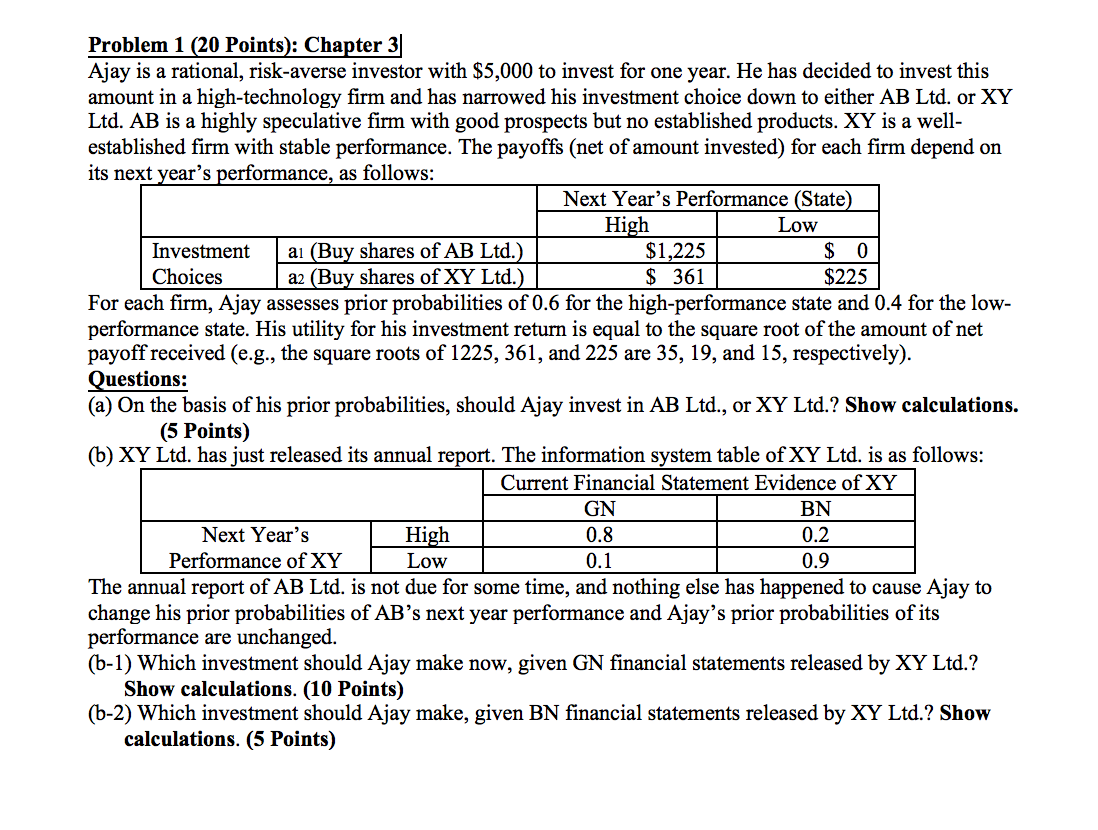

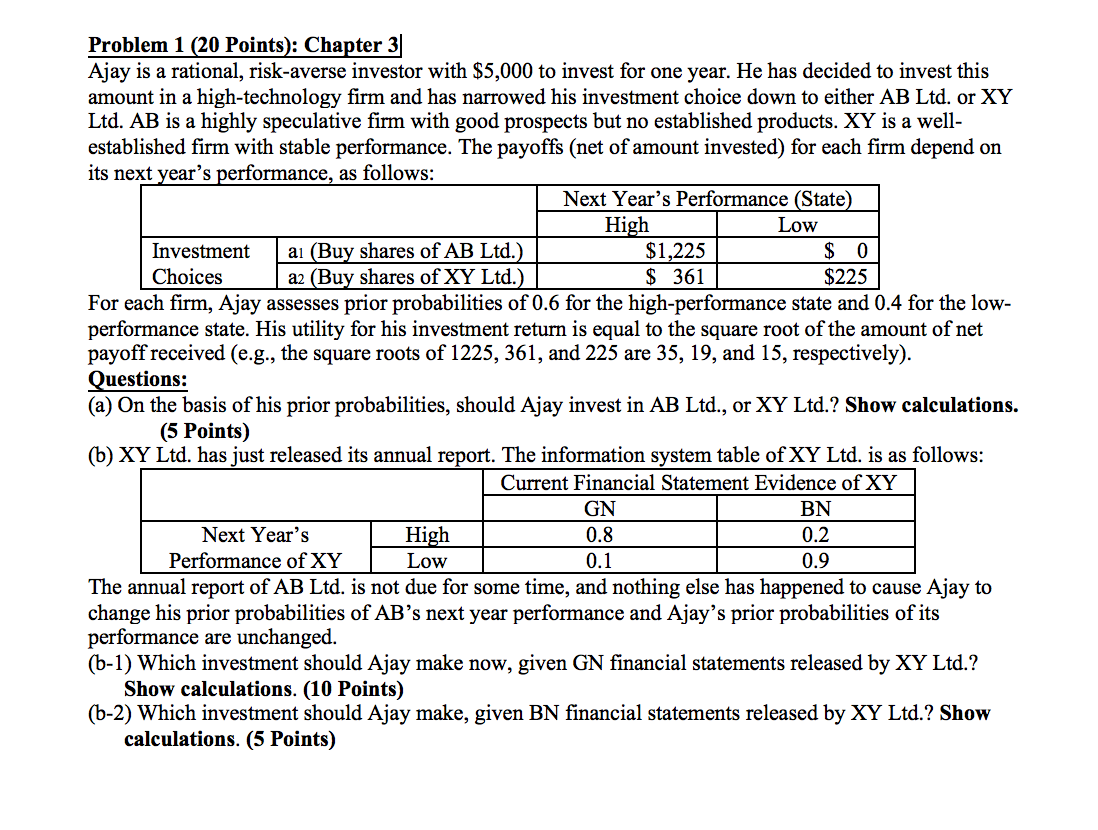

Problem 1 (20 Points): Chapter 3 Ajay is a rational, risk-averse investor with $5,000 to invest for one year. He has decided to invest this amount in a high-technology firm and has narrowed his investment choice down to either AB Ltd. or XY Ltd. AB is a highly speculative firm with good prospects but no established products. XY is a well- established firm with stable performance. The payoffs (net of amount invested) for each firm depend on its next year's performance, as follows: Next Year's Performance (State) High Low Investment ai (Buy shares of AB Ltd.) $1,225 $ 0 Choices a2 (Buy shares of XY Ltd.) $361 $225 For each firm, Ajay assesses prior probabilities of 0.6 for the high-performance state and 0.4 for the low- performance state. His utility for his investment return is equal to the square root of the amount of net payoff received (e.g., the square roots of 1225, 361, and 225 are 35, 19, and 15, respectively). Questions: (a) On the basis of his prior probabilities, should Ajay invest in AB Ltd., or XY Ltd.? Show calculations. (5 Points) (b) XY Ltd. has just released its annual report. The information system table of XY Ltd. is as follows: Current Financial Statement Evidence of XY GN Next Year's High 0.8 0.2 Performance of XY Low 0.1 0.9 The annual report of AB Ltd. is not due for some time, and nothing else has happened to cause Ajay to change his prior probabilities of AB's next year performance and Ajay's prior probabilities of its performance are unchanged. (b-1) Which investment should Ajay make now, given GN financial statements released by XY Ltd.? Show calculations. (10 Points) (b-2) Which investment should Ajay make, given BN financial statements released by XY Ltd.? Show calculations. (5 Points) BN Problem 1 (20 Points): Chapter 3 Ajay is a rational, risk-averse investor with $5,000 to invest for one year. He has decided to invest this amount in a high-technology firm and has narrowed his investment choice down to either AB Ltd. or XY Ltd. AB is a highly speculative firm with good prospects but no established products. XY is a well- established firm with stable performance. The payoffs (net of amount invested) for each firm depend on its next year's performance, as follows: Next Year's Performance (State) High Low Investment ai (Buy shares of AB Ltd.) $1,225 $ 0 Choices a2 (Buy shares of XY Ltd.) $361 $225 For each firm, Ajay assesses prior probabilities of 0.6 for the high-performance state and 0.4 for the low- performance state. His utility for his investment return is equal to the square root of the amount of net payoff received (e.g., the square roots of 1225, 361, and 225 are 35, 19, and 15, respectively). Questions: (a) On the basis of his prior probabilities, should Ajay invest in AB Ltd., or XY Ltd.? Show calculations. (5 Points) (b) XY Ltd. has just released its annual report. The information system table of XY Ltd. is as follows: Current Financial Statement Evidence of XY GN Next Year's High 0.8 0.2 Performance of XY Low 0.1 0.9 The annual report of AB Ltd. is not due for some time, and nothing else has happened to cause Ajay to change his prior probabilities of AB's next year performance and Ajay's prior probabilities of its performance are unchanged. (b-1) Which investment should Ajay make now, given GN financial statements released by XY Ltd.? Show calculations. (10 Points) (b-2) Which investment should Ajay make, given BN financial statements released by XY Ltd.? Show calculations. (5 Points) BN