Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 06-1A Variable costing income statement and conversion to absorption costing income (two consecutive years) LO P2, P3 (The following information applies to the questions

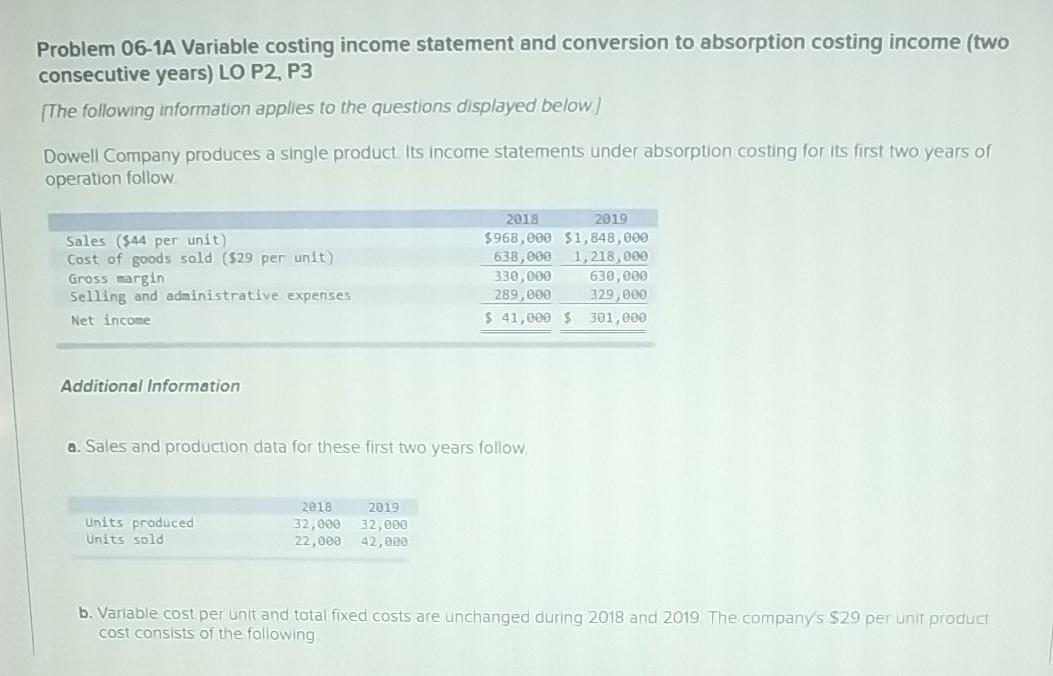

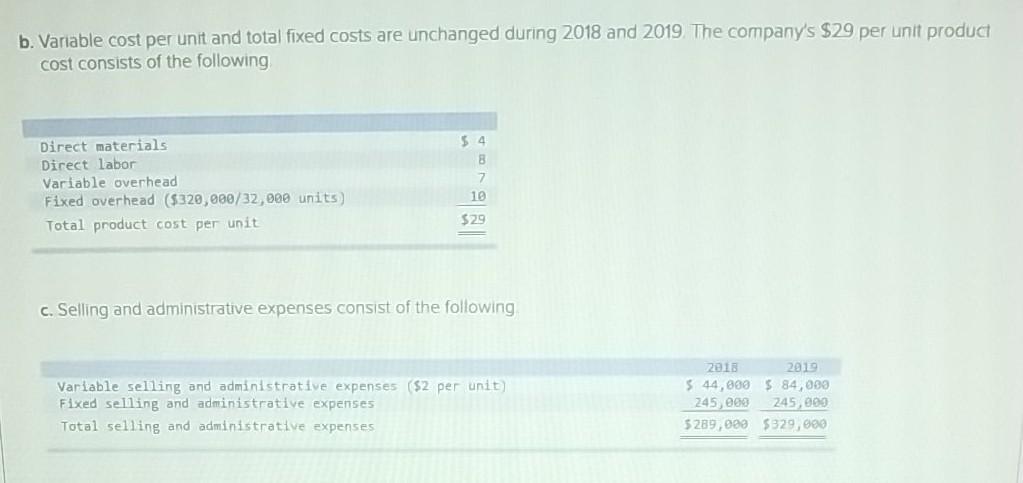

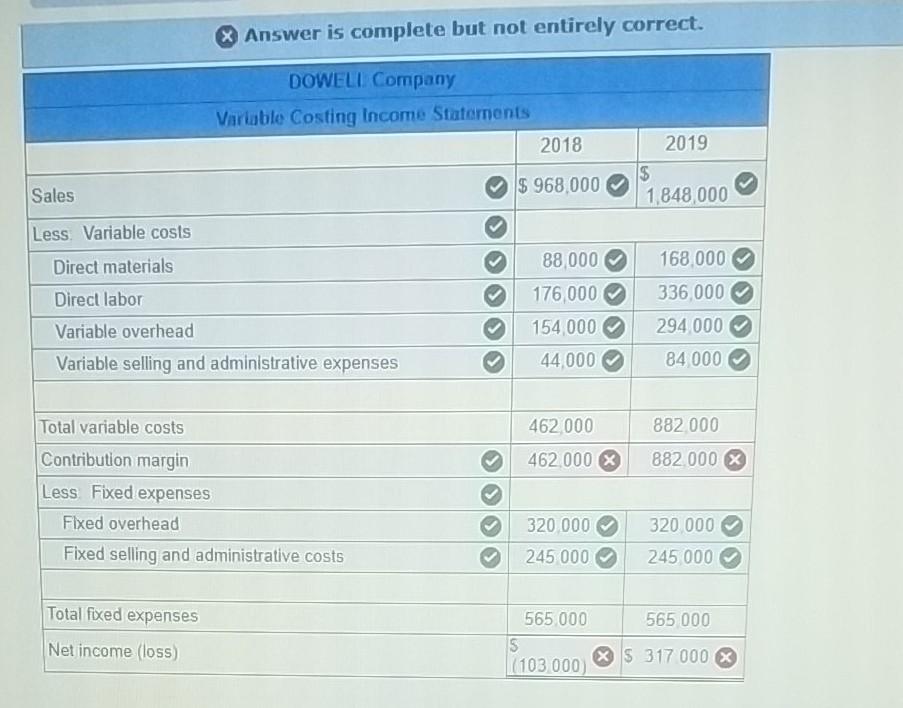

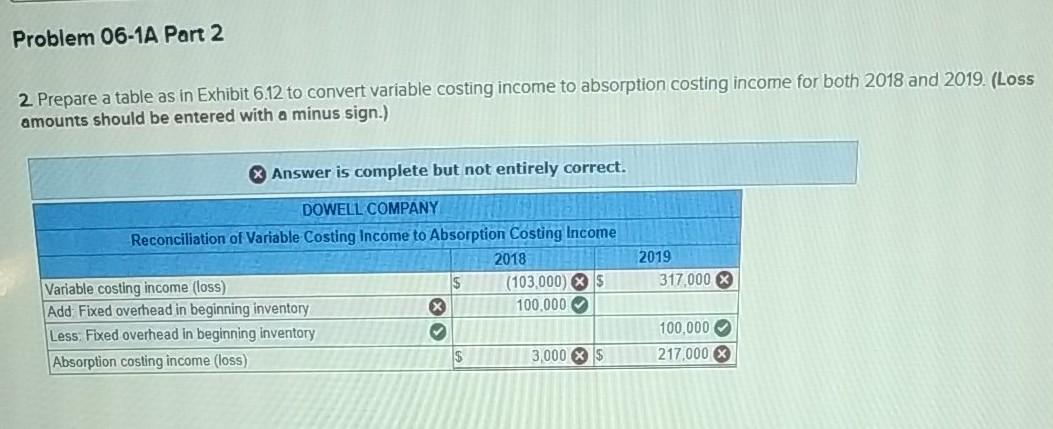

Problem 06-1A Variable costing income statement and conversion to absorption costing income (two consecutive years) LO P2, P3 (The following information applies to the questions displayed below) Dowell Company produces a single product. Its Income statements under absorption costing for its first two years of operation follow Sales (544 per unit) Cost of goods sold ($29 per unit) Gross margin Selling and administrative expenses Net income 2018 2019 $968,000 $1,848,000 638,000 1,218,000 330,000 630,000 289,000 329,000 5 41,000 5301,000 Additional Information a. Sales and production data for these first two years follow Units produced Units sold 2018 32,000 22,000 2019 32,000 42,000 b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's $29 penunit product cost consists of the following b. Variable cost per unit and total fixed costs are unchanged during 2018 and 2019. The company's $29 per unit product cost consists of the following Direct materials Direct labor Variable overhead Fixed overhead ($320,000/32,000 units) Total product cost per unit 8 7 19 $29 c. Selling and administrative expenses consist of the following Variable selling and administrative expenses ($2 per unit Fixed selling and administrative expenses Total selling and administrative expenses 2018 2019 $ 44,800 $ 84,000 245,000 245,000 5289,000 $329,000 Answer is complete but not entirely correct. DOWELL Company Variable Costing Income Statements 2018 2019 $ 1,848,000 Sales $ 968,000 Less. Variable costs Direct materials Direct labor Variable overhead Variable selling and administrative expenses 88,000 176 000 154 000 168,000 336.000 294 000 44 000 84 000 462 000 882.000 462.000 882 000 X Total variable costs Contribution margin Less Fixed expenses Fixed overhead Fixed selling and administrative costs 320 000 245 000 320 000 245 000 Total fixed expenses Net income (loss) 565 000 565 000 S (103 000) X $ 317 000 X Problem 06-1A Part 2 2. Prepare a table as in Exhibit 6.12 to convert variable costing income to absorption costing income for both 2018 and 2019. (Loss amounts should be entered with a minus sign.) & Answer is complete but not entirely correct. DOWELL COMPANY Reconciliation of Variable Costing Income to Absorption Costing Income 2018 Variable costing income (loss) $ (103,000 $ Add Fixed overhead in beginning inventory X 100.000 Less: Fixed overhead in beginning inventory Absorption costing income (loss) $ 3,000 X $ 2019 317 000 100,000 217,000 X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started