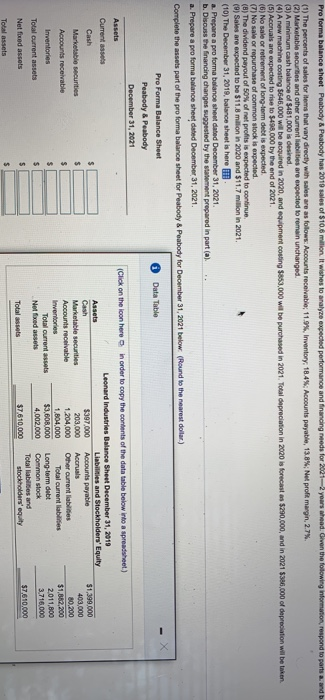

Pro forma balance sheet Peabody & Peabody has 2018 sales of $10.6 million. It wishes to analyze expected performance and financing needs for 2021-2 years ahead. Given the following information, respond to parts and b (1) The percent of sales for items that vary directly with sales are as follows: Accounts receivable 11.9% Inventory, 18.4%: Accounts payable, 13.8%; Net profit margin, 2.7% (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $481,000 is desired (4) A new machine costing $646.000 will be acquired in 2020, and equipment costing $853,000 will be purchased in 2021. Total depreciation in 2020 is forecast as $290,000, and in 2021 $386,000 of depreciation wil be taken (5) Accruals are expected to rise to $498.000 by the end of 2021. (6) No sale or retirement of long-term debt is expected (7) No sale or repurchase of common stock is expected (8) The dividend payout of 50% of net profits is expected to continue (9) Sales are expected to be $11.8 million in 2020 and $11.7 million in 2021. (10) The December 31, 2019, balance sheet is here a. Prepare a pro forma balance sheet dated December 31, 2021 b. Discuss the financing changes suggested by the statement prepared in part (a) a. Prepare a pro forma balance sheet dated December 31, 2021. Complete the assets part of the proforma balance sheet for Peabody & Peabody for December 31, 2021 below. (Round to the nearest dollar) Data Table Pro Forma Balance Sheet Peabody & Peabody December 31, 2021 Assets Current assets $ $ (Click on the loon here in order to copy the contents of the data table below into a spreadsheet) Leonard Industries Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $397,000 Accounts payable Marketable securities 203,000 Accrisis Accounts receivable 1.204,000 Other current liabilities Inventories 1,804,000 Total current liabilities Total current assets $3,608.000 Long-term debt Not fixed assets 4.002.000 Common stock Total liabilities and Total assets $7610,000 stockholders' equity Cash Marketable securities Accounts receivable Inventories Total current assets Net fixed assets $ $1,399.000 403,000 80,200 $1,682,200 2,011,800 3.716.000 $ $ $ $7,610,000 Total assets $