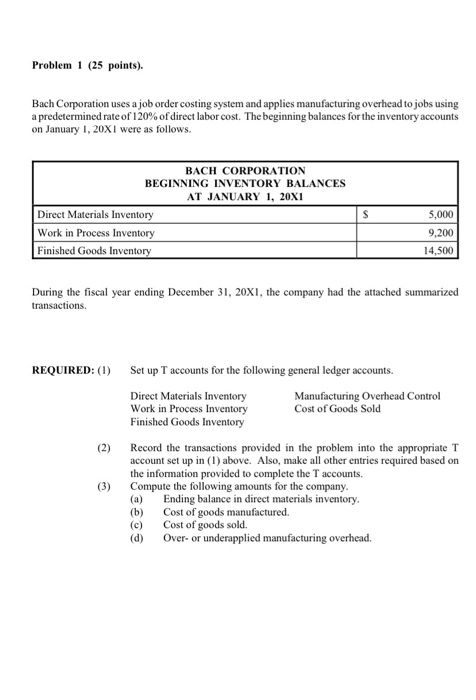

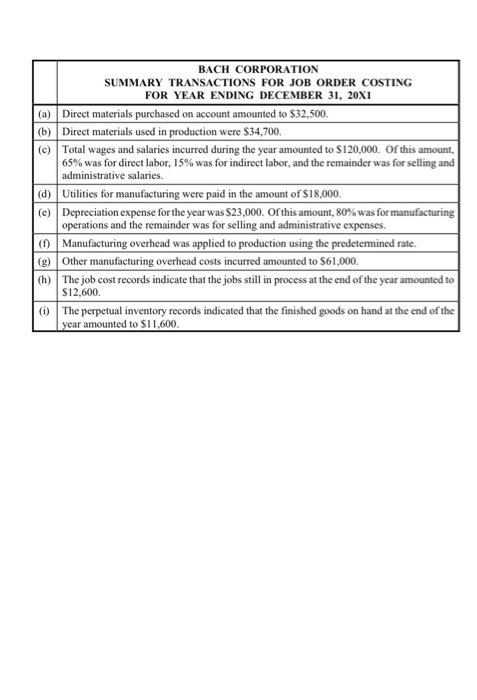

Problem 1 (25 points). Bach Corporation uses a job order costing system and applies manufacturing overhead to jobs using a predetermined rate of 120% of direct labor cost. The beginning balances for the inventory accounts on January 1, 20X I were as follows. BACH CORPORATION BEGINNING INVENTORY BALANCES AT JANUARY 1, 20X1 Direct Materials Inventory Work in Process Inventory Finished Goods Inventory 9.20. 14,500 During the fiscal year ending December 31, 20X1, the company had the attached summarized transactions, REQUIRED: (1) Set up T accounts for the following general ledger accounts. Direct Materials Inventory Work in Process Inventory Finished Goods Inventory Manufacturing Overhead Control Cost of Goods Sold (2) Record the transactions provided in the problem into the appropriate T account set up in (1) above. Also, make all other entries required based on the information provided to complete the T accounts. Compute the following amounts for the company. (a) Ending balance in direct materials inventory. (b) Cost of goods manufactured. (c) Cost of goods sold. (d) Over- or underapplied manufacturing overhead. BACH CORPORATION SUMMARY TRANSACTIONS FOR JOB ORDER COSTING FOR YEAR ENDING DECEMBER 31, 20X1 (a) Direct materials purchased on account amounted to $32,500. (b) Direct materials used in production were $34,700. (c) Total wages and salaries incurred during the year amounted to $120,000. Of this amount, 65% was for direct labor, 15% was for indirect labor, and the remainder was for selling and administrative salaries. (d) Utilities for manufacturing were paid in the amount of $18,000. (c) Depreciation expense for the year was $23,000. Of this amount, 80% was for manufacturing operations and the remainder was for selling and administrative expenses. (1) Manufacturing overhead was applied to production using the predetermined rate. Other manufacturing overhead costs incurred amounted to $61,000. (h) The job cost records indicate that the jobs still in process at the end of the year amounted to S12,600. The perpetual inventory records indicated that the finished goods on hand at the end of the year amounted to $11,600. (1)