Answered step by step

Verified Expert Solution

Question

1 Approved Answer

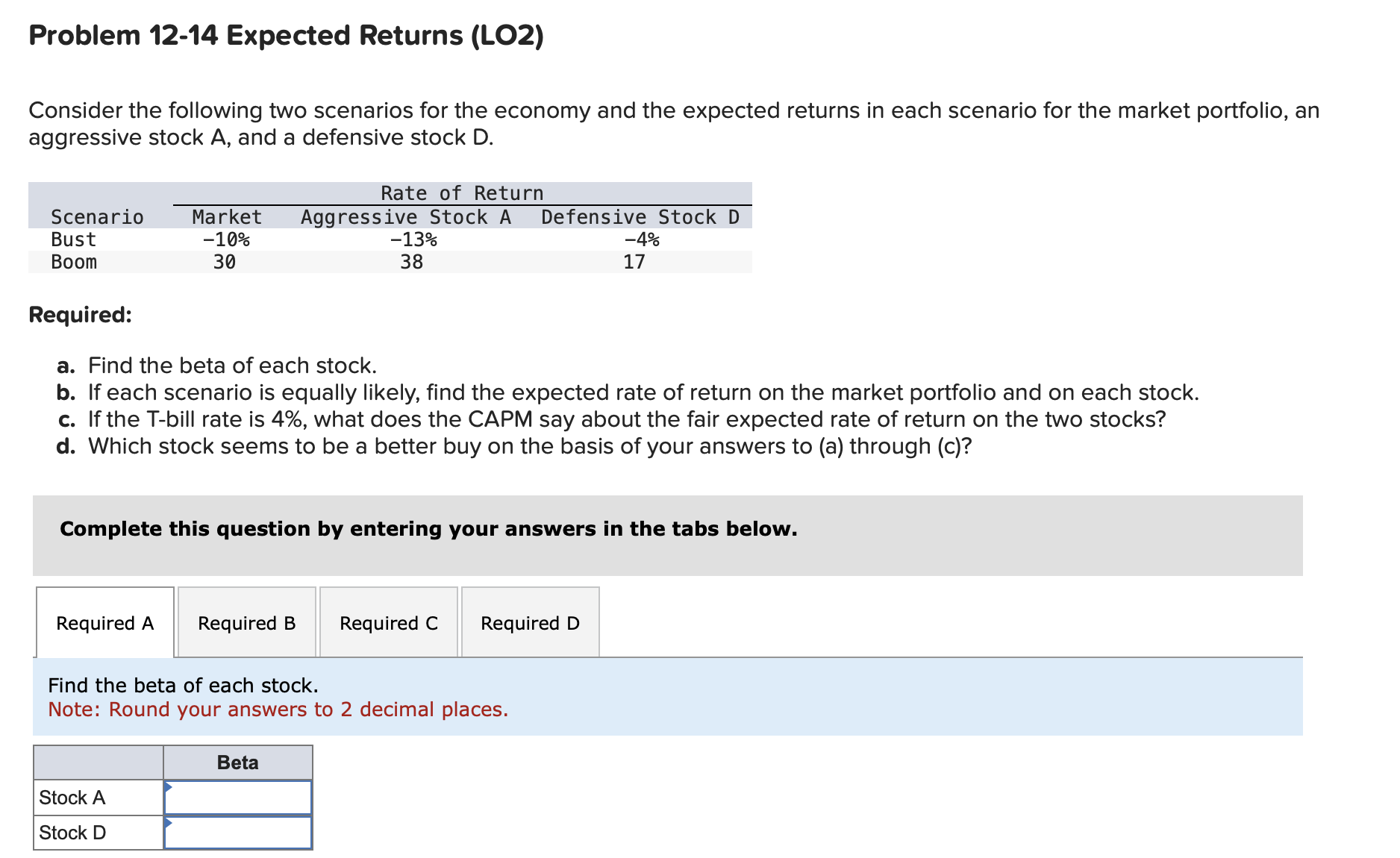

Problem 1 2 - 1 4 Expected Returns ( LO 2 ) Consider the following two scenarios for the economy and the expected returns in

Problem Expected Returns LO

Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an

aggressive stock and a defensive stock

Required:

a Find the beta of each stock.

b If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock.

c If the Tbill rate is what does the CAPM say about the fair expected rate of return on the two stocks?

d Which stock seems to be a better buy on the basis of your answers to a through c

Complete this question by entering your answers in the tabs below.

Find the beta of each stock.

Note: Round your answers to decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started