Answered step by step

Verified Expert Solution

Question

1 Approved Answer

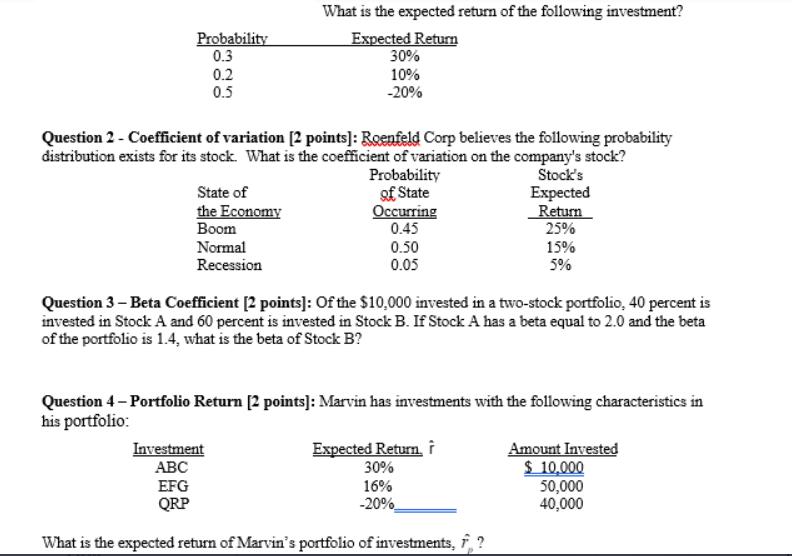

Probability 0.3 0.2 0.5 Question 2 - Coefficient of variation [2 points]: Roenfeld Corp believes the following probability distribution exists for its stock. What

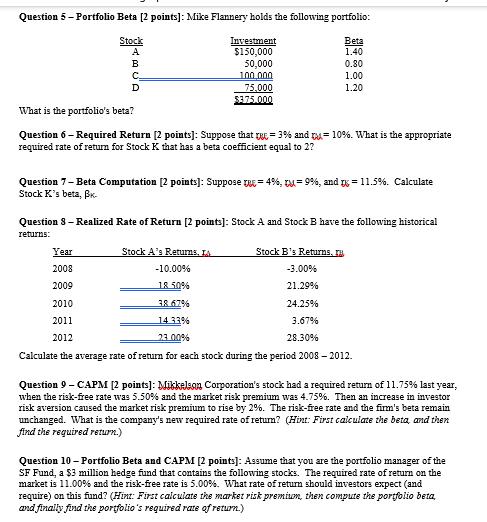

Probability 0.3 0.2 0.5 Question 2 - Coefficient of variation [2 points]: Roenfeld Corp believes the following probability distribution exists for its stock. What is the coefficient of variation on the company's stock? Probability of State Occurring 0.45 State of the Economy Boom Normal Recession What is the expected return of the following investment? Expected Return 30% 10% -20% EFG QRP 0.50 0.05 Question 3 - Beta Coefficient [2 points]: Of the $10,000 invested in a two-stock portfolio, 40 percent is invested in Stock A and 60 percent is invested in Stock B. If Stock A has a beta equal to 2.0 and the beta of the portfolio is 1.4, what is the beta of Stock B? Investment ABC Question 4 - Portfolio Return [2 points]: Marvin has investments with the following characteristics in his portfolio: Expected Return, i 30% 16% -20% What is the expected return of Marvin's portfolio of investments, f? Stock's Expected Return 25% 15% 5% Amount Invested $ 10,000 50,000 40,000 Question 5 - Portfolio Beta [2 points]: Mike Flannery holds the following portfolio: Beta Stock A 1.40 B 0.80 1.00 1.20 D Investment $150,000 50,000 100,000 75,000 $375.000 What is the portfolio's beta? Question 6 - Required Return [2 points]: Suppose that = 3% and = 10%. What is the appropriate required rate of return for Stock K that has a beta coefficient equal to 2? Question 7-Beta Computation [2 points]: Suppose te=4%, 9%, and = 11.5%. Calculate Stock K's beta, B- Question 8 - Realized Rate of Return [2 points]: Stock A and Stock B have the following historical returns: Year Stock A's Returns, IA Stock B's Returns, r 2008 -10.00% -3.00% 2009 18 50% 21.29% 2010 38.67% 24.25% 2011 14 33% 3.67% 2012 23.00% 28.30% Calculate the average rate of return for each stock during the period 2008 - 2012. Question 9 - CAPM [2 points]: Mikkelson Corporation's stock had a required return of 11.75% last year, when the risk-free rate was 5.50% and the market risk premium was 4.75%. Then an increase in investor risk aversion caused the market risk premium to rise by 2%. The risk-free rate and the firm's beta remain unchanged. What is the company's new required rate of return? (Hint: First calculate the beta, and then find the required return.) Question 10 - Portfolio Beta and CAPM [2 points]: Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 5.00%. What rate of return should investors expect (and require) on this fund? (Hint: First calculate the market risk premium, then compute the portfolio beta, and finally find the portfolio's required rate of return.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started