Answered step by step

Verified Expert Solution

Question

1 Approved Answer

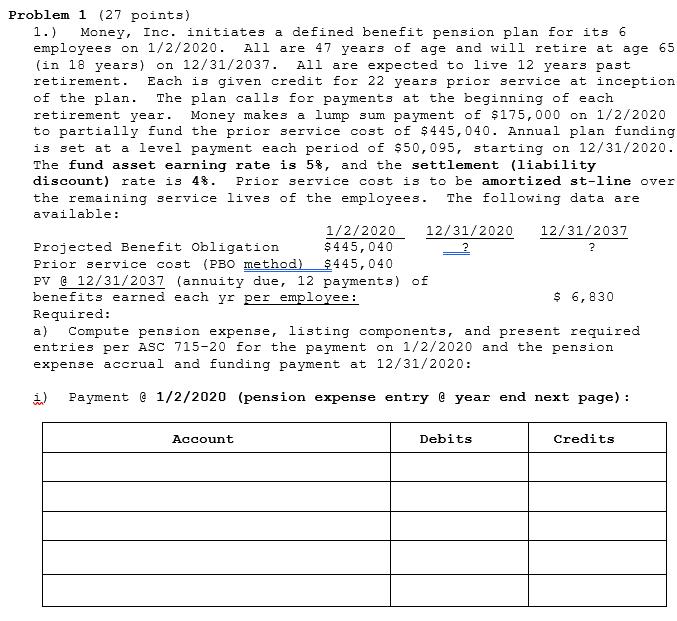

Problem 1.) 1 (27 points) Money, Inc. initiates a defined benefit pension plan for its 6 employees on 1/2/2020. All are 47 years of

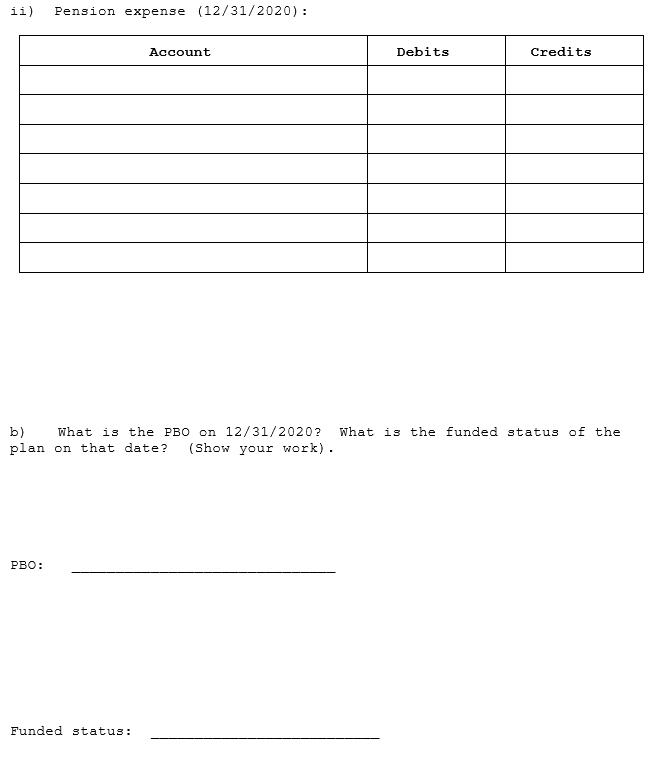

Problem 1.) 1 (27 points) Money, Inc. initiates a defined benefit pension plan for its 6 employees on 1/2/2020. All are 47 years of age and will retire at age 65 (in 18 years) on 12/31/2037. All are expected to live 12 years past retirement. Each is given credit for 22 years prior service at inception of the plan. The plan calls for payments at the beginning of each retirement year. Money makes a lump sum payment of $175,000 on 1/2/2020 to partially fund the prior service cost of $445, 040. Annual plan funding is set at a level payment each period of $50,095, starting on 12/31/2020. The fund asset earning rate is 5%, and the settlement (liability discount) rate is 48. Prior service cost is to be amortized st-line over the remaining service lives of the employees. The following data are available: 1/2/2020 $445, 040 $445, 040 12/31/2020 2 Projected Benefit Obligation Prior service cost (PBO method) PV @ 12/31/2037 (annuity due, 12 payments) of benefits earned each yr per employee: Required: Account 12/31/2037 ? a) Compute pension expense, listing components, and present required entries per ASC 715-20 for the payment on 1/2/2020 and the pension expense accrual and funding payment at 12/31/2020: 1) Payment @ 1/2/2020 (pension expense entry @ year end next page) : Debits $ 6,830 Credits ii) Pension expense (12/31/2020): PBO: Account Funded status: Debits b) What is the PBO on 12/31/2020? What is the funded status of the plan on that date? (Show your work). Credits

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Payment 122020 Account Debits Credits Cash 175000 Pension Benefit Obligation 445040 Pension Expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started