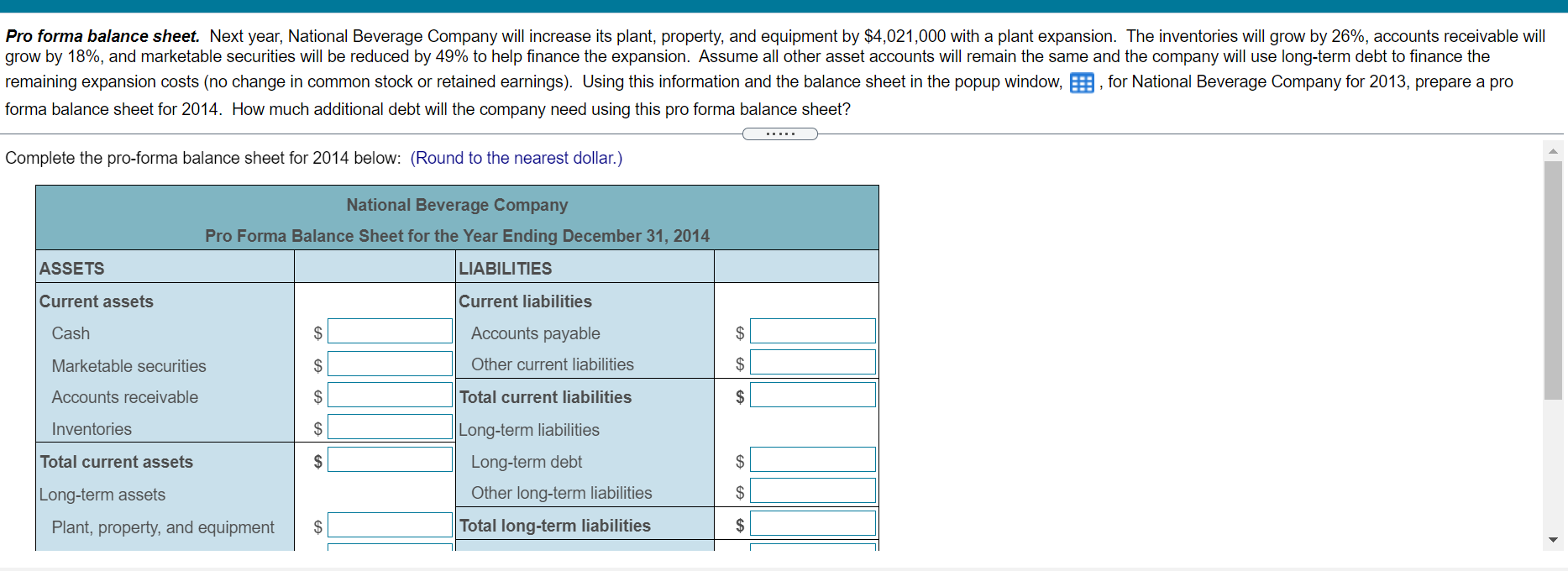

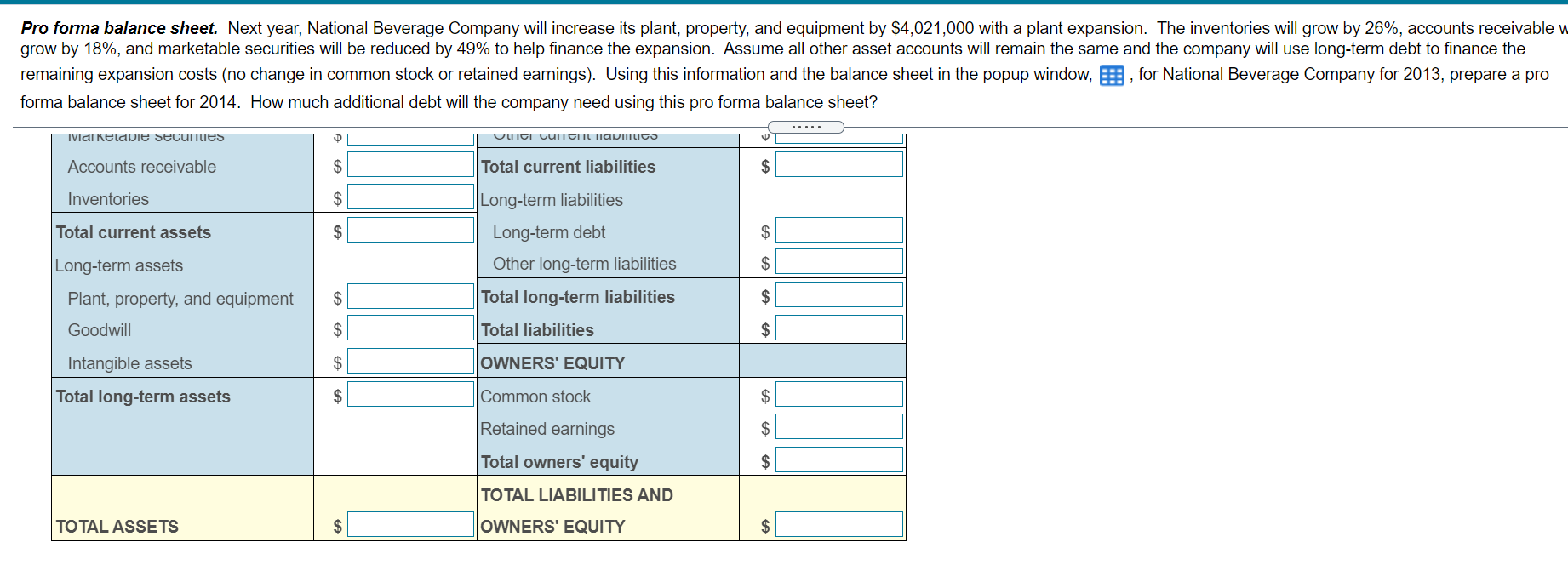

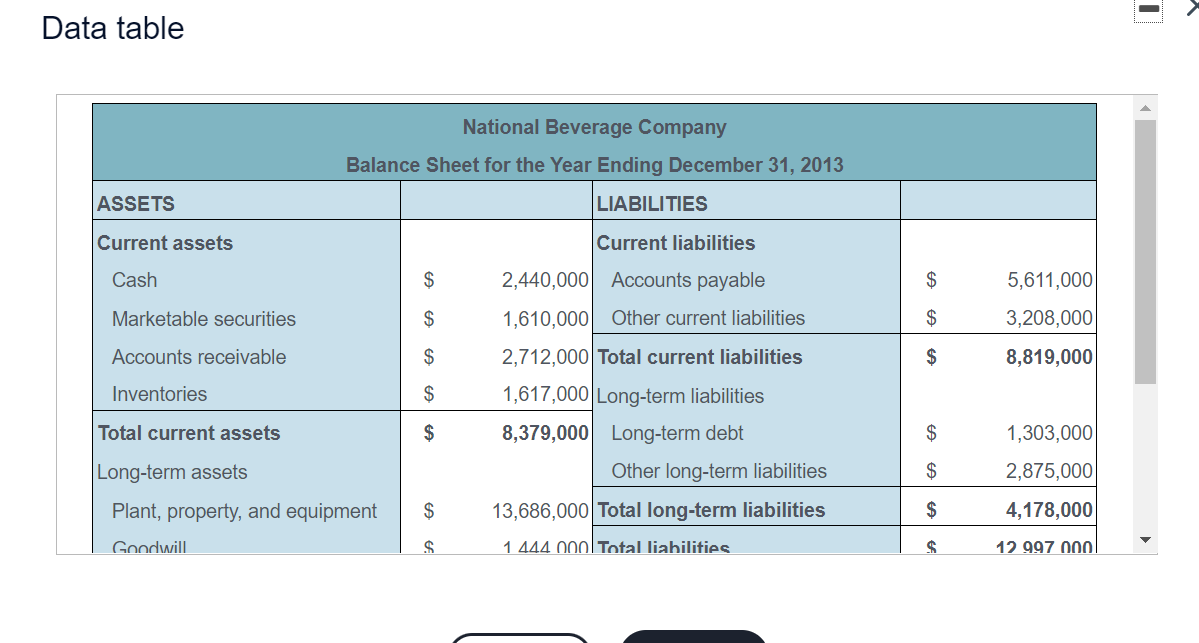

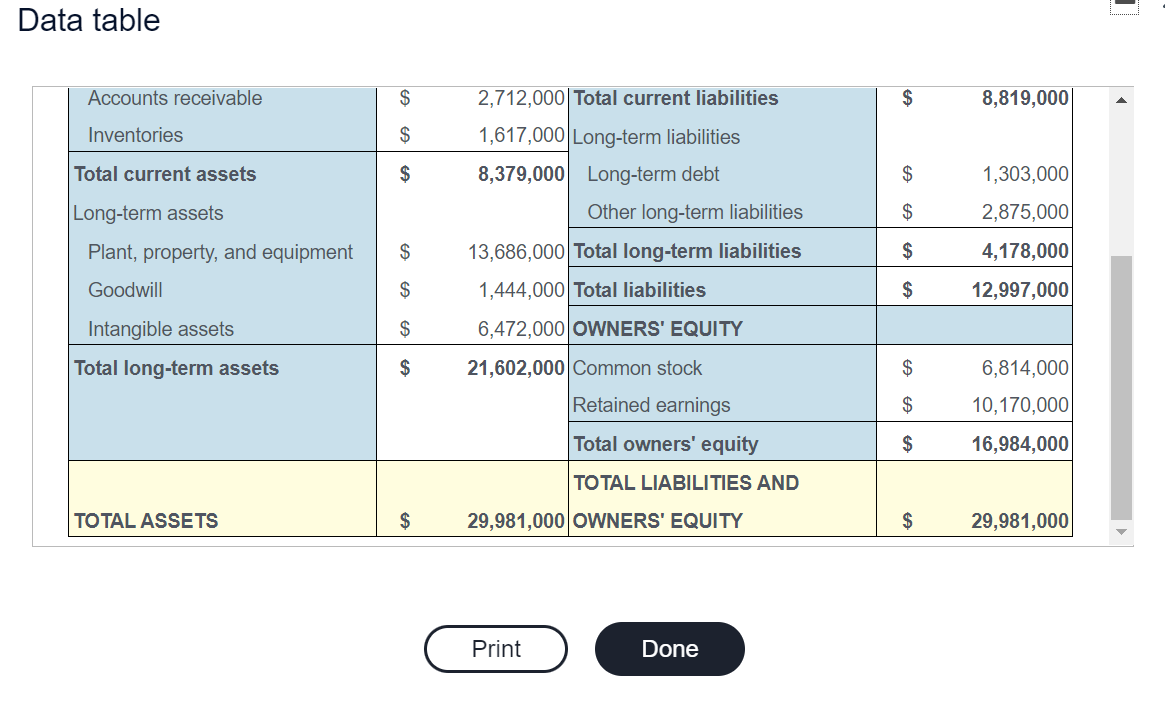

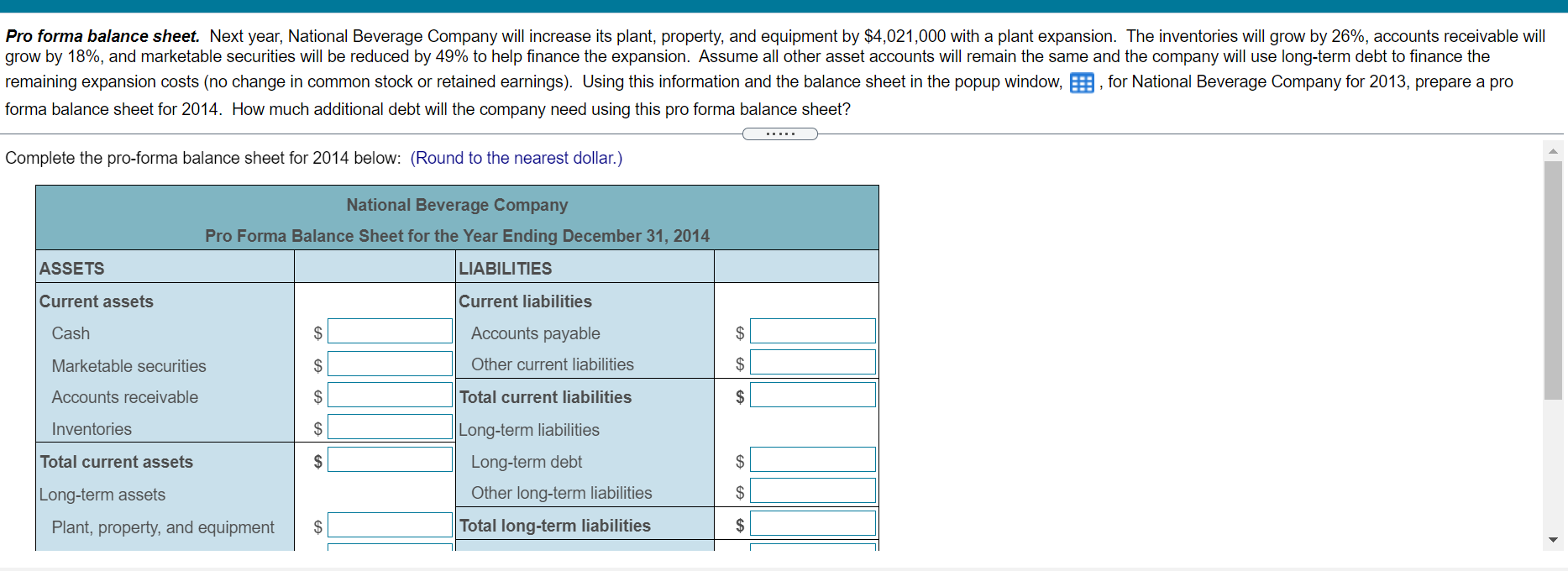

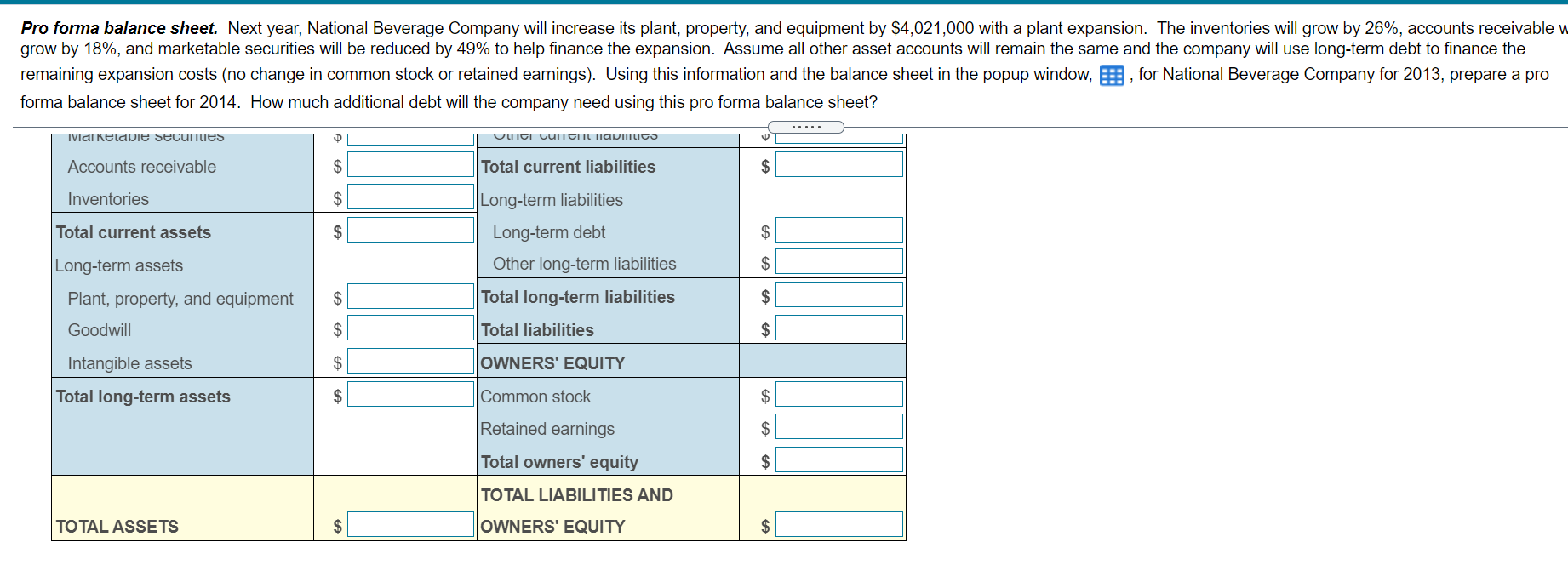

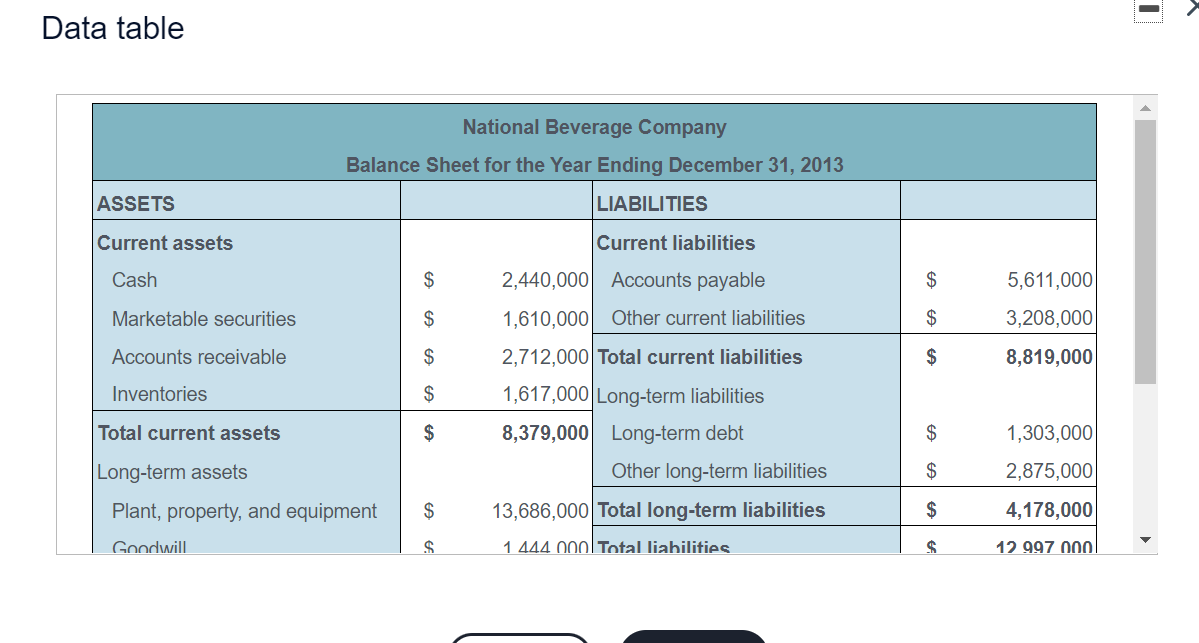

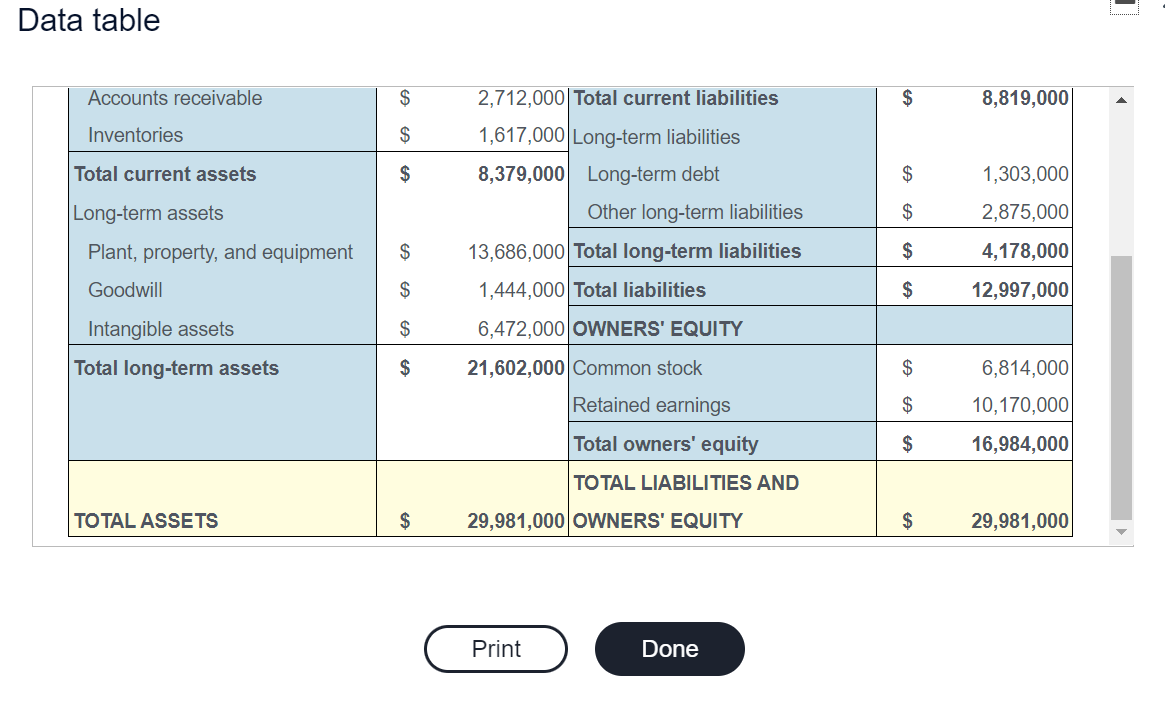

Pro forma balance sheet. Next year, National Beverage Company will increase its plant, property, and equipment by $4,021,000 with a plant expansion. The inventories will grow by 26%, accounts receivable will grow by 18%, and marketable securities will be reduced by 49% to help finance the expansion. Assume all other asset accounts will remain the same and the company will use long-term debt to finance the remaining expansion costs (no change in common stock or retained earnings). Using this information and the balance sheet in the popup window, , for National Beverage Company for 2013, prepare a pro forma balance sheet for 2014. How much additional debt will the company need using this pro forma balance sheet? , Complete the pro-forma balance sheet for 2014 below: (Round to the nearest dollar.) National Beverage Company Pro Forma Balance Sheet for the Year Ending December 31, 2014 LIABILITIES ASSETS Current assets Current liabilities Cash $ Accounts payable $ Marketable securities Other current liabilities $ Accounts receivable $ Total current liabilities Inventories $ Total current assets Long-term liabilities Long-term debt Other long-term liabilities $ Long-term assets $ Plant, property, and equipment $ Total long-term liabilities $ Pro forma balance sheet. Next year, National Beverage Company will increase its plant, property, and equipment by $4,021,000 with a plant expansion. The inventories will grow by 26%, accounts receivable w grow by 18%, and marketable securities will be reduced by 49% to help finance the expansion. Assume all other asset accounts will remain the same and the company will use long-term debt to finance the remaining expansion costs (no change in common stock or retained earnings). Using this information and the balance sheet in the popup window, , for National Beverage Company for 2013, prepare a pro forma balance sheet for 2014. How much additional debt will the company need using this pro forma balance sheet? ivial ketapie securites ULICI current llawIILIES Accounts receivable $ Total current liabilities $ Inventories $ Total current assets Long-term liabilities Long-term debt Other long-term liabilities $ Long-term assets Plant, property, and equipment Goodwill $ Total long-term liabilities $ $ Total liabilities $ Intangible assets OWNERS' EQUITY Total long-term assets $ Common stock $ Retained earnings $ Total owners' equity $ TOTAL LIABILITIES AND TOTAL ASSETS $ OWNERS' EQUITY $ | Data table National Beverage Company Balance Sheet for the Year Ending December 31, 2013 LIABILITIES ASSETS Current assets Current liabilities Cash $ $ 2,440,000 Accounts payable 1,610,000 Other current liabilities 5,611,000 3,208,000 Marketable securities $ $ Accounts receivable $ 2,712,000 Total current liabilities $ 8,819,000 Inventories $ Total current assets $ 1,617,000 Long-term liabilities 8,379,000 Long-term debt Other long-term liabilities 1,303,000 Long-term assets $ 2,875,000 Plant, property, and equipment $ 13,686,000 Total long-term liabilities $ 4,178,000 Goodwill $ 1 444 000 Total liabilities $ 12 997 000 1 Data table Accounts receivable $ 2,712,000 Total current liabilities $ 8,819,000 Inventories $ 1,617,000 Long-term liabilities 8,379,000 Long-term debt Total current assets $ $ 1,303,000 Long-term assets $ 2,875,000 Other long-term liabilities 13,686,000 Total long-term liabilities $ $ 4,178,000 Plant, property, and equipment Goodwill $ 1,444,000 Total liabilities $ 12,997,000 $ Intangible assets Total long-term assets $ 6,472,000 OWNERS' EQUITY 21,602,000 Common stock Retained earnings $ 6,814,000 10,170,000 $ Total owners' equity $ 16,984,000 TOTAL LIABILITIES AND TOTAL ASSETS $ 29,981,000 OWNERS' EQUITY $ 29,981,000 Print Done