Answered step by step

Verified Expert Solution

Question

1 Approved Answer

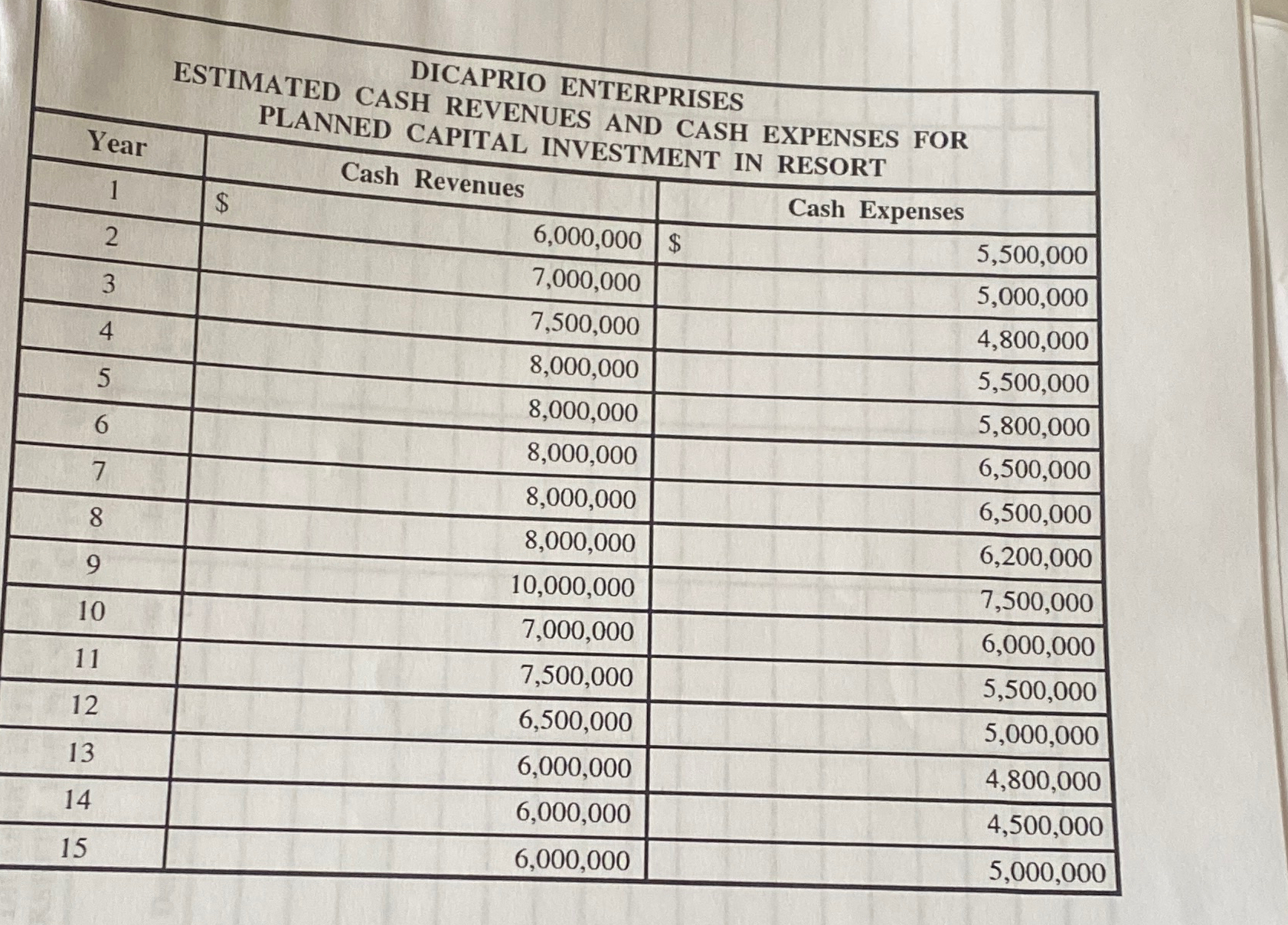

Problem ( 1 0 points ) . DiCaprio Enterprises is considering the construction of a new resort. The company plans on running the resort for

Problem points

DiCaprio Enterprises is considering the construction of a new resort. The company plans on running the resort for fifteen years, after which time they will sell the resort to another company for $ The company expects to have the attached cash revenues and expenses for the resort.

The resort will cost $ to build and the company will depreciate the property using the straight line depreciation method. The company expects its investments to payback their original cash investment on an after tax basis in years or less and it expects to earn an after tax rate of return on its investments of at least The company's average income tax rate is

REQUIRED:

Using the attached form, prepare a capital budgeting data worksheet for this capital investment. Round all calculations to the nearest whole dollar. Using the attached form, compute the after tax accounting rate of return for the proposed investment. Round your percentage to two decimal places four decimal places in all

Using the attached form, compute the after tax cash payback period for the proposed investment. Round your answer to two decimal places.

Using the attached form, compute the after tax net present value for th proposed investment. Round your answer to the nearest whole dollar. Should the company build the resort? Provide adequate support for yo answer.

DICAPRIO ENTERPRISES

ESTIMATED CASH REVENUES AND CASH EXPENSES FOR PLANNED CAPITAL INVESTMENT IN RESORT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started