Question

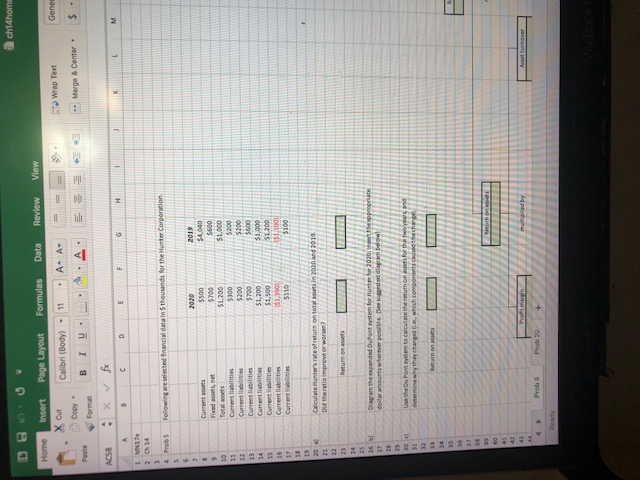

Prob 5 Following are selected financial data in $ thousands for the Hunter Corporation. 2020 2019 Current assets $500 $4,040 Fixed assets, net $700 $600

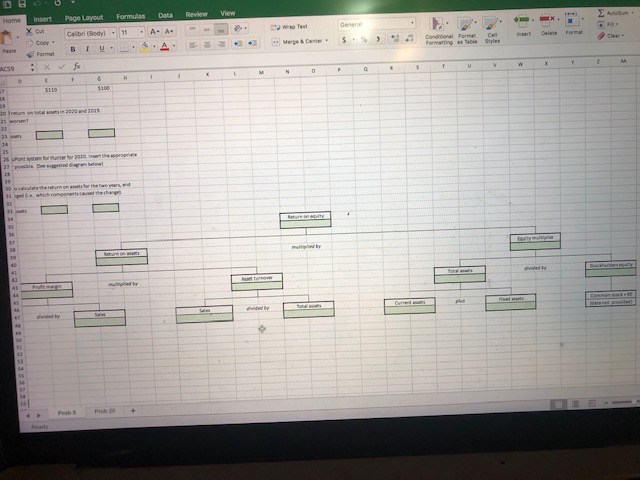

Prob 5 Following are selected financial data in $ thousands for the Hunter Corporation. 2020 2019 Current assets $500 $4,040 Fixed assets, net $700 $600 Total assets $1,200 $1,000 Current liabilities $300 $200 Current liabilities $200 $200 Current liabilities $700 $600 Current liabilities $1,200 $1,000 Current liabilities $1,500 $1,200 Current liabilities ($1,390) ($1,100) Current liabilities $110 $100 a) Calculate Hunter's rate of return on total assets in 2020 and 2019. Did the ratio improve or worsen? Return on assets b) Diagram the expanded DuPont system for Hunter for 2020. Insert the appropriate dollar amounts wherever possible. (See suggested diagram below) c) Use the Du Pont system to calculate the return on assets for the two years, and determine why they changed (i.e., which components caused the change). Return on assets Return on equity Return on assets multiplied by Equity multiplier Profit margin multiplied by Asset turnover Total assets divided by Stockholders equity Net income divided by Sales Sales divided by Total assets Current assets plus Fixed assets Common stock + RE (data not provided) Please help me, I don't understand it's due today. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started