Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 04-49 (LO 04-3) (Algo) [The following information applies to the questions displayed below.] Jacob is a member of WCC (an LLC taxed as a

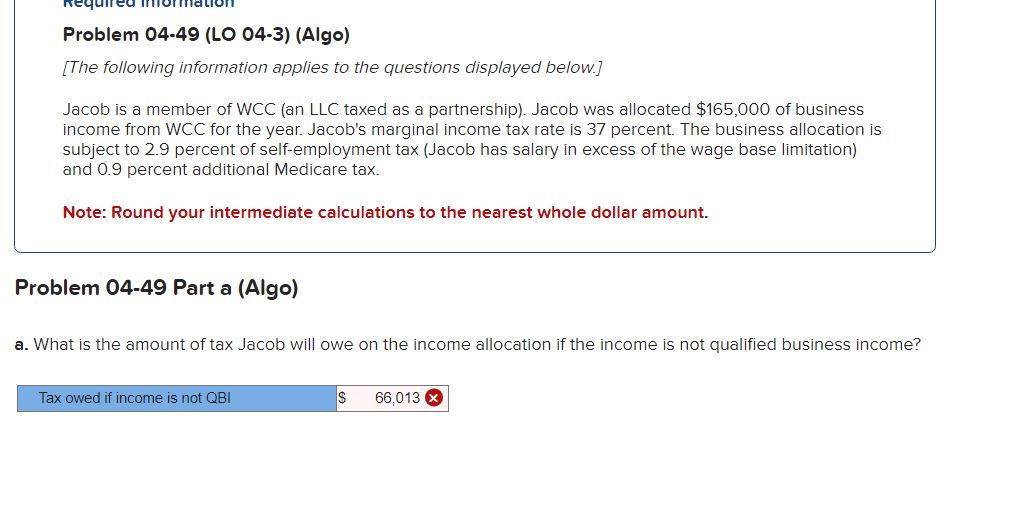

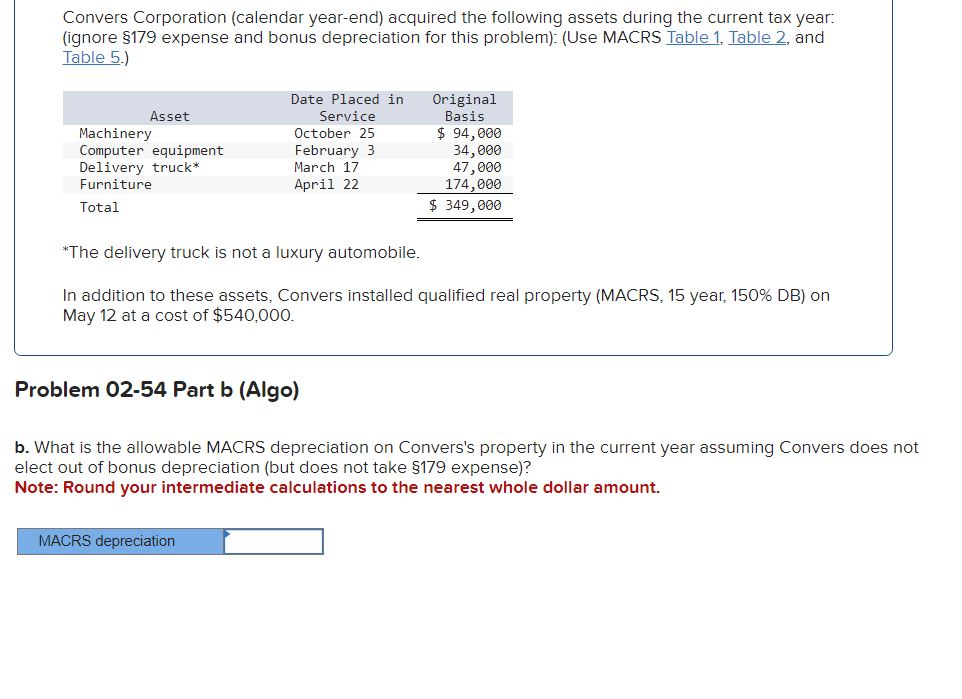

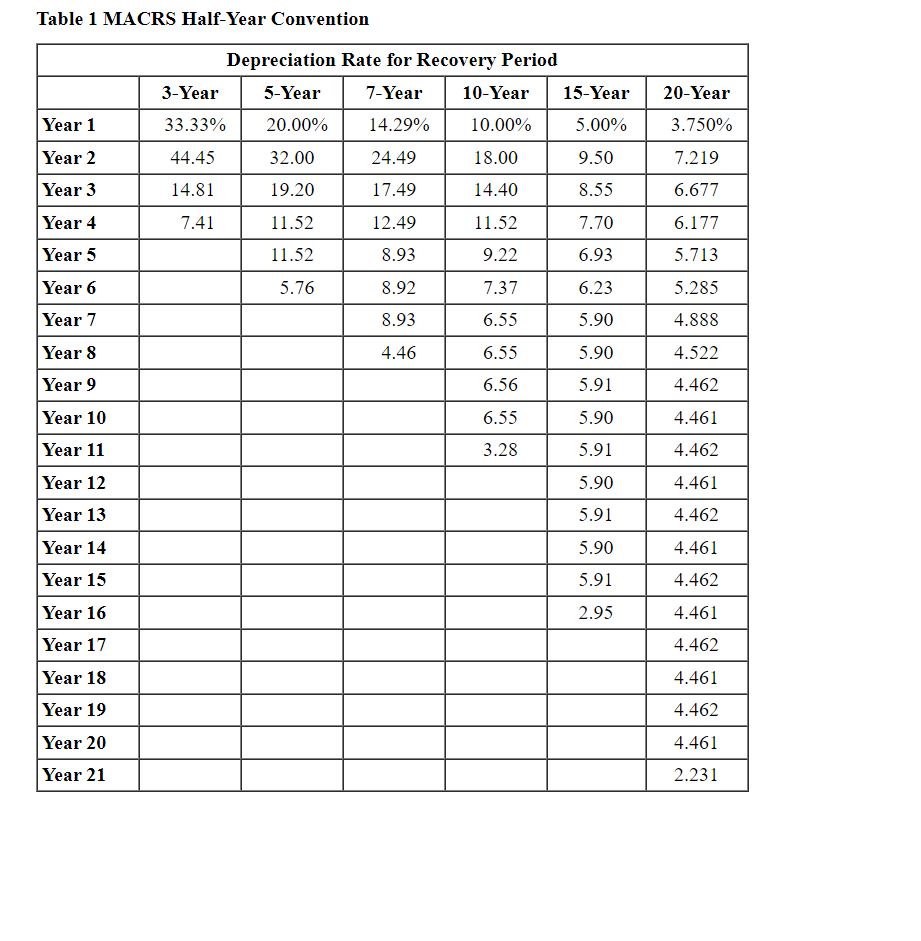

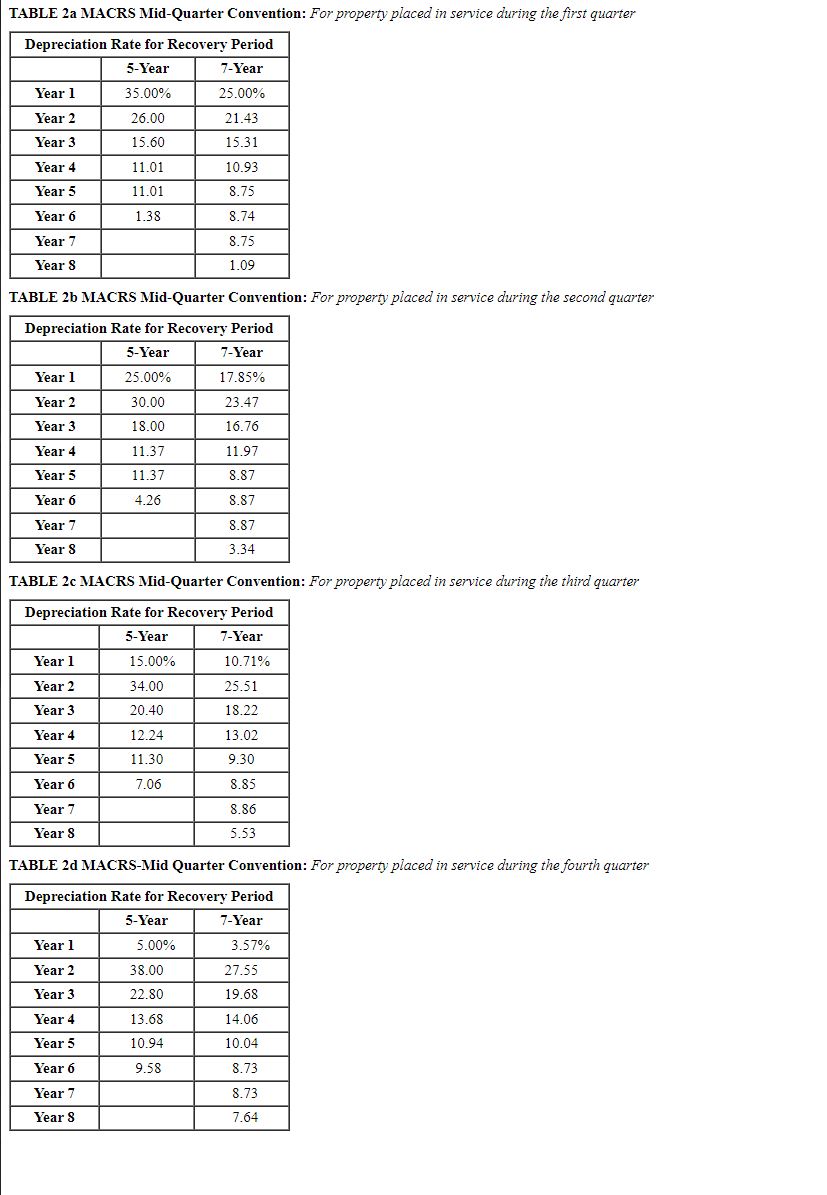

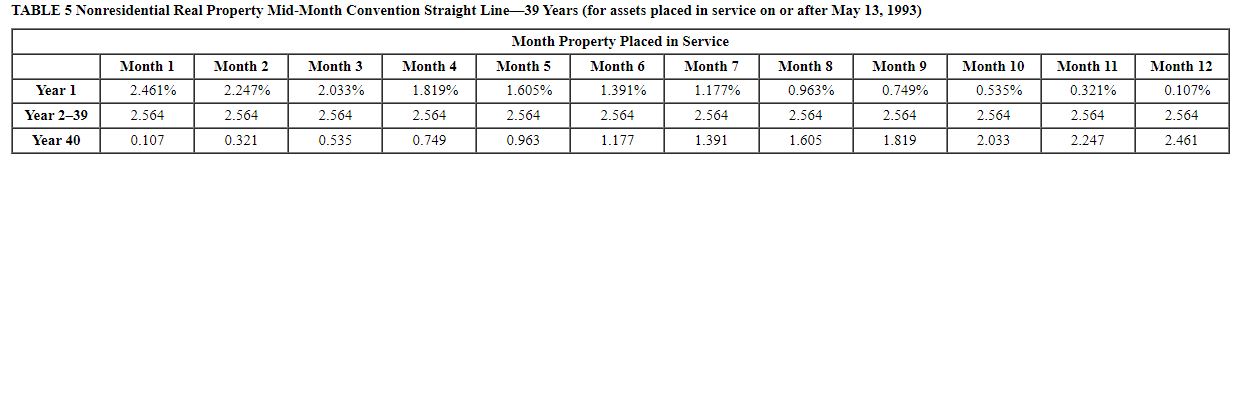

Problem 04-49 (LO 04-3) (Algo) [The following information applies to the questions displayed below.] Jacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $165,000 of business income from WCC for the year. Jacob's marginal income tax rate is 37 percent. The business allocation is subject to 2.9 percent of self-employment tax (Jacob has salary in excess of the wage base limitation) and 0.9 percent additional Medicare tax. Note: Round your intermediate calculations to the nearest whole dollar amount. oblem 04-49 Part a (Algo) What is the amount of tax Jacob will owe on the income allocation if the income is not qualified business income Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore \$179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.) *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150\% DB) on May 12 at a cost of $540,000. Problem 02-54 Part b (Algo) What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not lect out of bonus depreciation (but does not take $179 expense)? Jote: Round your intermediate calculations to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line39 Years (for assets placed in service on or after May 13, 1993)

Problem 04-49 (LO 04-3) (Algo) [The following information applies to the questions displayed below.] Jacob is a member of WCC (an LLC taxed as a partnership). Jacob was allocated $165,000 of business income from WCC for the year. Jacob's marginal income tax rate is 37 percent. The business allocation is subject to 2.9 percent of self-employment tax (Jacob has salary in excess of the wage base limitation) and 0.9 percent additional Medicare tax. Note: Round your intermediate calculations to the nearest whole dollar amount. oblem 04-49 Part a (Algo) What is the amount of tax Jacob will owe on the income allocation if the income is not qualified business income Convers Corporation (calendar year-end) acquired the following assets during the current tax year: (ignore \$179 expense and bonus depreciation for this problem): (Use MACRS Table 1, Table 2, and Table 5.) *The delivery truck is not a luxury automobile. In addition to these assets, Convers installed qualified real property (MACRS, 15 year, 150\% DB) on May 12 at a cost of $540,000. Problem 02-54 Part b (Algo) What is the allowable MACRS depreciation on Convers's property in the current year assuming Convers does not lect out of bonus depreciation (but does not take $179 expense)? Jote: Round your intermediate calculations to the nearest whole dollar amount. Table 1 MACRS Half-Year Convention TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter TABLE 2b MACRS Mid-Quarter Convention: For property placed in service during the second quarter TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line39 Years (for assets placed in service on or after May 13, 1993) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started