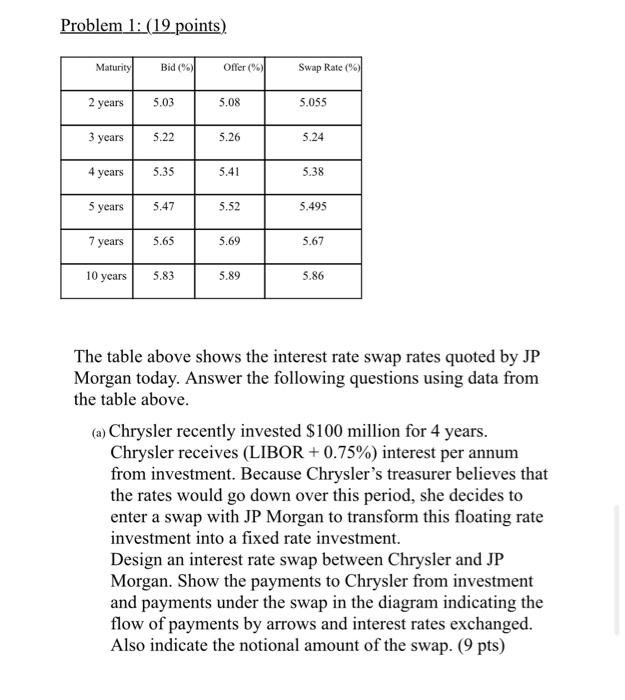

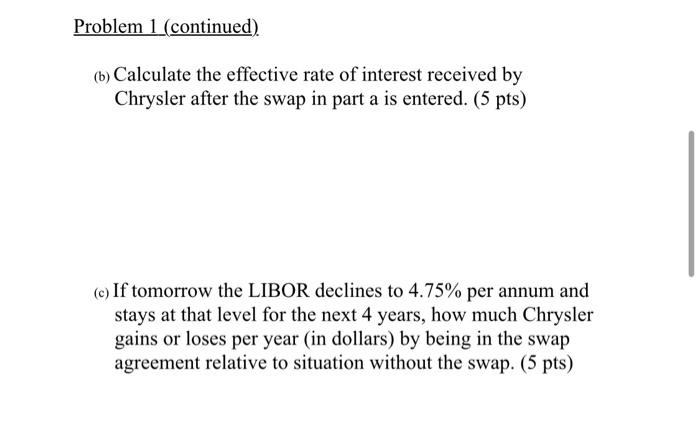

Problem 1: (19 points) Maturity Bid (%) Offer (%) Swap Rate(%) 2 years 5.03 5.08 5.055 3 years 5.22 5.26 5.24 4 years 5.35 5.41 5.38 5 years 5.47 5.52 5.495 7 years 5.65 5.69 5.67 10 years 5.83 5.89 5.86 The table above shows the interest rate swap rates quoted by JP Morgan today. Answer the following questions using data from the table above. (a) Chrysler recently invested $100 million for 4 years. Chrysler receives (LIBOR + 0.75%) interest per annum from investment. Because Chrysler's treasurer believes that the rates would go down over this period, she decides to enter a swap with JP Morgan to transform this floating rate investment into a fixed rate investment. Design an interest rate swap between Chrysler and JP Morgan. Show the payments to Chrysler from investment and payments under the swap in the diagram indicating the flow of payments by arrows and interest rates exchanged. Also indicate the notional amount of the swap. (9 pts) Problem 1 (continued) (b) Calculate the effective rate of interest received by Chrysler after the swap in part a is entered. (5 pts) (c) If tomorrow the LIBOR declines to 4.75% per annum and stays at that level for the next 4 years, how much Chrysler gains or loses per year (in dollars) by being in the swap agreement relative to situation without the swap. (5 pts) Problem 1: (19 points) Maturity Bid (%) Offer (%) Swap Rate(%) 2 years 5.03 5.08 5.055 3 years 5.22 5.26 5.24 4 years 5.35 5.41 5.38 5 years 5.47 5.52 5.495 7 years 5.65 5.69 5.67 10 years 5.83 5.89 5.86 The table above shows the interest rate swap rates quoted by JP Morgan today. Answer the following questions using data from the table above. (a) Chrysler recently invested $100 million for 4 years. Chrysler receives (LIBOR + 0.75%) interest per annum from investment. Because Chrysler's treasurer believes that the rates would go down over this period, she decides to enter a swap with JP Morgan to transform this floating rate investment into a fixed rate investment. Design an interest rate swap between Chrysler and JP Morgan. Show the payments to Chrysler from investment and payments under the swap in the diagram indicating the flow of payments by arrows and interest rates exchanged. Also indicate the notional amount of the swap. (9 pts) Problem 1 (continued) (b) Calculate the effective rate of interest received by Chrysler after the swap in part a is entered. (5 pts) (c) If tomorrow the LIBOR declines to 4.75% per annum and stays at that level for the next 4 years, how much Chrysler gains or loses per year (in dollars) by being in the swap agreement relative to situation without the swap. (5 pts)