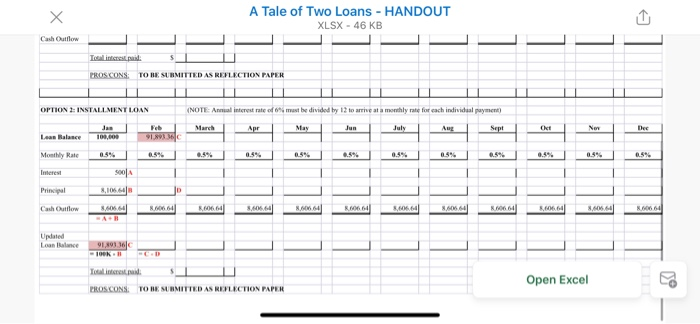

Pro and cons of this type

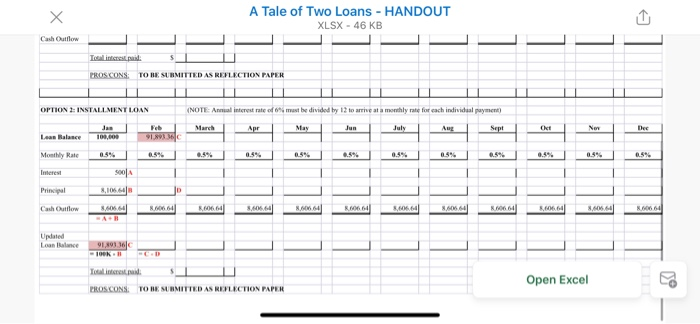

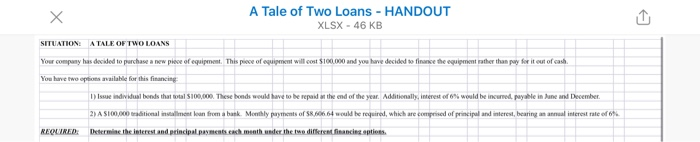

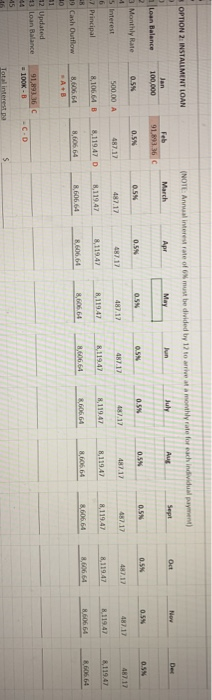

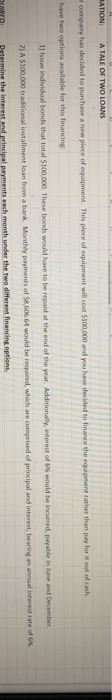

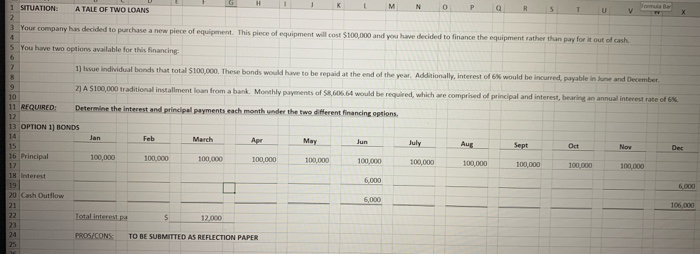

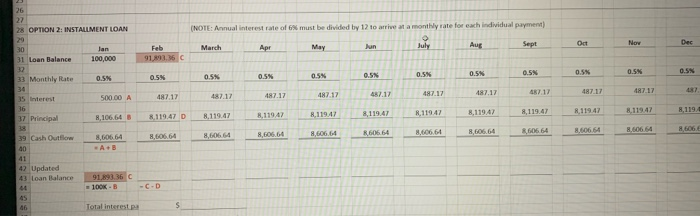

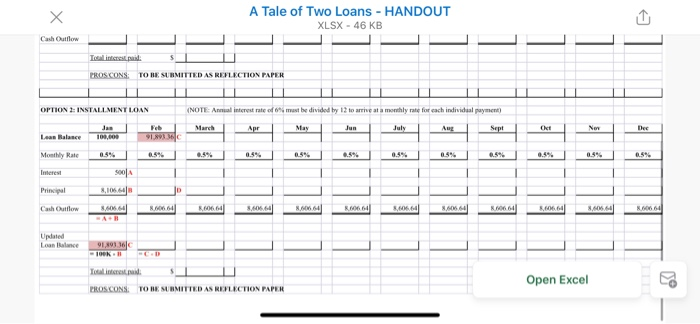

A Tale of Two Loans - HANDOUT XLSX - 46 KB Cash Outlow Teline. PROS CONS: TO BE SUBMITTED AS REFLECTION PAPER OPTION 2: INSTALLMENT LOAN NOTE: Ama interest rate of be divided by 12 to arrive rate for each individual payment La Ralance Mostly Rate 0.5% 24 0.5% Interest 500A 106 Chow 8.605. 0 8 .600.64 66.648.606.64 Updated Loan Istance 91.0116 Toitel.pad Open Excel PROS CONSE TO BE SUBMITTED AN REFLECTION PAPER A Tale of Two Loans - HANDOUT XLSX - 46 KB SITUATION:A TALE OF TWO LOANS Your company has decided to purchase a new piece of equipment. This p ofuit will cost $100.000 and you have decided to face the equipment rather than pay for it out of cash You have two options available for this financing 1) Issue individual bands that total $100,000. These bonds would have to be repard at the end of the year. Additionally, Interest of 6% would be incurred. payable in June and December 2) A S100,000 tonaliniament loan from a bank Mewly payments of S. 64 w e required, which are comedofi l and interest, bearing an interest rate of 6 REQUIRED Tetermine the interest and principal payments each month under the two different financie OPTION 2: INSTALLMENT LOAN (NOTE: Annual interest rate of ach individual payment) must be divided by 17 to arrive at March Sept Loan Balance 100,000 91.893.36 C 0.5% OS 0.5N 0.5% 0.5 3 Monthly Rate 0.5% 487.17 487.17 457.17 487.17 487.17 5 Interest 487.17 500.00 A 487.17 487.17 1,119.47 1,11947 - 8,106 64 B Principal 119.47 311947 D ,119.47 8.606 64 R606.64 8,606.64 8,606.64 8,606.66 8,606.64 8.606.64 19 Cash Outflow 2 Updated 43 Loan Balance 91,8936 = 100K-B Tot interest BATIONI A TALE OF TWO LOANS a company has decided to purchase a new piece of equipment. This piece of equipment will cost $100,000 and have two options available for this financing 1) Issue individual bonds that total $100,000. These bonds would have to be repaid at the end of the year. Additionally, Interest of 6% would be incurred, payable in lume and December 2) A $100.000 traditional installment loan from a bank. Monthly payments of SR 0.06.64 would be required, which are comprised of principal and interest, bearing an annual interest rate of MRER: Prisimine the interest and principal payments each month under the two different financing options 1 SITUATION: A TALE OF TWO LOANS 3 Your company has decided to purchase a new piece of e ent. This piece of equipment will cost $100.000 and you have decided to finance the rather than pay for it out of cash You have two options available for this financing 1) l e individual bonds that total $100.000. These bonds would have to be repaid at the end of the year. Additionally, interest of would be incurred, payable in June and December 2) A $100.000 traditional installment loan from a band Monthly payments of S w e d , which we comprised of principal and interesting interest rate of 11 REQUIRED: Determine the interest and principal payments each month under the two different financing options. 13 OPTION 1) BONDS March Sept 100 10000 100.000 100.000 100.000 100,000 10000 100.000 100 000 18 Interest 20 Cash Outllow PROS/CONS TO BE SUBMITTED AS REFLECTION PAPER 2 OPTION 2: INSTALLMENT LOAN (NOTE: Annual interest rate of must be divided by 12 to vie a monthly rate for each individual payment) Apr Aug March 91c Sept. Dec 31 Loan Balance 100,000 11 Monthly Rate ON OSN 0.5% 0.5 OS 500.00 A 487.17 487.12 487.17 487.17 187.17 6712 487.12 187.17 37 Principal ,10664 B 119.47 D 8119.47 R119.47 8,119.41 R 119.47 8,1191 30 Cash Quetion 606 64 606.66 RECE 0664 606 64 42 Updated 41 Loan Balance 91 .36 C 100K-B -C-D Total interest A Tale of Two Loans - HANDOUT XLSX - 46 KB Cash Outlow Teline. PROS CONS: TO BE SUBMITTED AS REFLECTION PAPER OPTION 2: INSTALLMENT LOAN NOTE: Ama interest rate of be divided by 12 to arrive rate for each individual payment La Ralance Mostly Rate 0.5% 24 0.5% Interest 500A 106 Chow 8.605. 0 8 .600.64 66.648.606.64 Updated Loan Istance 91.0116 Toitel.pad Open Excel PROS CONSE TO BE SUBMITTED AN REFLECTION PAPER A Tale of Two Loans - HANDOUT XLSX - 46 KB SITUATION:A TALE OF TWO LOANS Your company has decided to purchase a new piece of equipment. This p ofuit will cost $100.000 and you have decided to face the equipment rather than pay for it out of cash You have two options available for this financing 1) Issue individual bands that total $100,000. These bonds would have to be repard at the end of the year. Additionally, Interest of 6% would be incurred. payable in June and December 2) A S100,000 tonaliniament loan from a bank Mewly payments of S. 64 w e required, which are comedofi l and interest, bearing an interest rate of 6 REQUIRED Tetermine the interest and principal payments each month under the two different financie OPTION 2: INSTALLMENT LOAN (NOTE: Annual interest rate of ach individual payment) must be divided by 17 to arrive at March Sept Loan Balance 100,000 91.893.36 C 0.5% OS 0.5N 0.5% 0.5 3 Monthly Rate 0.5% 487.17 487.17 457.17 487.17 487.17 5 Interest 487.17 500.00 A 487.17 487.17 1,119.47 1,11947 - 8,106 64 B Principal 119.47 311947 D ,119.47 8.606 64 R606.64 8,606.64 8,606.64 8,606.66 8,606.64 8.606.64 19 Cash Outflow 2 Updated 43 Loan Balance 91,8936 = 100K-B Tot interest BATIONI A TALE OF TWO LOANS a company has decided to purchase a new piece of equipment. This piece of equipment will cost $100,000 and have two options available for this financing 1) Issue individual bonds that total $100,000. These bonds would have to be repaid at the end of the year. Additionally, Interest of 6% would be incurred, payable in lume and December 2) A $100.000 traditional installment loan from a bank. Monthly payments of SR 0.06.64 would be required, which are comprised of principal and interest, bearing an annual interest rate of MRER: Prisimine the interest and principal payments each month under the two different financing options 1 SITUATION: A TALE OF TWO LOANS 3 Your company has decided to purchase a new piece of e ent. This piece of equipment will cost $100.000 and you have decided to finance the rather than pay for it out of cash You have two options available for this financing 1) l e individual bonds that total $100.000. These bonds would have to be repaid at the end of the year. Additionally, interest of would be incurred, payable in June and December 2) A $100.000 traditional installment loan from a band Monthly payments of S w e d , which we comprised of principal and interesting interest rate of 11 REQUIRED: Determine the interest and principal payments each month under the two different financing options. 13 OPTION 1) BONDS March Sept 100 10000 100.000 100.000 100.000 100,000 10000 100.000 100 000 18 Interest 20 Cash Outllow PROS/CONS TO BE SUBMITTED AS REFLECTION PAPER 2 OPTION 2: INSTALLMENT LOAN (NOTE: Annual interest rate of must be divided by 12 to vie a monthly rate for each individual payment) Apr Aug March 91c Sept. Dec 31 Loan Balance 100,000 11 Monthly Rate ON OSN 0.5% 0.5 OS 500.00 A 487.17 487.12 487.17 487.17 187.17 6712 487.12 187.17 37 Principal ,10664 B 119.47 D 8119.47 R119.47 8,119.41 R 119.47 8,1191 30 Cash Quetion 606 64 606.66 RECE 0664 606 64 42 Updated 41 Loan Balance 91 .36 C 100K-B -C-D Total interest