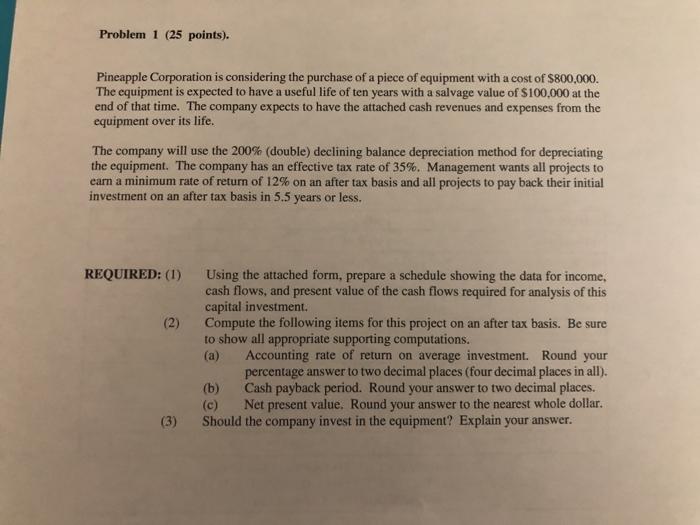

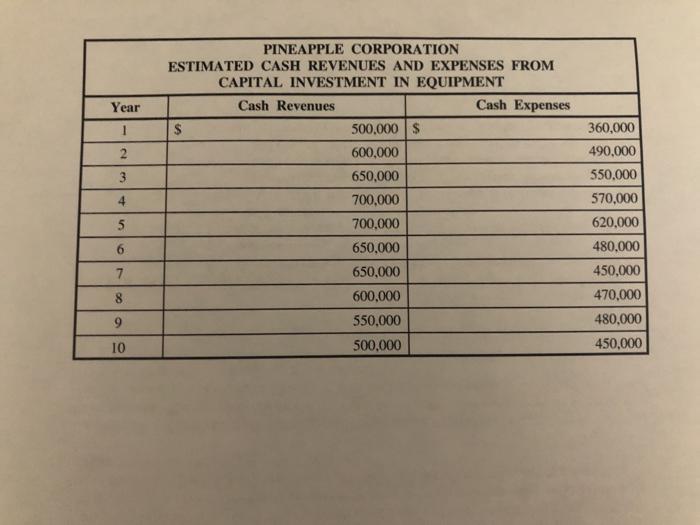

Problem 1 (25 points). Pineapple Corporation is considering the purchase of a piece of equipment with a cost of $800,000 The equipment is expected to have a useful life of ten years with a salvage value of $100.000 at the end of that time. The company expects to have the attached cash revenues and expenses from the equipment over its life. The company will use the 200% (double) declining balance depreciation method for depreciating the equipment. The company has an effective tax rate of 35%. Management wants all projects to earn a minimum rate of return of 12% on an after tax basis and all projects to pay back their initial investment on an after tax basis in 5.5 years or less. REQUIRED: (1) (2) Using the attached form, prepare a schedule showing the data for income, cash flows, and present value of the cash flows required for analysis of this capital investment Compute the following items for this project on an after tax basis. Be sure to show all appropriate supporting computations. (a) Accounting rate of return on average investment. Round your percentage answer to two decimal places (four decimal places in all). (b) Cash payback period. Round your answer to two decimal places. Net present value. Round your answer to the nearest whole dollar. Should the company invest in the equipment? Explain your answer. (3) Year 2 3 4 5 PINEAPPLE CORPORATION ESTIMATED CASH REVENUES AND EXPENSES FROM CAPITAL INVESTMENT IN EQUIPMENT Cash Revenues Cash Expenses $ 500,000 $ 600,000 650,000 700.000 700.000 650.000 650,000 600,000 550.000 500.000 360,000 490,000 550.000 570,000 620.000 480,000 450,000 470.000 480,000 450,000 6 7 8 9 10 Problem 1 (25 points). Pineapple Corporation is considering the purchase of a piece of equipment with a cost of $800,000 The equipment is expected to have a useful life of ten years with a salvage value of $100.000 at the end of that time. The company expects to have the attached cash revenues and expenses from the equipment over its life. The company will use the 200% (double) declining balance depreciation method for depreciating the equipment. The company has an effective tax rate of 35%. Management wants all projects to earn a minimum rate of return of 12% on an after tax basis and all projects to pay back their initial investment on an after tax basis in 5.5 years or less. REQUIRED: (1) (2) Using the attached form, prepare a schedule showing the data for income, cash flows, and present value of the cash flows required for analysis of this capital investment Compute the following items for this project on an after tax basis. Be sure to show all appropriate supporting computations. (a) Accounting rate of return on average investment. Round your percentage answer to two decimal places (four decimal places in all). (b) Cash payback period. Round your answer to two decimal places. Net present value. Round your answer to the nearest whole dollar. Should the company invest in the equipment? Explain your answer. (3) Year 2 3 4 5 PINEAPPLE CORPORATION ESTIMATED CASH REVENUES AND EXPENSES FROM CAPITAL INVESTMENT IN EQUIPMENT Cash Revenues Cash Expenses $ 500,000 $ 600,000 650,000 700.000 700.000 650.000 650,000 600,000 550.000 500.000 360,000 490,000 550.000 570,000 620.000 480,000 450,000 470.000 480,000 450,000 6 7 8 9 10