Answered step by step

Verified Expert Solution

Question

1 Approved Answer

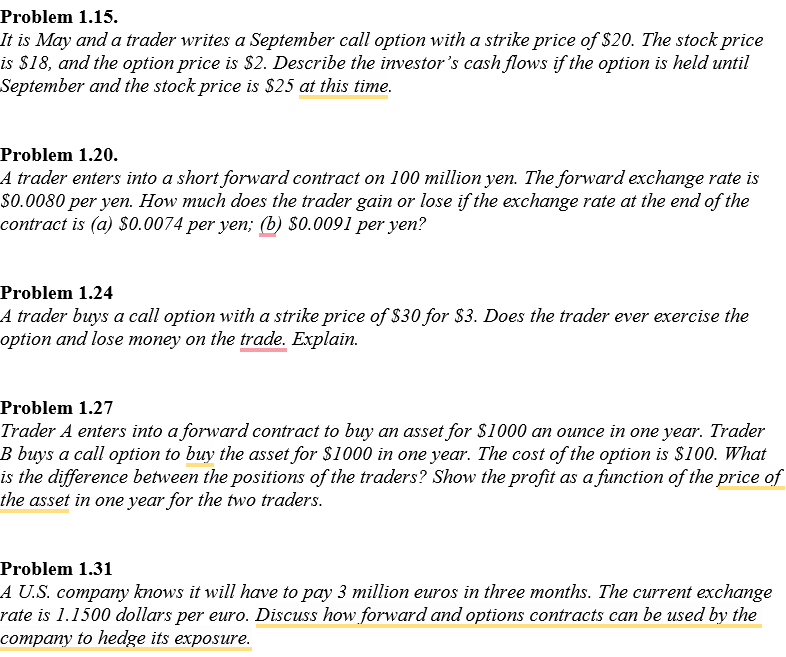

Problem 1 . 1 5 . It is May and a trader writes a September call option with a strike price of $ 2 0

Problem

It is May and a trader writes a September call option with a strike price of $ The stock price

is $ and the option price is $ Describe the investor's cash flows if the option is held until

September and the stock price is $ at this time.

Problem

A trader enters into a short forward contract on million yen. The forward exchange rate is

$ per yen. How much does the trader gain or lose if the exchange rate at the end of the

contract is a $ per yen; b $ per yen?

Problem

A trader buys a call option with a strike price of $ for $ Does the trader ever exercise the

option and lose money on the trade. Explain.

Problem

Trader A enters into a forward contract to buy an asset for $ an ounce in one year. Trader

buys a call option to buy the asset for $ in one year. The cost of the option is $ What

is the difference between the positions of the traders? Show the profit as a function of the price of

the asset in one year for the two traders.

Problem

A US company knows it will have to pay million euros in three months. The current exchange

rate is dollars per euro. Discuss how forward and options contracts can be used by the

company to hedge its exposure.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started