Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 0 - 6 Athena Investment Company is considering the purchase of an office property. After a careful review of the market and the

Problem

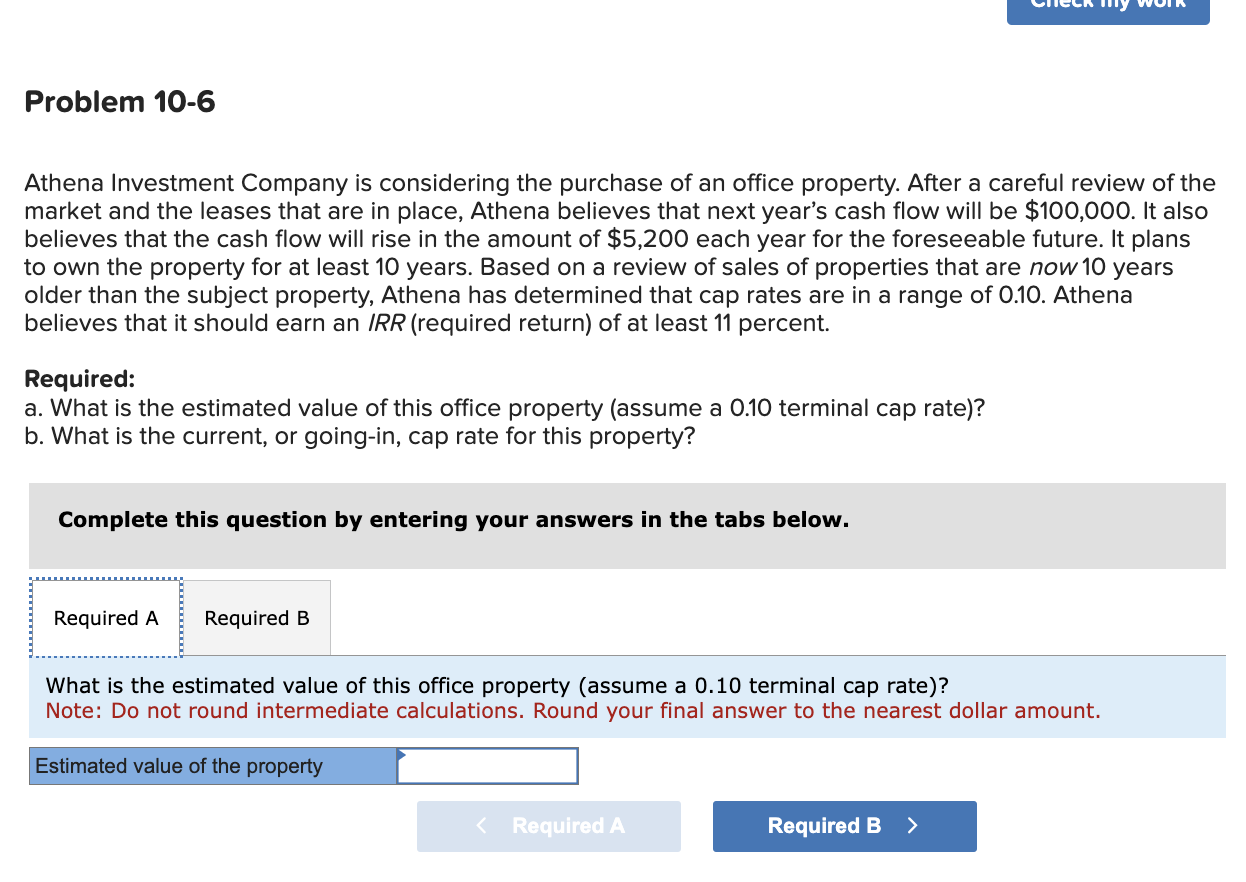

Athena Investment Company is considering the purchase of an office property. After a careful review of the

market and the leases that are in place, Athena believes that next year's cash flow will be $ It also

believes that the cash flow will rise in the amount of $ each year for the foreseeable future. It plans

to own the property for at least years. Based on a review of sales of properties that are now years

older than the subject property, Athena has determined that cap rates are in a range of Athena

believes that it should earn an IRR required return of at least percent.

Required:

a What is the estimated value of this office property assume a terminal cap rate

b What is the current, or goingin cap rate for this property?

Complete this question by entering your answers in the tabs below.

Required

Required B

What is the estimated value of this office property assume a terminal cap rate

Note: Do not round intermediate calculations. Round your final answer to the nearest dollar amount.

Estimated value of the property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started