Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 2 - 4 7 ( LO . 6 ) a . In 2 0 2 3 , Maria records self - employed earnings

Problem LO

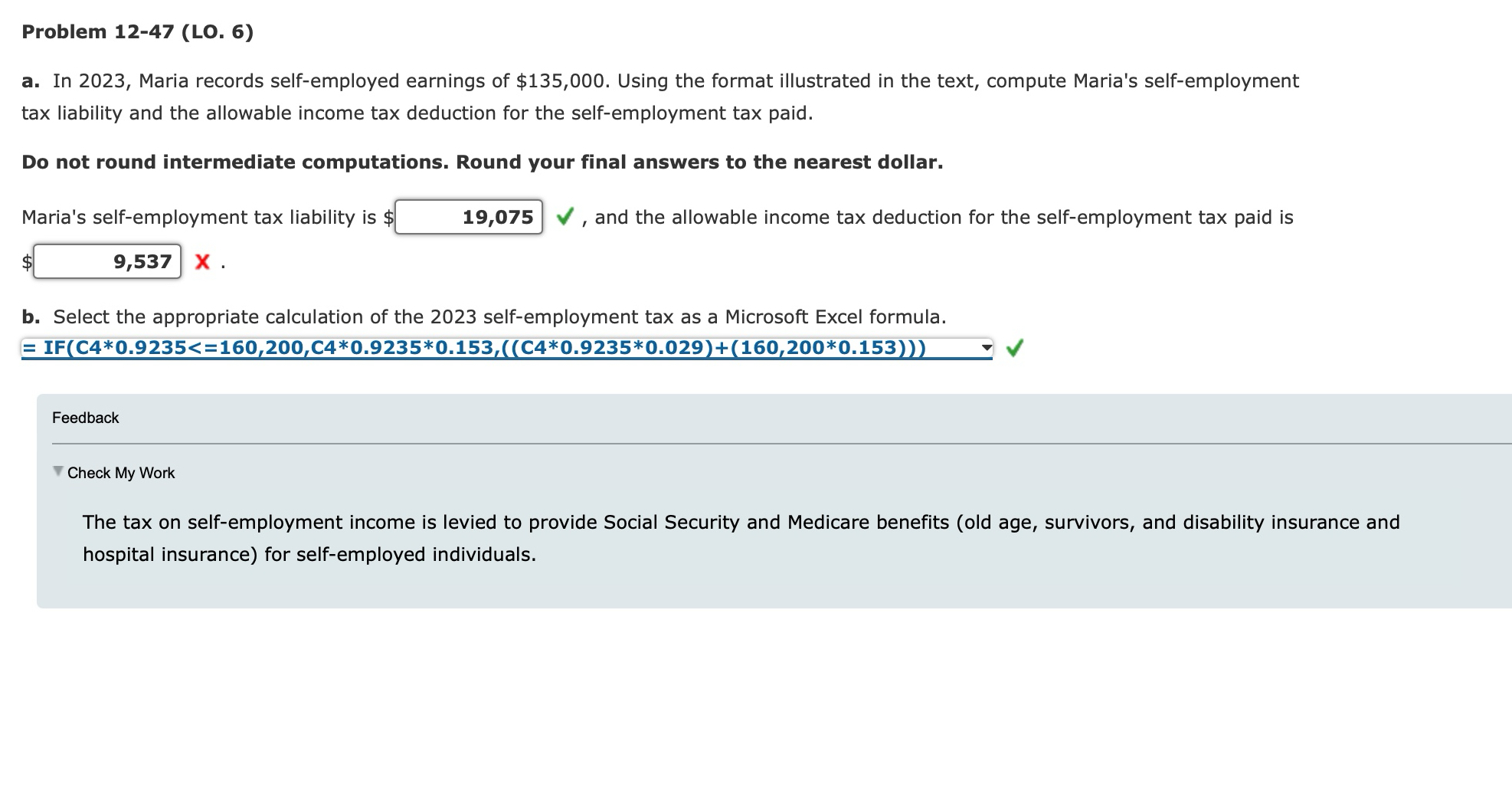

a In Maria records selfemployed earnings of $ Using the format illustrated in the text, compute Maria's selfemployment tax liability and the allowable income tax deduction for the selfemployment tax paid.

Do not round intermediate computations. Round your final answers to the nearest dollar.

Maria's selfemployment tax liability is $ and the allowable income tax deduction for the selfemployment tax paid is $

b Select the appropriate calculation of the selfemployment tax as a Microsoft Excel formula.

Feedback

Check My Work

The tax on selfemployment income is levied to provide Social Security and Medicare benefits old age, survivors, and disability insurance and hospital insurance for selfemployed individuals.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started