Answered step by step

Verified Expert Solution

Question

1 Approved Answer

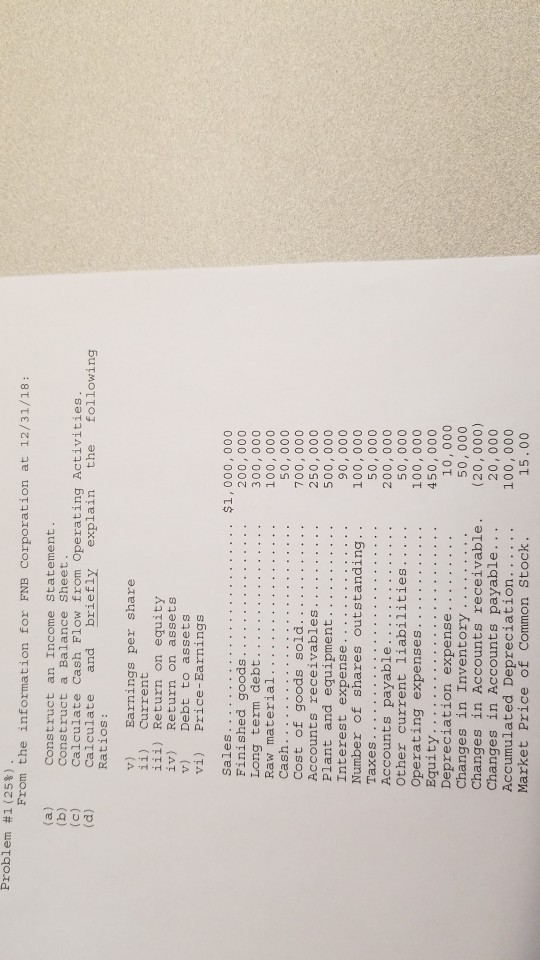

Problem #1 (25%) From the information for FNB Corporation at 12/31/18: Construct an Income Statement Construct a Balance Sheet (c) Calculate Cash Flow from Operating

Problem #1 (25%) From the information for FNB Corporation at 12/31/18: Construct an Income Statement Construct a Balance Sheet (c) Calculate Cash Flow from Operating Activities (d) Calculate and briefly explain the following Ratios: v) Earnings per share ii) current iii) Return on equity iv) Return on assets v) Debt to assets vi) Price-Earnings $1,000,000 200,000 300,000 100,000 50,000 700,000 250,000 500,000 90,000 Number of shares outstanding 100,000 50,000 200,000 50,000 Finished goods . . Accounts receivables" , .. Interest expense. ...- 450,000 10,000 50,000 Changes in Inventory Changes in Accounts receivable. (20,000) Changes in Accounts payable 20,000 100,000 Market Price of Common Stock

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started