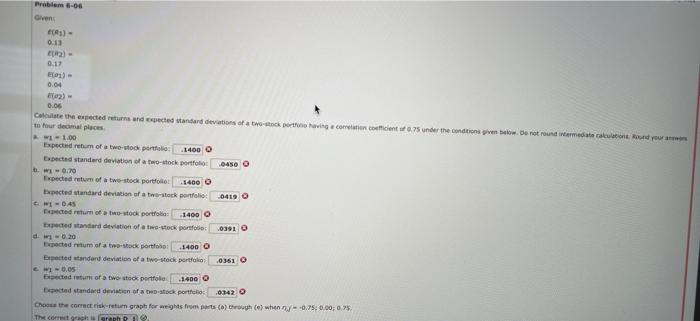

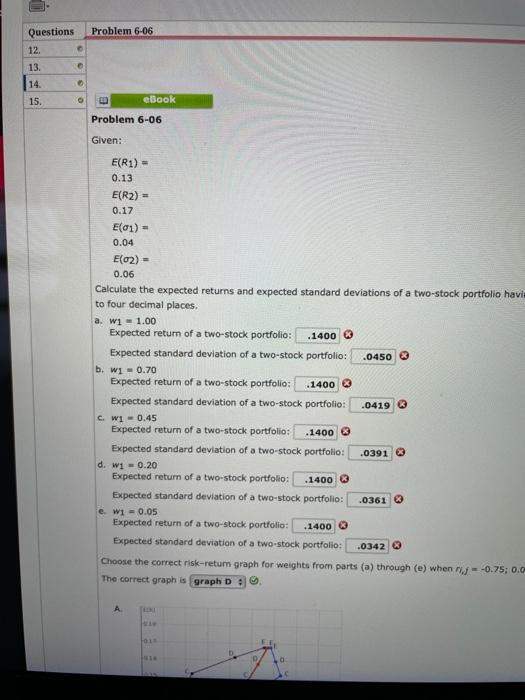

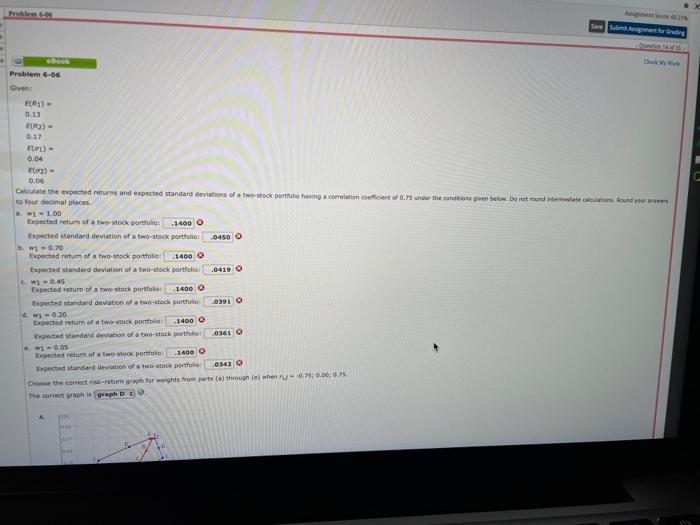

Problem -06 Given 0.13 017 Ees) - 0.04 0.06 Catate the expected returns and expected standard deviations of a two-stockporting com.sunder the conditions given below. Do not round meditation your to our decimal places W - 1.00 Expected tom of two-stock portfolio: 1400 O Expected standard deviation of a two-stock portfolio 0450 O D. WI-0.70 Expected return of a two-stock portfolio 1400 O pected standard deviation of a two-stock portfolio .0419 O -0.45 Beted return of a two-stock portfolio 1400 O Expected standard deviation of a two-stock portfolio d 0.20 Expected return of a two-stock portfolio Expected standard deviation of a two-stock portfolio .0361 0 -0.05 pected return of a two-stock portfolio Derected standard deviation of two portfolio Choose the correcteur graph for weights from parts (o) h (e) when 0.750.00; 0.75 The correct graph is graph 0391 0 1400 O 1400 O 0342 O Problem 6-06 Questions 12. 13 14. 15. o 20 eBook Problem 6-06 Given: E(R1) - 0.13 E(R2) = 0.17 E(01) - 0.04 E(02) - 0.06 Calculate the expected returns and expected standard deviations of a two-stock portfolio havi to four decimal places. a. w1 -1.00 Expected retum of a two-stock portfolio: .1400 3 Expected standard deviation of a two-stock portfolio: .0450 3 b. WI -0.70 Expected return of a two-stock portfolio: .1400 3 Expected standard deviation of a two-stock portfolio: .0419 3 C WI-0.45 Expected return of a two-stock portfolio: .1400 3 Expected standard deviation of a two-stock portfolio: .0391 3 d. wi - 0.20 Expected return of a two-stock portfolio: .1400 3 Expected standard deviation of a two-stock portfolio: .0361 3 e. w1 -0.05 Expected return of a two-stock portfolio: .1400 Expected standard deviation of a two-stock portfolio: .0342 3 Choose the correct risk-return graph for weights from parts (a) through (e) when - -0.75; 0. The correct graph is graph D. A Prob. a suiana Agnate Problem 6-06 Gren 1) 0.13 (R2) - 0.17 0.04 (02) - 0.06 Calculate the expected returns and expected standard deviations of the stock portfolis having a correlation coeficient of 0.75 under the conditions given below. Do not round often Round your to four decimal places W - 1.00 Expected return of a two-stock portfolio.1400 O Expected standard deviation of a two-stock portfolio bw1 -0.70 Expected return of two-stock portfolio 1400 O Expected standard deviation of a two-stock portfolio 0419 O wy 0.45 Expected return of a two-stock portfolio 1400 Expected standard deviation of a two-stock portfolio dwa - 0.20 Expected return of a two-stock portfolio Expected standard deviation of a two-stock portfolio W-0.05 Expected of a two-stock portfoto: 1400 O Expected standard deviation of two-stock portfolio Od the correct retum.graph for weights from parts) through when -0.75, 0.00 0.75 The corect graph graph De 0450 1400 0361 0342