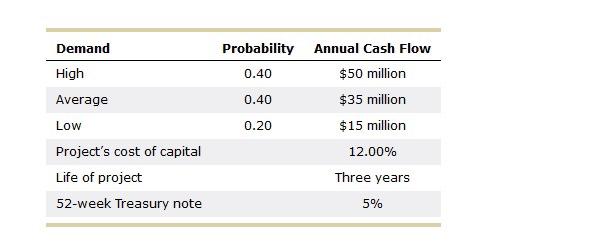

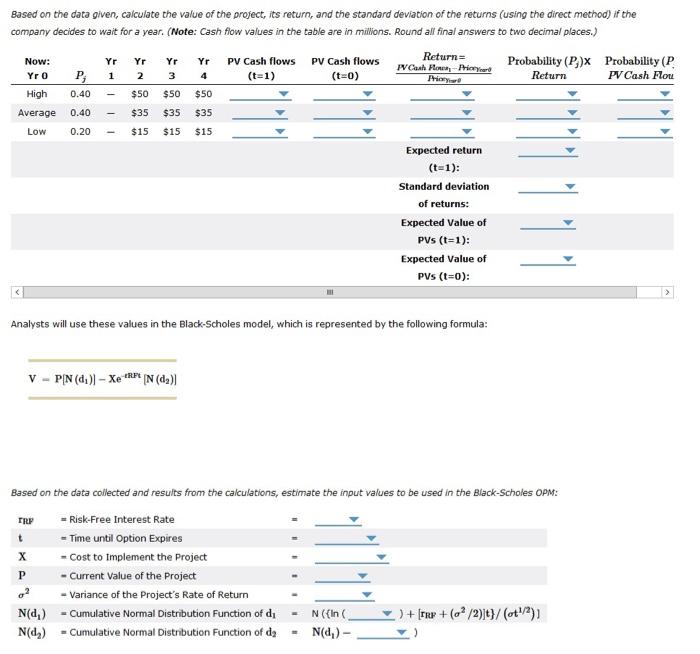

Probability 0.40 0.40 Demand High Average Low Project's cost of capital Life of project 52-week Treasury note 0.20 Annual Cash Flow $50 million $35 million $15 million 12.00% Three years 5% $35 Based on the data given, calculate the value of the project, its return, and the standard deviation of the returns (using the direct method) if the company decides to wait for a year. (Note: Cash flow values in the table are in millions. Round all final answers to two decimal places.) Now: Yr Yr Yr Yr PV Cash flows PV Cash flows Return= FV Cash Rom-Prince Probability (P)X Probability (P. Yr 0 P, 1 2 3 4 (t=1) (t=0) Phim Return PV Cash Flou High 0.40 $50 $50 $50 Average 0.40 $35 $35 Low 0.20 $15 $15 $15 Expected return (t-1): Standard deviation of returns: Expected Value of PVS (t=1): Expected Value of PVS (t=0): > Analysts will use these values in the Black-Scholes model, which is represented by the following formula: V = P/N (41)] - Xe * [N (44) R.PL FRY t Based on the data collected and results from the calculations, estimate the input values to be used in the Black-Scholes OPM: = Risk-Free Interest Rate - Time until Option Expires X - Cost to Implement the Project P - Current Value of the Project - Variance of the Project's Rate of Return N(d) - Cumulative Normal Distribution Function of d, N({In .) + (rre+ (o? /2)}}/(t2) N(d) = Cumulative Normal Distribution Function of da N(d) - 2 Probability 0.40 0.40 Demand High Average Low Project's cost of capital Life of project 52-week Treasury note 0.20 Annual Cash Flow $50 million $35 million $15 million 12.00% Three years 5% $35 Based on the data given, calculate the value of the project, its return, and the standard deviation of the returns (using the direct method) if the company decides to wait for a year. (Note: Cash flow values in the table are in millions. Round all final answers to two decimal places.) Now: Yr Yr Yr Yr PV Cash flows PV Cash flows Return= FV Cash Rom-Prince Probability (P)X Probability (P. Yr 0 P, 1 2 3 4 (t=1) (t=0) Phim Return PV Cash Flou High 0.40 $50 $50 $50 Average 0.40 $35 $35 Low 0.20 $15 $15 $15 Expected return (t-1): Standard deviation of returns: Expected Value of PVS (t=1): Expected Value of PVS (t=0): > Analysts will use these values in the Black-Scholes model, which is represented by the following formula: V = P/N (41)] - Xe * [N (44) R.PL FRY t Based on the data collected and results from the calculations, estimate the input values to be used in the Black-Scholes OPM: = Risk-Free Interest Rate - Time until Option Expires X - Cost to Implement the Project P - Current Value of the Project - Variance of the Project's Rate of Return N(d) - Cumulative Normal Distribution Function of d, N({In .) + (rre+ (o? /2)}}/(t2) N(d) = Cumulative Normal Distribution Function of da N(d) - 2