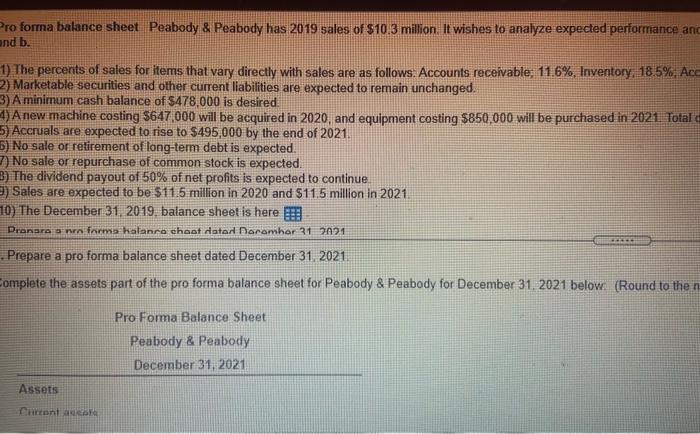

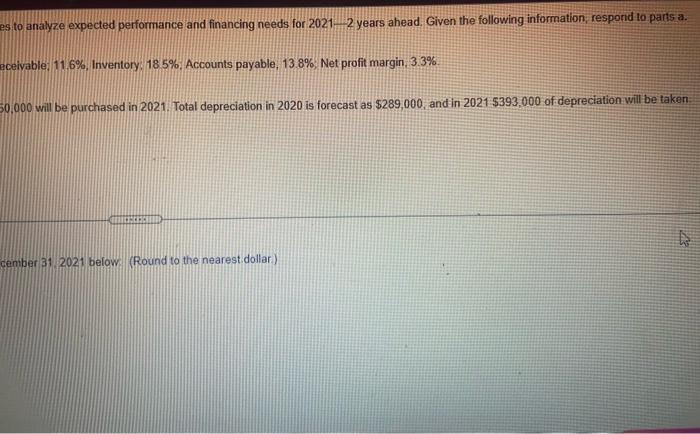

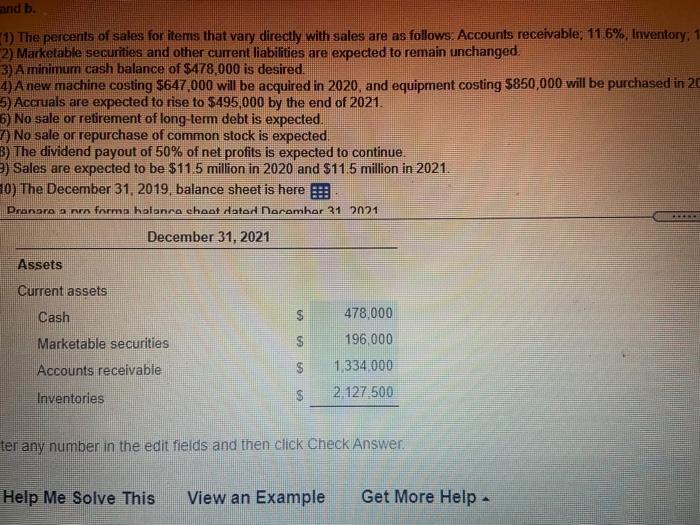

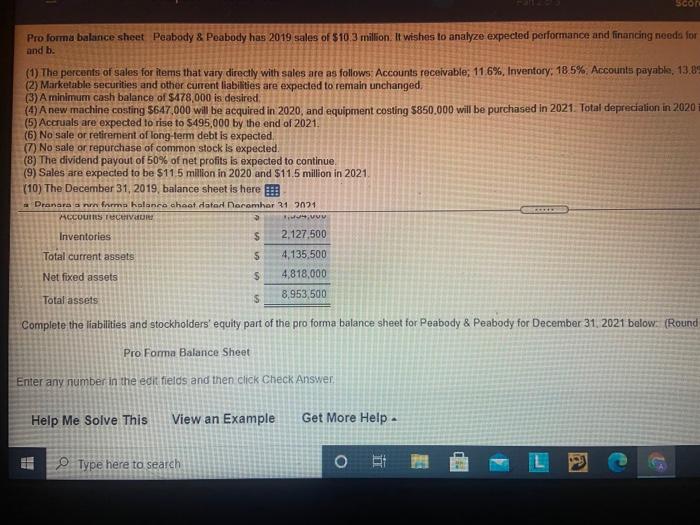

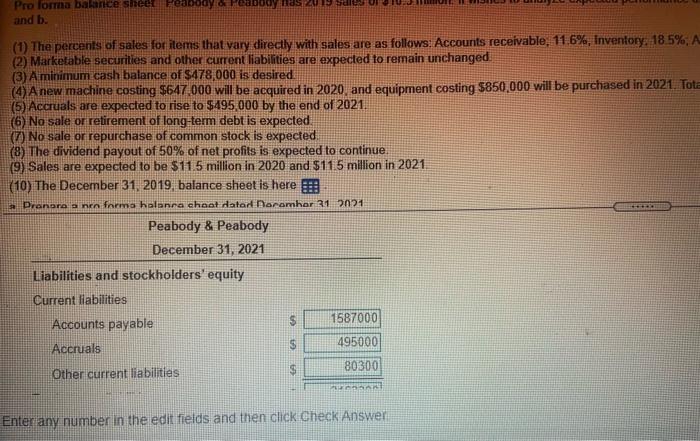

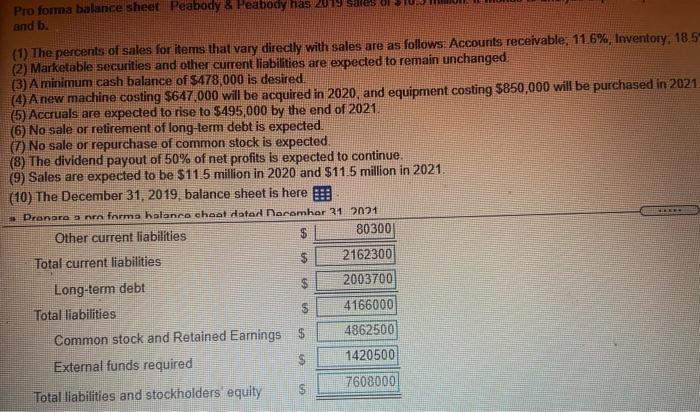

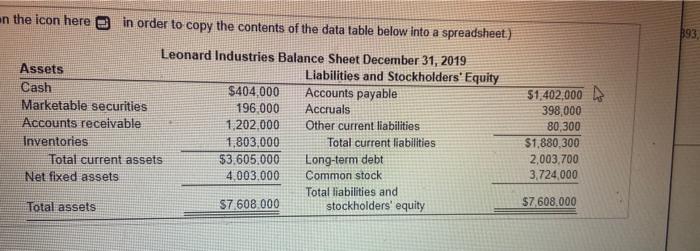

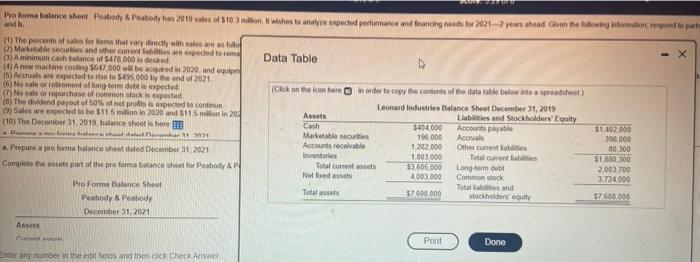

Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.3 million. It wishes to analyze expected performance and and b. 1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable: 116%, Inventory, 185% Ace 2) Marketable securities and other current liabilities are expected to remain unchanged. 3) A minimum cash balance of $478.000 is desired 1) Anew machine costing $647 000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021 Total 5) Accruals are expected to rise to $495,000 by the end of 2021 b) No sale or retirement of long-term debt is expected. 7) No sale or repurchase of common stock is expected. 3) The dividend payout of 50% of net profits is expected to continue 2) Sales are expected to be $11.5 million in 2020 and $11.5 million in 2021 10) The December 31, 2019. balance sheet is here Dronare a farma halanro choot datan Darambar 31 2021 Prepare a pro forma balance sheet dated December 31, 2021 omplete the assets part of the pro forma balance sheet for Peabody & Peabody for December 31, 2021 below. (Round to the n Pro Forma Balance Sheet Peabody & Peabody December 31, 2021 Assets Current mes to analyze expected performance and financing needs for 2021-2 years ahead. Given the following information, respond to parts a. eceivable: 11.6%, Inventory: 18.5% Accounts payable, 13.8%. Net profit margin 3.3% 50.000 will be purchased in 2021. Total depreciation in 2020 is forecast as $289,000, and in 2021 $393.000 of depreciation will be taken is cember 31, 2021 below (Round to the nearest dollar) and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 11 6%, Inventory: 1 2) Marketable securities and other current liabilities are expected to remain unchanged. 3) A minimum cash balance of $478,000 is desired 4) A new machine costing $647,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 20 5) Accruals are expected to rise to $495,000 by the end of 2021. 6) No sale or retirement of long-term debt is expected. 7)No sale or repurchase of common stock is expected. 3) The dividend payout of 50% of net profits is expected to continue. 9) Sales are expected to be $115 million in 2020 and $11.5 million in 2021. 10) The December 31, 2019. balance sheet is here E Prangro a na forma holanca chaat datan Daramihor 31 2071 December 31, 2021 Assets Current assets Cash GA 478,000 Marketable securities CA 196,000 Accounts receivable $ 1334 000 2 127.500 Inventories CA ter any number in the edit fields and then click Check Answer Help Me Solve This View an Example Get More Help scon Pro forma balance sheet Peabody & Peabody has 2019 sales of $10.3 million. It wishes to analyze expected performance and financing noods for and b. (1) The percents of sales for items that vary directly with sales are as follows: Accounts receivable; 116%. Inventory. 18.5% Accounts payable, 13.89 (2) Marketable securities and other current liabilities are expected to remain unchanged. (3) A minimum cash balance of $478.000 is desired (4) A new machine costing 5647,000 will be acquired in 2020, and equipment costing $850.000 will be purchased in 2021. Total depreciation in 2020 (5) Accruals are expected to rise to $495,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected (7) No sale or repurchase of common stock is expecled (8) The dividend payout of 50% of net profits is expected to continue (9) Sales are expected to be $115 million in 2020 and $11.5 million in 2021 (10) The December 31, 2019, balance sheet is here I Dranara a reforma holanco choot data Doromhor 21 2071 HECOURS ICR Inventories 2.127,500 Total current assets 5 4,135,500 Net fixed assets $ 4,818,000 Total assets S 8,953,500 Complete the liabilities and stockholders' equity part of the pro forma balance sheet for Peabody & Peabody for December 31, 2021 below. (Round > Vuu $ S Pro Forma Balance Sheet Enter any number in the edit fields and then click Check Answer Help Me Solve This View an Example Get More Help F Type here to search O HOST Pro loma balance sheer Feabody and b. (1) The percent of sales for items that vary directly with sales are as follows: Accounts receivable, 11.6%, Inventory: 18.5%, A (2) Marketable securities and other current liabilities are expected to remain unchanged (3) A minimum cash balance of $478.000 is desired (4) A new machine costing $647 000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021. Tota (5) Accruals are expected to rise to $495,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected. (7) No sale or repurchase of common stock is expected, (8) The dividend payout of 50% of net profits is expected to continue. Sales are expected to be $11.5 million in 2020 and $115 million in 2021 (10) The December 31, 2019. balance sheet is here * Pranaro nen forma holanra choot datar Doramhor 21 2021 Peabody & Peabody December 31, 2021 Liabilities and stockholders' equity Current liabilities Accounts payable $ 1587000 Accruals S 495000 S 80300 Other current liabilities AR Enter any number in the edit fields and then click Check Answer Pro forma balance sheet Peabody & Peabody has 2019 sales o and b. (1) The percents of sales for items that vary directly with sales are as follows Accounts receivable, 116%, Inventory, 18.5" (2) Marketable securities and other current liabilities are expected to remain unchanged (3) A minimum cash balance of $478,000 is desired (4) Anew machine costing $647,000 will be acquired in 2020, and equipment costing $850,000 will be purchased in 2021 (5) Accruals are expected to rise to $495,000 by the end of 2021. (6) No sale or retirement of long-term debt is expected (7) No sale or repurchase of common stock is expected (8) The dividend payout of 50% of net profits is expected to continue. (9) Sales are expected to be $11.5 million in 2020 and $11.5 million in 2021 (10) The December 31, 2019. balance sheet is here !!! a Pranara a non farma holanco cheat datad Docomhar 21 201 Other current liabilities 80300 Total current liabilities $ 2162300 Long-term debt 2003700 Total liabilities S 4166000 Common stock and Retained Earnings $ 4862500 External funds required $ 1420500 7608000 Total liabilities and stockholders equity CA . CA on the icon here in order to copy the contents of the data table below into a spreadsheet) $93 Leonard Industries Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' Equity Cash $404,000 Accounts payable Marketable securities 196.000 Accruals Accounts receivable 1,202.000 Other current liabilities Inventories 1,803,000 Total current liabilities Total current assets 53.605.000 Long-term debt Net fixed assets 4.003.000 Common stock Total liabilities and Total assets S7 608.000 stockholders' equity $1,402,000 m. 398,000 80,300 $1,880,300 2,003,700 3,724.000 $7608.000 Profom balance sheet Peabody boy ho 2015 of 10.3 millon. whes to analyze expected performance and friencing needs for 2021-years ahead on the following information pond te perte and (t) The percent of the forms that vary fectly with sales are as foto Marbet securities and other current is peded to X (3) A minimum cash balance of $478.000 6 dested Data Table A new machine coon 560 000 will be squired in 2020, and 15) Acous expected to be to $49000 by the end of 2021 (6) Nose or rement of long-term dobiti specie C) No sale or ropurchase of common stock is expected (Click on the icon here in order to copy the contents of the datatable below to spreadsheet) (0) The dividend payout of 50% of net prospected to continue Leonard Industries Balance Sheet December 31, 2019 (9) Sales are expected to be $115 million in 2020 and $115 million in 20 Assets Liabilities and Stockholders' Equity (10) The December 31, 2019. balance sheets Cash 5404000 Accounts payable 51 402000 Drama Marble trecut 196.000 Accrual 390.000 a. Prepare apo for balance sheet oled December 31 2021 Accounts receivable 1.202000 Other current 30,300 Inventor 1.803,000 Total Current 51 B60300 Complete the part of the profoma balance sheet for Peabody&P Total cursos 53.605 000 Long-term debit 2003 700 Netfredsss 400.000 Common ock 3.724 000 Pro Forma Balance Sheet Totals and Total 37.600.000 Peabody & Peabody stockholders equity 57.668.000 December 31, 2021 Print Done Enter any number the others and then check