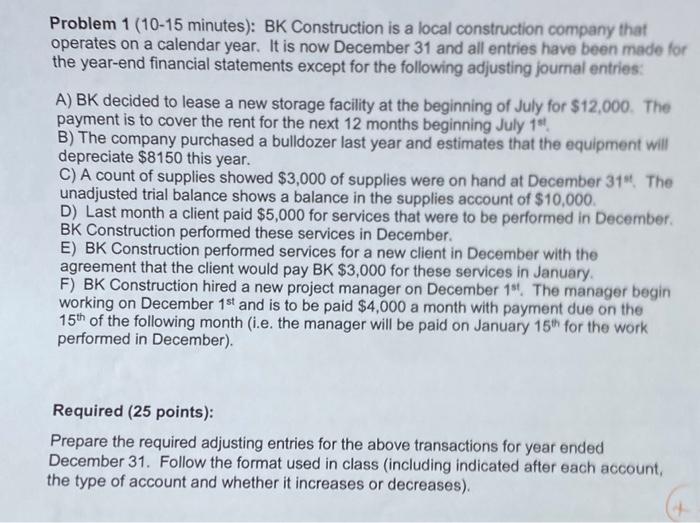

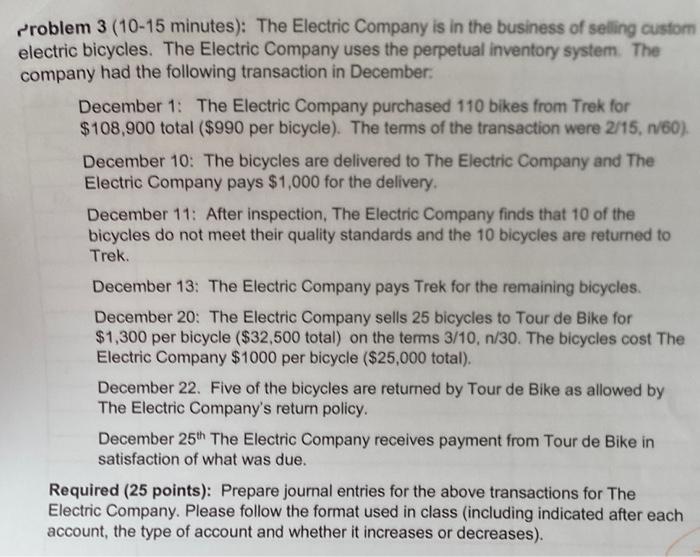

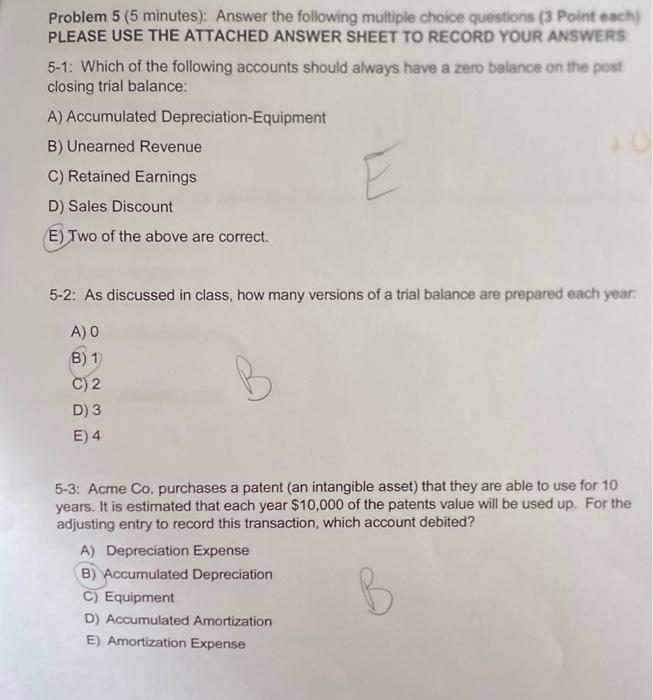

Problem 1 (10-15 minutes): BK Construction is a local construction company that operates on a calendar year. It is now December 31 and all entries have been made for the year-end financial statements except for the following adjusting joumal entries: A) BK decided to lease a new storage facility at the beginning of July for $12,000. The payment is to cover the rent for the next 12 months beginning July 1 tt. B) The company purchased a bulldozer last year and estimates that the equipment will depreciate $8150 this year. C) A count of supplies showed $3,000 of supplies were on hand at December 31:t. The unadjusted trial balance shows a balance in the supplies account of $10,000. D) Last month a client paid $5,000 for services that were to be performed in December. BK Construction performed these services in December. E) BK Construction performed services for a new client in December with the agreement that the client would pay BK $3,000 for these services in January. F) BK Construction hired a new project manager on December 1 it. The manager begin working on December 1st and is to be paid $4,000 a month with payment due on the 15th of the following month (i.e. the manager will be paid on January 15th for the work performed in December). Required (25 points): Prepare the required adjusting entries for the above transactions for year ended December 31 . Follow the format used in class (including indicated after each account, the type of account and whether it increases or decreases). blem 3 (10-15 minutes): The Electric Company is in the business of selling custom ctric bicycles. The Electric Company uses the perpetual inventory system. The mpany had the following transaction in December: December 1: The Electric Company purchased 110 bikes from Trek for $108,900 total ( $990 per bicycle). The terms of the transaction were 2/15,n/60 ). December 10: The bicycles are delivered to The Electric Company and The Electric Company pays $1,000 for the delivery. December 11: After inspection, The Electric Company finds that 10 of the bicycles do not meet their quality standards and the 10 bicycles are returned to Trek. December 13: The Electric Company pays Trek for the remaining bicycles. December 20: The Electric Company sells 25 bicycles to Tour de Bike for $1,300 per bicycle ($32,500 total) on the terms 3/10,n/30. The bicycles cost The Electric Company $1000 per bicycle ($25,000 total). December 22. Five of the bicycles are returned by Tour de Bike as allowed by The Electric Company's return policy. December 25th The Electric Company receives payment from Tour de Bike in satisfaction of what was due. Required (25 points): Prepare journal entries for the above transactions for The Electric Company. Please follow the format used in class (including indicated after each account, the type of account and whether it increases or decreases). Problem 5 ( 5 minutes): Answer the following multiple choice questions (3 Point each PLEASE USE THE ATTACHED ANSWER SHEET TO RECORD YOUR ANSWERS 5-1: Which of the following accounts should always have a zero balance on the post closing trial balance: A) Accumulated Depreciation-Equipment B) Unearned Revenue C) Retained Earnings D) Sales Discount E) Two of the above are correct. 5-2: As discussed in class, how many versions of a trial balance are prepared each year. A) 0 B) 1 C) 2 D) 3 E) 4 5-3: Acme Co. purchases a patent (an intangible asset) that they are able to use for 10 years. It is estimated that each year $10,000 of the patents value will be used up. For the adjusting entry to record this transaction, which account debited? A) Depreciation Expense B) Accumulated Depreciation C) Equipment D) Accumulated Amortization E) Amortization Expense 5-4: The financial statement are most commorly prepared dreclly ather A) The post-closing trial balance B) The adisted trial balance C) The unadjusted trial balance D) Closing entries 5-5: The cost of goods sold equation for periodic inventory is represented by which of the following: A) BI+PEI=COGS B) Sales - COGS = GP C) BI+PCOGS=El D) None of the above