Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 0 - 1 8 ( Algo ) Return on Investment ( ROI ) and Residual Income [ LO 1 0 - 1 ,

Problem Algo Return on Investment ROI and Residual Income LO L

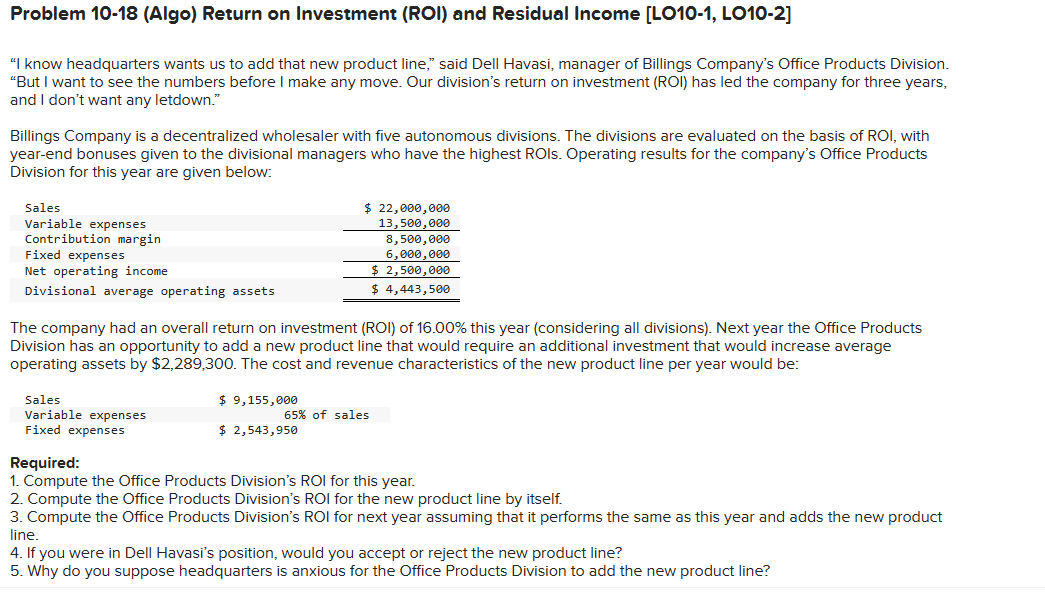

"I know headquarters wants us to add that new product line," said Dell Havasi, manager of Billings Company's Office Products Division.

"But I want to see the numbers before I make any move. Our division's return on investment ROl has led the company for three years,

and I don't want any letdown."

Billings Company is a decentralized wholesaler with five autonomous divisions. The divisions are evaluated on the basis of ROI, with

yearend bonuses given to the divisional managers who have the highest ROls. Operating results for the company's Office Products

Division for this year are given below:

The company had an overall return on investment ROI of this year considering all divisions Next year the Office Products

Division has an opportunity to add a new product line that would require an additional investment that would increase average

operating assets by $ The cost and revenue characteristics of the new product line per year would be:

Sales

Variable expenses

Fixed expenses

$

of sales

$

Required:

Compute the Office Products Division's ROI for this year.

Compute the Office Products Division's ROI for the new product line by itself.

Compute the Office Products Division's ROI for next year assuming that it performs the same as this year and adds the new product

line.

If you were in Dell Havasi's position, would you accept or reject the new product line?

Why do you suppose headquarters is anxious for the Office Products Division to add the new product line?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started