Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 1 (25 points] We learned in Chapters 5-6 that we can calculate consumer welfare loss (income compen- sation) from price changes using the concept

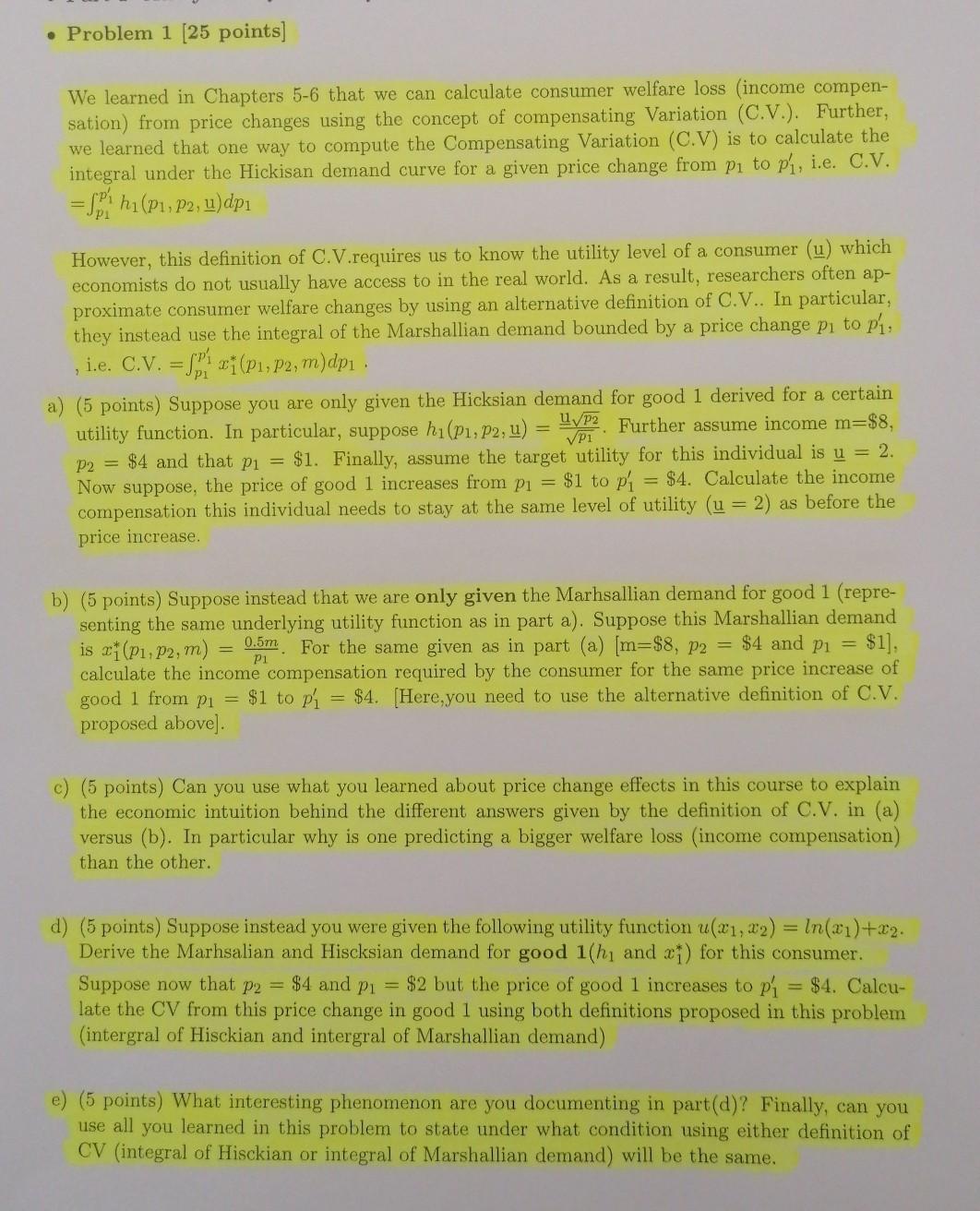

Problem 1 (25 points] We learned in Chapters 5-6 that we can calculate consumer welfare loss (income compen- sation) from price changes using the concept of compensating Variation (C.V.). Further, we learned that one way to compute the Compensating Variation (C.V) is to calculate the integral under the Hickisan demand curve for a given price change from pi to p,, i.e. C.V. =SP hi(P1, P2, u)dpi However, this definition of C.V.requires us to know the utility level of a consumer (u) which economists do not usually have access to in the real world. As a result, researchers often ap- proximate consumer welfare changes by using an alternative definition of C.V.. In particular, they instead use the integral of the Marshallian demand bounded by a price change pi to pi. i.e. C.V. - Spk 21 (P1, P2, m)dpi . a) (5 points) Suppose you are only given the Hicksian demand for good 1 derived for a certain utility function. In particular, suppose h(P1, P2, u) = 4/P2. Further assume income m=$8, P2 = $4 and that pi = $1. Finally, assume the target utility for this individual is u = 2. Now suppose, the price of good 1 increases from pi = $1 to pi = $4. Calculate the income compensation this individual needs to stay at the same level of utility (u = 2) as before the price increase. b) (5 points) Suppose instead that we are only given the Marhsallian demand for good 1 (repre- senting the same underlying utility function as in part a). Suppose this Marshallian demand 0.5m is x1(P1, P2, m) For the same given as in part (a) [m=$8, P2 = $4 and p = $1], calculate the income compensation required by the consumer for the same price increase of good 1 from pi = $1 to p = = $4. (Here, you need to use the alternative definition of C.V. proposed above). P1 c) (5 points) Can you use what you learned about price change effects in this course to explain the economic intuition behind the different answers given by the definition of C.V. in (a) versus (b). In particular why is one predicting a bigger welfare loss (income compensation) than the other. d) (5 points) Suppose instead you were given the following utility function u(x1,x2) = ln(21)+x2. Derive the Marhsalian and Hisksian demand for good 1(hi and xi) for this consumer. Suppose now that p2 = $4 and p = $2 but the price of good 1 increases to pi = $4. Calcu- late the CV from this price change in good l using both definitions proposed in this problem (intergral of Hisckian and intergral of Marshallian demand) (5 points) What interesting phenomenon are you documenting in part(d)? Finally, can you use all you learned in this problem to state under what condition using either definition of CV (integral of Hisckian or integral of Marshallian demand) will be the same. Problem 1 (25 points] We learned in Chapters 5-6 that we can calculate consumer welfare loss (income compen- sation) from price changes using the concept of compensating Variation (C.V.). Further, we learned that one way to compute the Compensating Variation (C.V) is to calculate the integral under the Hickisan demand curve for a given price change from pi to p,, i.e. C.V. =SP hi(P1, P2, u)dpi However, this definition of C.V.requires us to know the utility level of a consumer (u) which economists do not usually have access to in the real world. As a result, researchers often ap- proximate consumer welfare changes by using an alternative definition of C.V.. In particular, they instead use the integral of the Marshallian demand bounded by a price change pi to pi. i.e. C.V. - Spk 21 (P1, P2, m)dpi . a) (5 points) Suppose you are only given the Hicksian demand for good 1 derived for a certain utility function. In particular, suppose h(P1, P2, u) = 4/P2. Further assume income m=$8, P2 = $4 and that pi = $1. Finally, assume the target utility for this individual is u = 2. Now suppose, the price of good 1 increases from pi = $1 to pi = $4. Calculate the income compensation this individual needs to stay at the same level of utility (u = 2) as before the price increase. b) (5 points) Suppose instead that we are only given the Marhsallian demand for good 1 (repre- senting the same underlying utility function as in part a). Suppose this Marshallian demand 0.5m is x1(P1, P2, m) For the same given as in part (a) [m=$8, P2 = $4 and p = $1], calculate the income compensation required by the consumer for the same price increase of good 1 from pi = $1 to p = = $4. (Here, you need to use the alternative definition of C.V. proposed above). P1 c) (5 points) Can you use what you learned about price change effects in this course to explain the economic intuition behind the different answers given by the definition of C.V. in (a) versus (b). In particular why is one predicting a bigger welfare loss (income compensation) than the other. d) (5 points) Suppose instead you were given the following utility function u(x1,x2) = ln(21)+x2. Derive the Marhsalian and Hisksian demand for good 1(hi and xi) for this consumer. Suppose now that p2 = $4 and p = $2 but the price of good 1 increases to pi = $4. Calcu- late the CV from this price change in good l using both definitions proposed in this problem (intergral of Hisckian and intergral of Marshallian demand) (5 points) What interesting phenomenon are you documenting in part(d)? Finally, can you use all you learned in this problem to state under what condition using either definition of CV (integral of Hisckian or integral of Marshallian demand) will be the same

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started