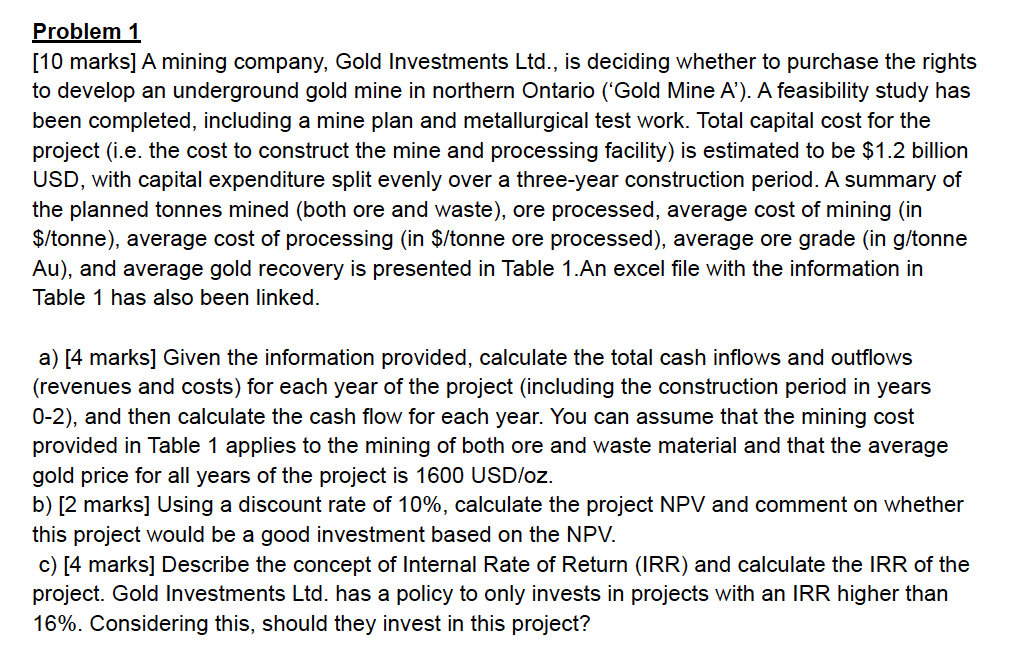

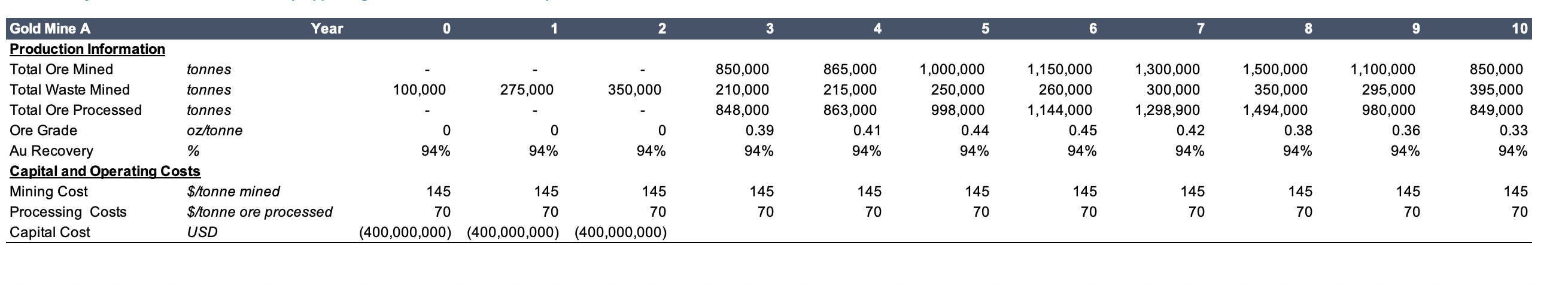

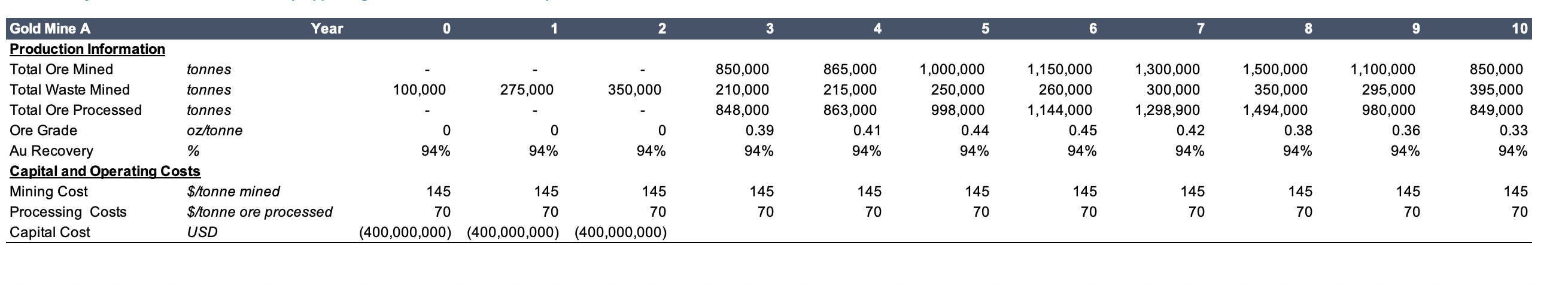

Problem 1 [10 marks] A mining company, Gold Investments Ltd., is deciding whether to purchase the rights to develop an underground gold mine in northern Ontario ("Gold Mine A'). A feasibility study has been completed, including a mine plan and metallurgical test work. Total capital cost for the project (i.e. the cost to construct the mine and processing facility) is estimated to be $1.2 billion USD, with capital expenditure split evenly over a three-year construction period. A summary of the planned tonnes mined (both ore and waste), ore processed, average cost of mining (in $/tonne), average cost of processing (in $/tonne ore processed), average ore grade (in g/tonne Au), and average gold recovery is presented in Table 1.An excel file with the information in Table 1 has also been linked. a) [4 marks] Given the information provided, calculate the total cash inflows and outflows (revenues and costs) for each year of the project (including the construction period in years 0-2), and then calculate the cash flow for each year. You can assume that the mining cost provided in Table 1 applies to the mining of both ore and waste material and that the average gold price for all years of the project is 1600 USD/oz. b) [2 marks] Using a discount rate of 10%, calculate the project NPV and comment on whether this project would be a good investment based on the NPV. c) [4 marks] Describe the concept of Internal Rate of Return (IRR) and calculate the IRR of the project. Gold Investments Ltd. has a policy to only invests in projects with an IRR higher than 16%. Considering this, should they invest in this project? 0 1 2 4 5 6 7 8 9 10 100,000 275,000 350,000 Gold Mine A Year Production Information Total Ore Mined tonnes Total Waste Mined tonnes Total Ore Processed tonnes Ore Grade oz/tonne Au Recovery % Capital and Operating Costs Mining Cost $/onne mined Processing Costs $/tonne ore processed Capital Cost USD 850,000 210,000 848,000 0.39 94% 865,000 215,000 863,000 0.41 94% 1,000,000 250,000 998,000 0.44 94% 1,150,000 260,000 1,144,000 0.45 94% 1,300,000 300,000 1,298,900 0.42 94% 1,500,000 350,000 1,494,000 0.38 94% 1,100,000 295,000 980,000 0.36 94% 850,000 395,000 849,000 0.33 94% 0 0 0 94% 94% 94% 145 145 145 145 145 70 70 70 (400,000,000) (400,000,000) (400,000,000) 145 70 145 70 145 70 145 70 145 70 145 70 70 70 Problem 1 [10 marks] A mining company, Gold Investments Ltd., is deciding whether to purchase the rights to develop an underground gold mine in northern Ontario ("Gold Mine A'). A feasibility study has been completed, including a mine plan and metallurgical test work. Total capital cost for the project (i.e. the cost to construct the mine and processing facility) is estimated to be $1.2 billion USD, with capital expenditure split evenly over a three-year construction period. A summary of the planned tonnes mined (both ore and waste), ore processed, average cost of mining (in $/tonne), average cost of processing (in $/tonne ore processed), average ore grade (in g/tonne Au), and average gold recovery is presented in Table 1.An excel file with the information in Table 1 has also been linked. a) [4 marks] Given the information provided, calculate the total cash inflows and outflows (revenues and costs) for each year of the project (including the construction period in years 0-2), and then calculate the cash flow for each year. You can assume that the mining cost provided in Table 1 applies to the mining of both ore and waste material and that the average gold price for all years of the project is 1600 USD/oz. b) [2 marks] Using a discount rate of 10%, calculate the project NPV and comment on whether this project would be a good investment based on the NPV. c) [4 marks] Describe the concept of Internal Rate of Return (IRR) and calculate the IRR of the project. Gold Investments Ltd. has a policy to only invests in projects with an IRR higher than 16%. Considering this, should they invest in this project? 0 1 2 4 5 6 7 8 9 10 100,000 275,000 350,000 Gold Mine A Year Production Information Total Ore Mined tonnes Total Waste Mined tonnes Total Ore Processed tonnes Ore Grade oz/tonne Au Recovery % Capital and Operating Costs Mining Cost $/onne mined Processing Costs $/tonne ore processed Capital Cost USD 850,000 210,000 848,000 0.39 94% 865,000 215,000 863,000 0.41 94% 1,000,000 250,000 998,000 0.44 94% 1,150,000 260,000 1,144,000 0.45 94% 1,300,000 300,000 1,298,900 0.42 94% 1,500,000 350,000 1,494,000 0.38 94% 1,100,000 295,000 980,000 0.36 94% 850,000 395,000 849,000 0.33 94% 0 0 0 94% 94% 94% 145 145 145 145 145 70 70 70 (400,000,000) (400,000,000) (400,000,000) 145 70 145 70 145 70 145 70 145 70 145 70 70 70