Answered step by step

Verified Expert Solution

Question

1 Approved Answer

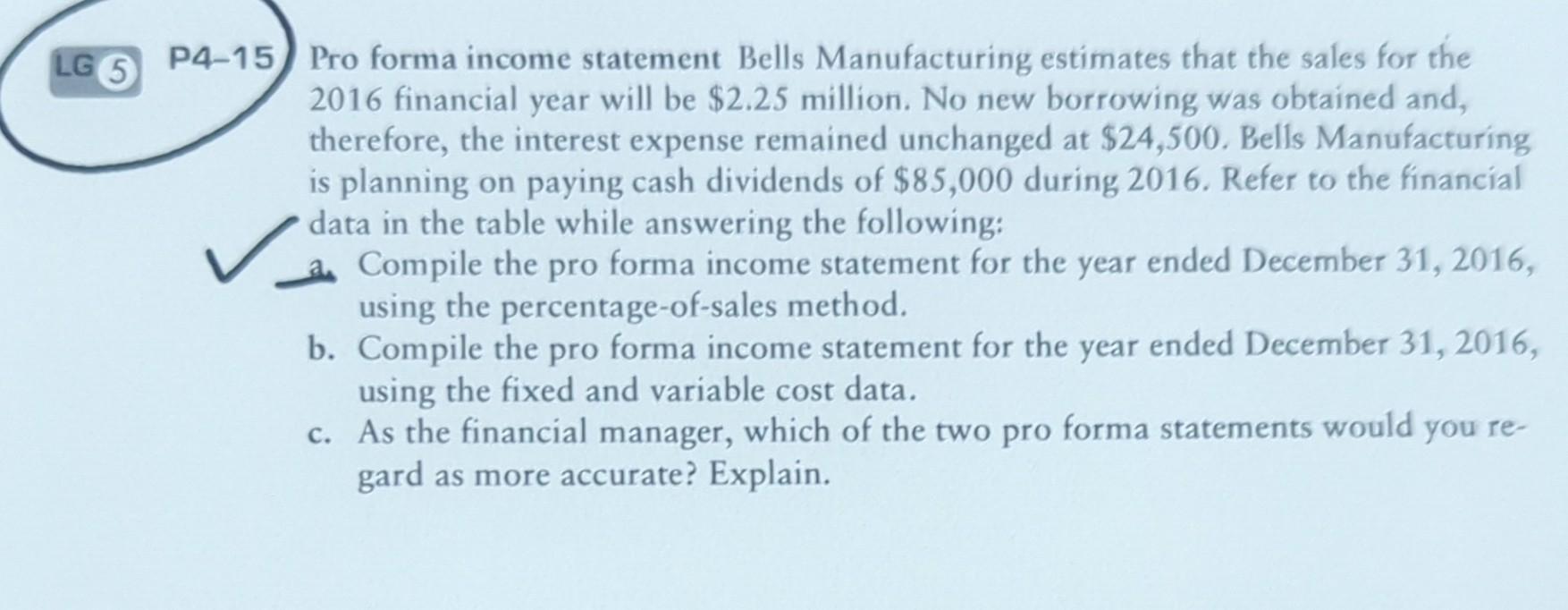

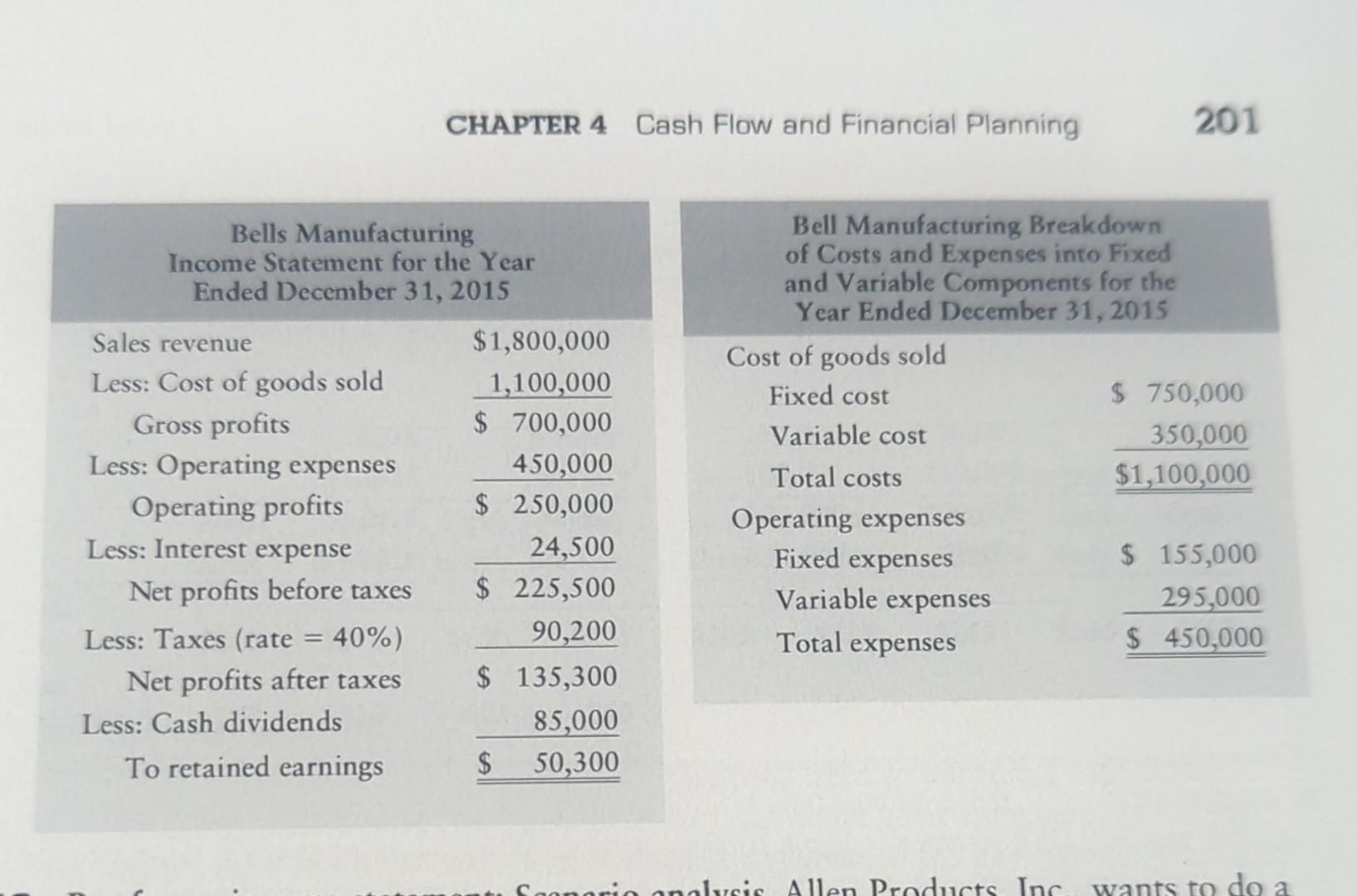

Pro forma income statement Bells Manufacturing estimates that the sales for the 2016 financial year will be $2.25 million. No new borrowing was obtained and,

Pro forma income statement Bells Manufacturing estimates that the sales for the 2016 financial year will be $2.25 million. No new borrowing was obtained and, therefore, the interest expense remained unchanged at $24,500. Bells Manufacturing is planning on paying cash dividends of $85,000 during 2016. Refer to the financial data in the table while answering the following: a. Compile the pro forma income statement for the year ended December 31, 2016, using the percentage-of-sales method. b. Compile the pro forma income statement for the year ended December 31, 2016, using the fixed and variable cost data. c. As the financial manager, which of the two pro forma statements would you regard as more accurate? Explain. CHAPTER 4 Cash Flow and Financial Planning 201

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started