplier under GST in the State of Kerala, is engaged in the construction business. It provides the following information

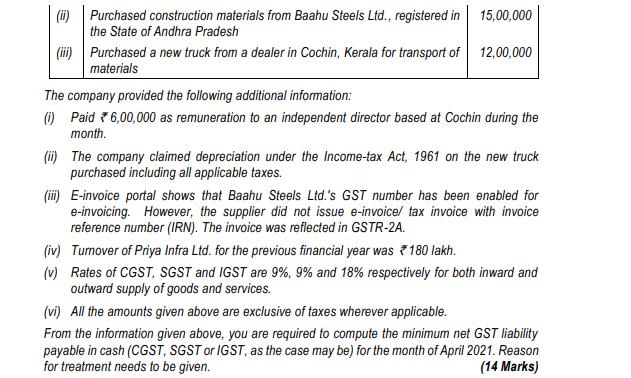

Priya Infra Ltd., a registered supplier under GST in the State of Kerala, is engaged in the construction business. It provides the following information for the month of April, 2021: Particulars S. No. (1) (ii) (iii) OUTWARD SUPPLY: Transferred one load of tiles to its branch in Cochin, Kerala, from its head office at Trivandrum, Kerala. Both places are under the same GST registration. Provided pure labour services of construction of single commercial unit not forming part of any complex to a customer in Bengaluru (Karnataka). Supplies a consignment of marbles in the territorial waters to Classic Builders LLP. The said territorial waters is located at a distance of 11 nautical miles from the baseline of State of Kerala and 12 nautical miles from the baseline of State of Tamil Nadu. (iv) Received an advance for future supplies of goods and services from customer in Kerala (of which 70% is related to future supplies of services). (i) (v) Computer used for business purpose was given free of cost to an unrelated person based in Kerala, computer was purchased 2 years' back at cost of 88,500 (including GST of 13,500,) having a W.D.V. of 71,685 as on the date of sale. Open market value is 55,000 (excluding GST). No ITC is taken on this computer at the time of purchase. INWARD SUPPLY: Availed services of an arbitral tribunal In Trivandrum, Kerala to settle a case relating to RERA Act. Amount (3) 7,50,000 15,00,000 6,00,000 7,00,000 Nil 7,00,000 Purchased construction materials from Baahu Steels Ltd., registered in the State of Andhra Pradesh 15,00,000 (iii) Purchased a new truck from a dealer in Cochin, Kerala for transport of 12,00,000 materials The company provided the following additional information: (i) Paid 6,00,000 as remuneration to an independent director based at Cochin during the month. (ii) The company claimed depreciation under the Income-tax Act, 1961 on the new truck purchased including all applicable taxes. (iii) E-invoice portal shows that Baahu Steels Ltd.'s GST number has been enabled for e-invoicing. However, the supplier did not issue e-invoice/ tax invoice with invoice reference number (IRN). The invoice was reflected in GSTR-2A. (iv) Turnover of Priya Infra Ltd. for the previous financial year was *180 lakh. (v) Rates of CGST, SGST and IGST are 9%, 9% and 18% respectively for both inward and outward supply of goods and services. (vi) All the amounts given above are exclusive of taxes wherever applicable. From the information given above, you are required to compute the minimum net GST liability payable in cash (CGST, SGST or IGST, as the case may be) for the month of April 2021. Reason for treatment needs to be given. (14 Marks)

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started